Kratos Defense & Security Solutions, Inc. KTOS , with rising earnings estimates, low debt, high liquidity and a rising backlog, offers a great investment opportunity in the Zacks Aerospace Defense Equipment industry.

Let’s focus on the reasons that make this Zacks Rank #2 (Buy) stock an attractive investment pick at the moment.

KTOS’ Growth Projections & Surprise History

The Zacks Consensus Estimate for KTOS’ 2025 earnings per share (EPS) has increased 3.5% to 59 cents in the past 90 days and indicates a 27.9% improvement from the year-ago estimated figure.

The consensus estimate for 2025 total revenues is pinned at $1.28 billion, which indicates growth of 12.2% from the 2024 estimated figure.

The company delivered an average earnings surprise of 70.63% in the last four quarters.

Debt Position of KTOS

Currently, Kratos Defense’s total debt to capital is 11.65%, better than the industry’s average of 54.03%.

Kratos Defense’s times interest earned ratio (TIE) at the end of the third quarter of 2024 was 4.9. The company’s strong TIE ratio indicates that it will be able to meet its interest payment obligations in the near term without any problems.

KTOS’ Liquidity

The company’s current ratio at the end of the third quarter of 2024 was 3.22, higher than the industry’s average of 1.43. The ratio, being greater than one, indicates Kratos Defense’s ability to meet its future short-term liabilities without difficulties.

KTOS’ Rising Backlog

Kratos Defense had an excellent backlog of $1.29 billion as of Sept. 29, 2024, up 11.1% from the year-ago quarter’s figure. Such significant backlog trends boost the company's revenue-generating possibilities for the following quarters. KTOS expects to recognize approximately 19% of the total backlog as revenues in 2024, an additional 50% in 2025 and the balance thereafter.

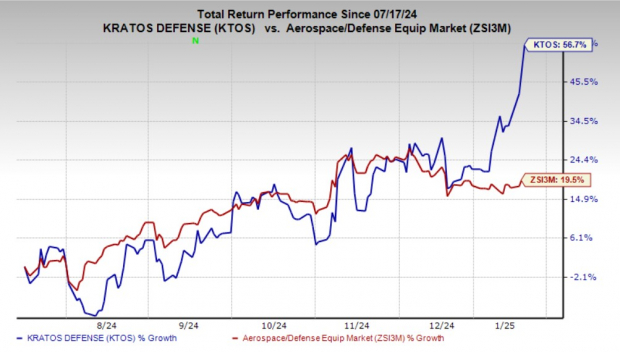

KTOS Stock’s Price Movement

Shares of KTOS have gained 56.7% in the past six months compared with the industry’s 19.5% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks from the same industry are Mercury Systems MRCY, AAR Corp. AIR and Leonardo DRS, Inc. DRS. Mercury Systems sports a Zacks Rank #1 (Strong Buy) at present, while AAR Corp. and Leonardo carry a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mercury Systems has a long-term earnings growth rate of 13.2%. The Zacks Consensus Estimate for MRCY’s fiscal 2025 sales is pinned at $848.9 million, which indicates year-over-year growth of 1.6%.

AAR Corp. delivered an average earnings surprise of 3.90% in the last four quarters. The Zacks Consensus Estimate for AIR’s fiscal 2025 sales is pinned at $2.76 billion, which indicates year-over-year growth of 18.9%.

Leonardo DRS delivered an average earnings surprise of 22.27% in the last four quarters. The Zacks Consensus Estimate for DRS’ 2025 sales is pinned at $3.43 billion, which indicates year-over-year growth of 7.4%.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>AAR Corp. (AIR) : Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS) : Free Stock Analysis Report

Mercury Systems Inc (MRCY) : Free Stock Analysis Report

Leonardo DRS, Inc. (DRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.