Fresenius Medical Care AG & Co. KGaA FMS is well-poised for growth on the back of a broad range of dialysis products and services and a solid global foothold. However, stiff competition remains a concern.

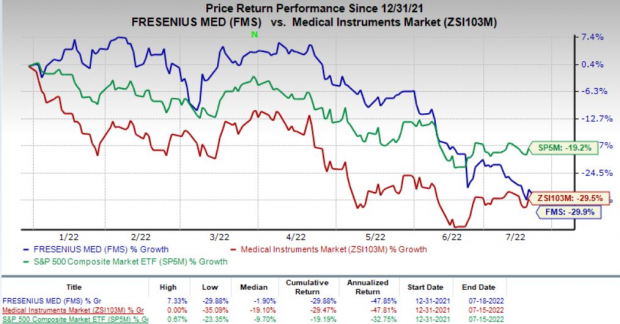

Shares of this Zacks Rank #3 (Hold) company have lost 29.9% compared with the industry’s decline of 29.5% in a year’s time. The S&P 500 Index has plunged 19.2% in the same time frame.

The company — with a market capitalization of $13.75 billion — is one of the largest integrated providers of products and services for individuals undergoing dialysis following chronic kidney failure. It anticipates earnings to improve 12.5% over the next five years. It beat earnings estimates in three of the trailing four quarters and missed once, the average surprise being 5.2%.

Key Catalysts

Fresenius Medical provides a wide range of Dialysis products in its dialysis clinics and third-party clinics. These include modular machine components, dialyzers, bloodline systems, HD (hemodialysis) solutions, concentrates and water treatment systems.

Fresenius Medical offers a wide array of Hemodyalisis, Peritoneal dialysis and Acute Dialysis products. Fresenius Medical Care is focused on further expanding its home dialysis offerings in order to further boost the quality of life for its patients and increase their choice of available treatment options.

Image Source: Zacks Investment Research

In April 2022, the company received 510(k) clearance from the FDA for Versi PD Cycler System — the next-generation portable automated peritoneal dialysis system from Fresenius Medical Care North America. It is noteworthy that this dialysis system is simple, quiet, portable and advanced and has been developed to boost health equity for making home therapy more viable for a wider pool of dialysis patients.

Fresenius Medical has a solid market hold in the regions of North America, Europe (EMEA), the Asia Pacific and Latin America. To strengthen its market position, the company is resorting to various approaches like enhancing its organic growth and making strategic and suitable acquisitions. The company also aims to align its business activities through public-private partnerships in the dialysis business to tap into new markets in the coming quarters.

In the first quarter of 2022, the company witnessed strong contributions of 4%, 2% and 16% from the Asia Pacific, EMEA and Latin America, respectively.

What’s Hurting the Stock?

Fresenius Medical has numerous competitors in the field of health care services and the sale of dialysis products. Intense competition in the niche markets is likely to hamper the company’s sales opportunities, which in turn can lead to a loss of market share.

Meanwhile, COVID-related excess mortality and the war in Ukraine are affecting Fresenius Medical Cares' dialysis operations and patient care, thus hurting its top line. Moreover, significantly elevated labor costs in the United States are hurting operating margin. However, the company’s cost-saving initiatives has helped cushion the decline in operating margin.

Estimate Trend

The Zacks Consensus Estimate for 2023 revenues is pegged at $19.79 billion, suggesting a decline of 5% from the year-ago reported number, while the same for earnings stands at $1.98 per share, indicating a drop of 3.9%.

Stocks to Consider

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Masimo Corporation MASI and ShockWave Medical, Inc. SWAV.

AMN Healthcare surpassed earnings estimates in each of the trailing four quarters, the average surprise being 15.6%. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 1.1%. The company’s earnings yield of 8.9% compares favorably with the industry’s (1.4%).

Masimo beat earnings estimates in each of the trailing four quarters, the average surprise being 4.4%. The company currently carries a Zacks Rank #2 (Buy).

Masimo’s estimated earnings growth rate for second-quarter 2022 is pegged at 22.3%. The company’s earnings yield is 3.6% against the industry’s (8%).

ShockWave Medical surpassed earnings estimates in all the trailing four quarters, the average surprise being 190%. The company currently sports a Zacks Rank #1.

ShockWave Medical’s earnings growth rate for 2022 is estimated at 877%. The company’s earnings yield of 1% compares favorably with the industry’s (8%).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masimo Corporation (MASI): Free Stock Analysis Report

Fresenius Medical Care AG & Co. KGaA (FMS): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.