As 2020 progresses, Canopy Growth (CGC) will slowly adjust the business model away from wild startup operations to more normalized for the current cannabis realities. Previously, the company built the business for grand market scale and the new CEO from Constellation Brands is slowly right sizing the ship and making the large Canadian cannabis player a sustainable leader in the space.

Canopy Growth has a market cap of only $5.3 billion now with a large cash balance. The company is poised to boost revenues this fiscal year while substantially cutting costs. As out year revenue targets start heading towards $1 billion, the stock has the potential to rally from these levels.

Closing Global Operations

As with most of the cannabis players, the global cannabis market hasn’t opened up as predicted. The cannabis market is mostly Canada, U.S. and a few medical countries around the globe.

For this reason, the biggest area of savings in the sector are streamlining global operations and exiting locations with no path to profitability in the near term. In addition, a country generating a few million in annual revenues just isn’t worth the time of the executive management teams. Both Canopy Growth and Aurora Cannabis (ACB) have ambitions of reaching $1 billion in annual revenues making small foreign countries immaterial to future operations.

For this reason, Canopy Growth is wisely exiting operations in South Africa and Lesotho along with ceasing cultivation operations in Columbia. Along with exiting hemp farming operations in New York, the company is shifting more toward brand development and out of pure farming operations where supplies are abundant.

The company didn’t provide any details on the cost savings, but one can envision these operations all being pure cash bleeding units. The headcount reduction is only 85 full-time positions, but every dollar adds up when a business has quarterly EBITDA losses of C$90 million.

Ignore Pre-Tax Charge

Canopy Growth plans to take an estimated pre-tax charge of C$700 to $C800 million. The company ended the December quarter with C$2.6 billion in goodwill and intangible assets on the book while the market cap is only $5.3 billion now. The assets clearly aren’t valued based on market conditions expected in the next year.

These write downs are more reflections of the issues of the past year. What investors want to see is Canopy Growth come through with the cannabis growth similar to the recent results from Aphria (APHA).

Analysts forecast revenues slumping slightly in the March quarter with solid quarterly boosts throughout FY21. When combined with some big cuts in the EBITDA losses, the stock is a solid buy here below $15 and especially on more dips towards $10.

Canopy Growth lost C$92 million in the prior quarter and analysts are forecasting something similar in the March quarter. These downsized operations since the new CEO took over won’t have a full impact until this current quarter and investors want to see the losses cut at least in half with so much low-calorie expenses stripped out of the business.

Consensus Verdict

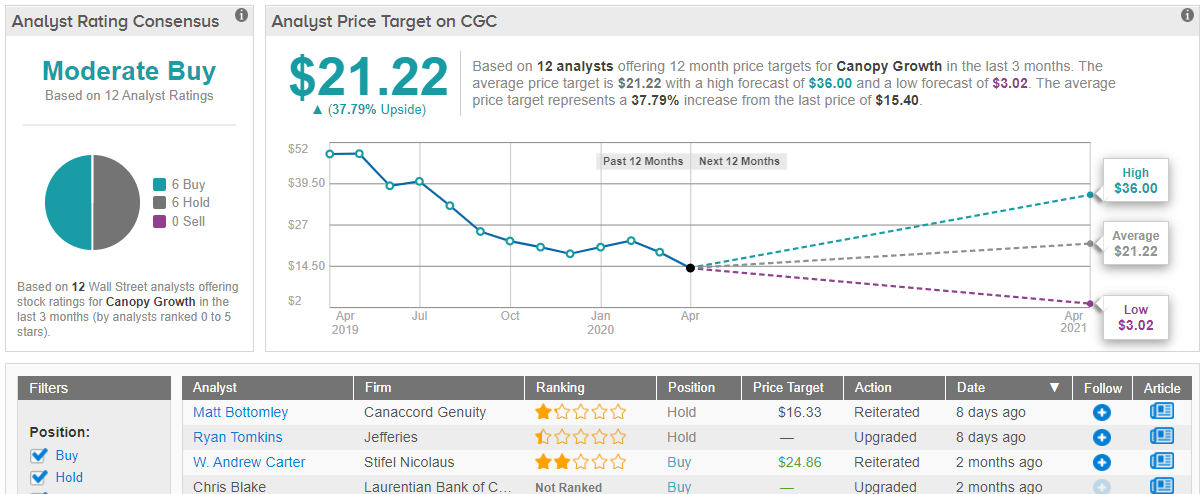

What do analysts say about the cannabis giant? It’s totally split. TipRanks analytics shows out of 12 analysts, 6 are bullish on Canopy Growth stock, while 6 remain sidelined. Yet, the consensus price target of $21.22 implies a potential upside of nearly 38%. (See Canopy Growth stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclosure: The author has no position in Canopy Growth stock.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.