The trade war between the United States and the European Union (EU) is escalating, with the EU announcing €26 billion worth of retaliatory tariffs on American goods. This move comes shortly after the United States imposed 25% tariffs on steel and aluminum imports from the EU. Unlike before, the United States is not offering exemptions for products that are not available domestically.

The EU’s countermeasures are set to take effect in two phases, on April 1 and April 13, and will affect primary American exports like bourbon whiskey, jeans and motorcycles, with the tariffs expected to total €18 billion. One of the most impacted companies is HarleyDavidson HOG, which now faces a whopping 56% tariff on motorcycles exported to the EU. This is a huge shift from the previous trade conflict in 2018 when the company was forced to shift part of its production overseas to avoid excessive costs.

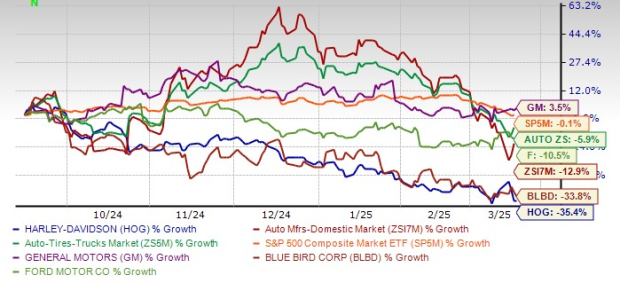

Over the past six months, HOG shares have lost 35.4%, underperforming the Zacks Auto, Tires and Trucks sector’s loss of 5.9% and the Zacks Automotive – Domestic industry’s dip of 12.9%. The S&P 500 index has lost 0.1% in the same time frame. The company has been suffering from weak wholesale and retail demand and lower revenues from its HDMC segment due to lower shipments. Its highly leveraged balance sheet has also been a cause of concern for investors.

HOG shares have also lagged industry peers like General Motors GM, Ford Motor F and Blue Bird BLBD over the same period. While GM shares have gained 3.5%, F and BLBD shares have lost 10.5% and 33.8% over the past six months, respectively.

Six Month Performance

Image Source: Zacks Investment Research

HarleyDavidson is now in a tough spot. These tariffs can severely impact its European sales, increase production costs due to higher tariffs on raw material and squeeze the company’s profit margins. In 2018, HOG estimated that a 31% tariff would cost it between $90 million and $100 million on an annual basis.

With tariffs that are even higher now, HOG may struggle to minimize these costs, especially when moving production abroad is a less viable option now because of the broader scope of trade restrictions extending to more components and raw materials.

To mitigate the challenges, HarleyDavidson may explore alternative strategies such as seeking local production partnerships in Europe. Furthermore, the company has been focusing on diversifying its revenue streams by expanding into electric motorcycles via its LiveWire brand. Although the segment constituted just 0.5% of the company’s revenues in 2024, its global retail performance grew 46% year over year, maintaining its leadership with a 65% market share in the U.S. 50+ horsepower on-road EV segment.

Currently boasting just two models, the LiveWire One and Del Mar, HOG aims to expand its offerings in this segment, and if successful, LiveWire can help offset some of the expected revenue losses in the EU market.

HOG’s Earnings & Revenue Estimates Indicate YoY Decline

The Zacks Consensus Estimate for HOG’s first-quarter 2025 revenues is pegged at $1.13 billion, suggesting a year-over-year decline of 23.54%. The consensus mark for first-quarter EPS is currently pegged at 90 cents, down 9.1% over the past 30 days, and indicating a concerning decline of 47.67% from the prior-year quarter.

The Zacks Consensus Estimate for HOG’s full-year 2025 revenues is pegged at $4.07 billion, suggesting a year-over-year decline of approximately 2%. The consensus mark for 2025 EPS is currently pegged at $3.29 and has moved south by 4.4% over the past 30 days. The figure indicates a decline of 4.36% on a year-over-year basis.

Conclusion

Looking ahead, HarleyDavidson’s future will depend on how effectively it navigates trade tensions, adapts to the changing market scenario and continues its push toward electric motorcycles. If the company does successfully manage its costs and maintain global demand, it can emerge stronger in the long run. However, in the near term, this trade war is likely to put significant pressure on its growth trajectory.

HOG currently carries a Zacks Rank #5 (Strong Sell), suggesting that it may be wise for investors to stay away from the stock for the time being. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Ford Motor Company (F) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.