NVIDIA NVDA and Palantir Technologies Inc. PLTR have been among the best-performing stocks recently, with artificial intelligence (AI) being a key driver behind their success. Over the past year, NVDA has surged 186.1%, while PLTR skyrocketed 355.4%.

One-Year Price Chart

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Both companies are benefiting from the AI boom, though in different ways. NVIDIA leads the charge with its cutting-edge GPUs (graphics processing units), which are essential for AI processing across various industries, including data centers and autonomous systems. Its dominance in AI hardware positions NVIDIA for rapid growth.

On the other hand, Palantir leverages its advanced data analytics software to help both companies and governments harness AI insights, making complex data actionable. While NVIDIA’s growth is driven by hardware demand, Palantir’s success lies in its AI-driven data solutions.

Before deciding which stock is the best investment option amid the growing acceptance of AI, let's conduct a thorough analysis of the fundamentals of both companies.

Understanding NVDA & PLTR’s Core Business Approaches

NVIDIA: NVIDIA specializes in developing high-performance GPUs that serve as the computational backbone for AI systems. These GPUs, integrated into NVDA’s advanced HGX platform and Hopper architecture, are essential for training and deploying AI models. Industry leaders such as Adobe Inc. ADBE and Microsoft Corporation MSFT leverage NVIDIA’s technology to power AI-driven solutions.

The company’s hardware, software and cloud services have become indispensable for organizations and governments aiming to build, train and deploy AI systems at scale. This growing demand is driven by the rise of "AI factories" (dedicated AI data centers) and "sovereign AI infrastructure" (country-specific AI ecosystems), solidifying NVIDIA’s position at the forefront of the AI revolution and creating significant opportunities for investors.

Palantir: Palantir’s business model is centered on enabling AI-driven decision-making for commercial and government sectors. The company’s Artificial Intelligence Platform (AIP) integrates advanced AI models with enterprise workflows, automating critical processes and optimizing operations???. Notably, PLTR differentiates by focusing on deployment-ready AI rather than proof-of-concept projects.

Financial Strengths and Challenges

NVIDIA has demonstrated rapid and consistent revenue growth, with revenues and earnings increasing by double-digit percentages sequentially over the past several quarters. In the last reported quarter, the company generated an impressive $35.1 billion in revenues, reflecting a staggering year-over-year growth of 94%.

In contrast, PLTR operates on a smaller scale with significantly slower revenue growth. The company generated $725.5 million in revenue during the last reported quarter, a figure that pales in comparison to NVIDIA's $35.1 billion in sales.

Comparing the Valuation Metrics of NVDA & PLTR

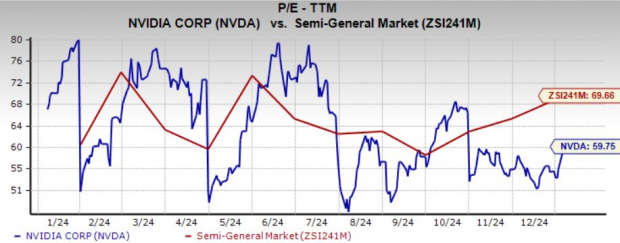

NVDA stock is trading at a trailing 12-month price-to-earnings (P/E) of 59.75x, which trails the industry average of 69.66x. On the other hand, PLTR stock is trading at a trailing 12-month price-to-sales (P/S) of 70.56x, which exceeds the industry average of 10.37x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

It should be noted that Palantir has historically struggled with consistent profitability, which makes traditional valuation metrics like P/E less meaningful. As a result, the P/S ratio is often employed as a more suitable metric for evaluating the company’s value concerning its revenue growth.

Identifying the Better Stock

Both companies are capitalizing on the growing popularity of AI, but NVIDIA is considered the better investment due to its faster growth, stronger market position and slightly better value for the price compared to Palantir. Simply put, NVIDIA is viewed as having a greater edge in AI and is expected to offer better returns for investors.

Hence, we can conclude that it's more prudent to invest in the undervalued stock NVDA, carrying a Zacks Rank of #2 (Buy), rather than PLTR, which carries a Zacks Rank of #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.