Wynn Resorts, Limited WYNN is likely to benefit from solid Macau performance, non-gaming revenue-boosting strategies and expansion efforts. Also, focus on non-gaming investments bodes well. However, increased operating expenses is a concern.

Let us discuss the factors that highlight why investors should retain the stock.

Factors Likely to Drive Growth

Wynn Resorts derives a solid share of revenues from Macau — the most prominent gaming destination in the world. The worst seems to be over for Macau's gaming industry as China's economy is slowly gaining momentum. During the second quarter of 2023, Wynn Resorts witnessed growth in Macau's mass gaming, luxury retail and hotel businesses, portraying exceptional post-Covid recovery.

During the fourth quarter of 2022, Wynn Resorts (Macau) entered into a 10-year agreement with the Macau government to renew its gaming concession, covering Wynn Macau and Wynn Palace Cotai. The company is confident that the proposed capex and programming will drive growth in the upcoming periods. For 2023 (through 2024), the company expects capex related to concession commitments to be in the range of $300-$400 million.

Wynn Resorts focuses on non-gaming avenues to drive growth. In second-quarter 2023, the company’s non-gaming business witnessed robust growth owing to strength across retail business. The non-gaming business witnessed robust growth owing to strength across the retail business. During the quarter, non-gaming revenues increased 3.8% year over year to $55.1 million. Attributes such as quality product and service offerings, the relaunch of the loyalty program (in Macau) and the robust non-gaming events calendar added to the positives. Moving ahead, the company emphasizes innovative non-gaming investments to boost tourism and strong shareholder returns. This includes investments in a new theater and events and entertainment center, incremental parking, food and beverage and entertainment amenities. During the second quarter of 2023, the company stated advancement concerning the East of Broadway expansion project in Boston.

The emphasis on the expansion of new markets bodes well. Wynn Resorts and Marjan, RAK Hospitality Holding recently inked an agreement to develop a multibillion-dollar integrated resort on the artificial Al Marjan Island in Ras Al Khaimah, United Arab Emirates. This move marks Wynn Resorts’ foray into a new market. The resort is scheduled to open in 2026. This will mark the company’s first resort in the MENA region. During the second quarter of 2023, the company progressed with respect to the project design. Also, optimism can be noted due to opportunities arising from the backdrop of beachside setting development.

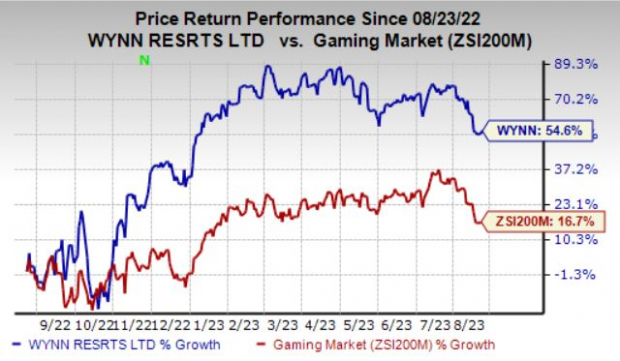

Image Source: Zacks Investment Research

In the past year, shares of Wynn Resorts have surged 54.6% compared with the industry’s 16.7% growth.

Concerns

Increased operating expenses are a concern for the company. During the second quarter of 2023, the company’s total operating expenses came in at $ 1,345.5 million compared with $960.9 million reported in the prior-year quarter. The upside was primarily due to a rise in casino, room, food and beverage, entertainment, retail and other and general and administrative expenses. However, this was partially offset by a fall in property charges and other expenses. The company remains cautious of wage inflation and interest rate increases.

Zacks Rank & Key Picks

Wynn Resorts currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.5%, on average. Shares of RCL have gained 155% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 54.5% and 180.3%, respectively, from the year-ago period’s levels.

Trip.com Group Limited TCOM flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 147.9%, on average. Shares of TCOM have increased 41.5% in the past year.

The Zacks Consensus Estimate for TCOM’s 2023 sales and EPS indicates a rise of 104.9% and 537.9%, respectively, from the year-ago period’s levels.

Skechers U.S.A., Inc. SKX sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 39.1%, on average. Shares of SKX have increased 29.6% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS indicates a rise of 8.5% and 41.2%, respectively, from the year-ago period’s levels.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to "insane levels," and they're likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.