CF Industries Holdings, Inc. CF is benefiting from healthy nitrogen fertilizer demand in major markets and lower natural gas costs amid headwinds from lower nitrogen prices.

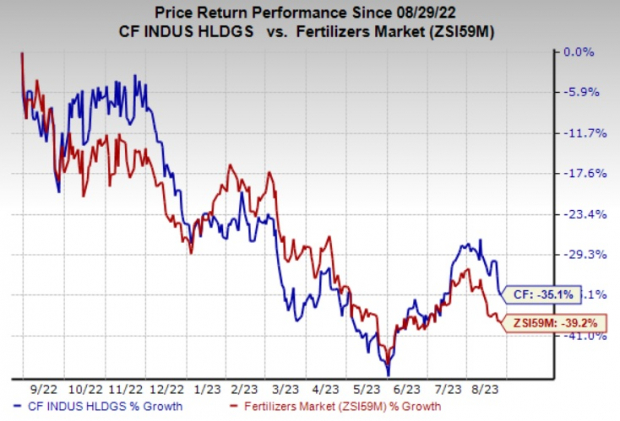

The company’s shares are down 35.1% over a year compared with the 39.2% decline of its industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Healthy Nitrogen Demand Bodes Well

CF Industries is well-placed to gain from rising global demand for nitrogen fertilizers, driven by significant agricultural demand. Higher crop commodity prices are contributing to healthy demand globally. Industrial demand has also recovered from the pandemic-related disruptions.

High levels of corn planted acres in the United States and favorable farm economics are likely to drive the demand for nitrogen in North America. Increased planted corn acres, higher crop prices and healthy farm economics are expected to support urea demand in Brazil. The company also expects demand in India to be driven by the government’s plans to maintain high urea volumes in stock.

The company is also expected to benefit from lower natural gas prices. CF Industries witnessed a significant decline in natural gas costs in the second quarter of 2023. Average cost of natural gas fell to $2.75 per MMBtu in the second quarter of 2023 from $7.05 per MMBtu in the year-ago quarter. Lower natural gas costs led to a decline in the company's cost of sales. The benefits of reduced gas costs are expected to continue in the third quarter.

CF Industries also remains committed to boosting shareholders’ value by leveraging strong cash flows. It generated operating cash flows of roughly $3.9 billion and a free cash flow of around $2.8 billion in 2022. The company also returned $1.65 billion to shareholders through share repurchases and dividends in 2022. During the first half of 2023, the company repurchased 3.1 million shares for $205 million, which included the purchase of 2 million shares for $130 million in the second quarter.

Weaker Nitrogen Prices a Concern

CF Industries faces headwinds from lower nitrogen prices. Global nitrogen prices have declined since the beginning of 2023. Higher global supply availability driven by higher global operating rates due to lower global energy costs has resulted in a decline in prices. Lower average selling prices weighed on CF's top line in the second quarter. The weak pricing environment is expected to continue in the third quarter. Lower pricing is expected to hurt the company’s sales and margins.

CF Industries Holdings, Inc. Price and Consensus

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Carpenter Technology Corporation CRS, Hawkins, Inc. HWKN and PPG Industries, Inc. PPG.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 61% in a year.

Hawkins currently carrying a Zacks Rank #1. It has a projected earnings growth rate of 18.9% for the current year.

Hawkins has a trailing four-quarter earnings surprise of roughly 25.6%, on average. HWKN shares are up around 43% in a year.

PPG Industries currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been revised 3.6% upward over the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 7.3%, on average. PPG shares have gained around 10% in a year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>PPG Industries, Inc. (PPG) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.