There’s a lot going on in the world today and it’s easy to feel overwhelmed by all that's happening around us: The war in Ukraine, Israel and Gaza, another mass shooting -- those are just a few of the front-page events that have taken over the news cycle.

From a capital markets perspective, the backdrop is also challenging. Despite a post-Fed rebound, the Nasdaq-100 (NDX) and S&P 500 Index (SPX) are both lower over the past few months, as is the small cap Russell 2000 Index (RUT).

Perspective

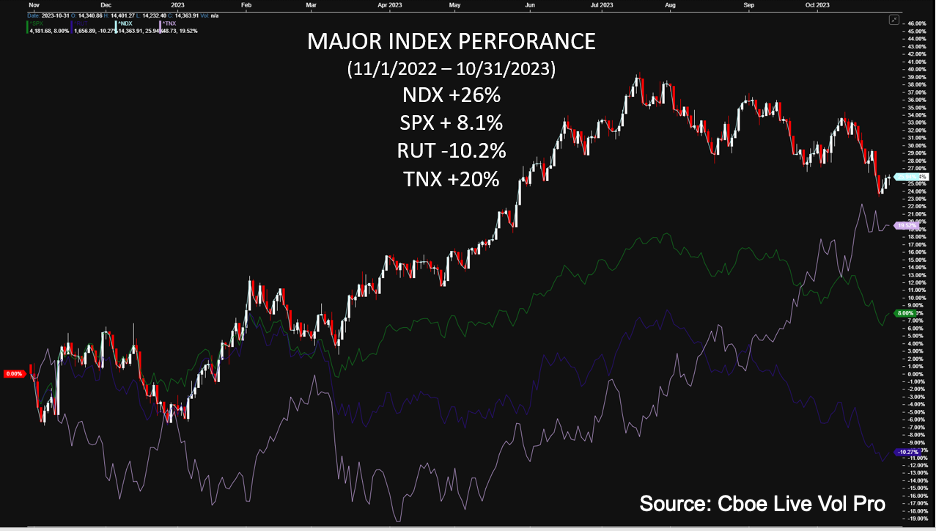

The past 12 months have been productive for most of the major equity indexes. The standout, as it has been for the better part of 15 years, is the Nasdaq-100. As October came to a close, NDX has gained around 26% since this time last year.

By comparison, the S&P 500 is higher by 8.1%, and the small cap Russell 2000 has struggled mightily. Smaller, less profitable, generally more indebted companies haven’t performed well over the last year: The RUT is down more than 10%.

The last index highlighted in the chart below plots the yield for the 10-year U.S. treasuries over the past 12 months (on a percentage basis), showing that it's higher by about 20%. In more meaningful terms, the 10-year was as low as 3.28% in April and moved up to 4.98% in mid-October. That’s the highest yield since August of 2007.

What I Do

I put capital to work with a long-term horizon. I also allocate some funds to more opportunistic positioning and some to hedging portfolio risk. On that last point, my focus there is typically on index options.

For example, I systematically buy a well-known ETF designed to track the NDX. I might periodically sell a few XND calls, buy a few XND puts, or combine them for a collar if I’m concerned about a potential pullback over a specific time frame.

The real point here is this is a situation where I can control my exposure. I know how much Nasdaq-100 ETF risk I own, and the options allow me to customize the upside and downside exposure through expiration (assuming the trade isn’t exited early).

XND options are cash settled, so even if the underlying index moves above/below a strike, my core position is not called away. They are European-styled, so there’s no risk of early assignment. Some brokerage firms will cross-margin the ETF and options exposure. In the case of index options, they are doubly beneficial to me because I can use them personally to help navigate market turbulence.

Index

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

This originally appeared in our Smart Investing newsletter. Sign up here to access your weekly digest of the latest investing news, personal finance tips and educational must-knows – all in one place.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.