The market has gone into overdrive in 2024. Technology stocks especially so. After posting a 55% total return in 2023, the Nasdaq-100 index followed up with 27.5% total returns so far in 2024 (as of this writing). These are two of the strongest years in the index's history. Counterintuitively, momentum in the Nasdaq index typically begets more momentum. Historically, every time the Nasdaq produces 30% returns in a year, the following year sees gains of at least 19%, indicating that the momentum in technology stocks has a good chance of continuing in 2025.

In 2023 and 2024, the leader of the tech stock party was Nvidia. In 2025, I think Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) will take the lead as the artificial intelligence (AI) leader. Here's why investors should bet on Alphabet stock in 2025 and hold on for long-term gains.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Alphabet: Finally getting AI appreciation

When OpenAI's ChatGPT went viral in late 2022, investors in Alphabet got nervous. The owner of Google, YouTube, and the DeepMind research lab was supposed to be the leader in AI research. In fact, the company had invented the transformer model that led to the ChatGPT breakthrough at OpenAI, and yet, the company could not capitalize on the situation.

In early 2023, Alphabet stock got much cheaper with ChatGPT taking off in popularity. When Microsoft partnered with OpenAI and CEO Satya Nadella said he wanted to "make Google dance," investors got even more nervous. Was the Google Search monopoly about to be broken?

Two years later, it's clear that Alphabet has risen to the challenge. It has copied all of OpenAI's products, innovated in Google Search to embed more AI tools in the product, and retained its market share in search engines. Now, it's starting to extend its lead in AI commercialization. Recent announcements include an AI video generator, quantum computing chips, and the expansion of Waymo's self-driving car unit to new cities -- just to name a few updates. The worry over Alphabet's lagging in AI innovation should be over. This company is at the forefront of the sector yet again.

More growth in cloud computing ahead

Extending its AI lead will help Alphabet grow its business. More search queries will lead to more revenue at Google Search, which is around 74% of the company's overall revenue. Most important will be the cloud-infrastructure business named Google Cloud. This segment hit $11.35 billion in revenue last quarter with profit margins inflecting higher.

Alphabet's AI expertise allows it to sell these computing, storage, and software tools to third-party companies. As spending on AI grows, a lot of it will be funneled to Google Cloud's data centers. It is only a small part of the business today, but I think there is a clear path to $100 billion in Google Cloud revenue within a few years. Assuming the company can hit or surpass 25% profit margins -- which competitor Amazon Web Services easily beats -- that is $25 billion in annual earnings from this fast-growing division. I would expect these financial metrics to hit these milestones by the end of the decade, if not sooner.

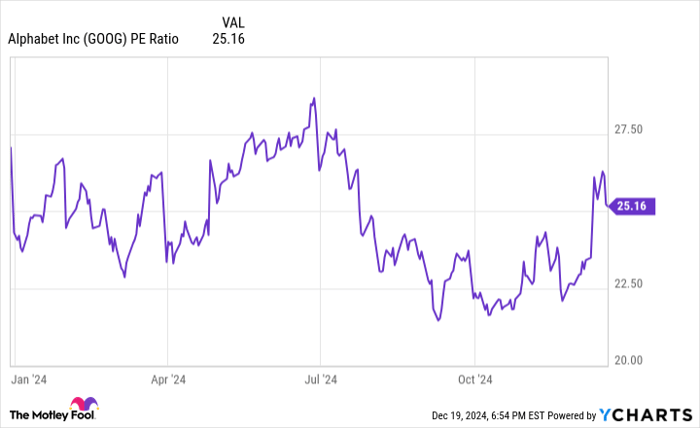

Data by YCharts.

Why Alphabet stock will soar in 2025

Despite Alphabet stock's recovery, it still looks like an attractive buy at current valuation levels. The stock has a trailing price-to-earnings (P/E) ratio of 25, which is well below the S&P 500 average of 30. Alphabet's revenue is growing 15% year over year and should keep growing at a double-digit rate if the company can maintain and extend its lead in AI.

Management is simultaneously investing in AI and returning more cash to shareholders through share repurchases and dividends. Add these in the mix, and Alphabet's shareholder returns will be even better in 2025 and beyond.

To sum it up, Alphabet trades at a discounted P/E to the broad market and should keep growing revenue at a double-digit rate for the next few years. Plus, it has a management team returning capital to shareholders. This is the holy trinity of stock market outperformance and is why Alphabet is a good bet for investors to buy and hold in 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.