Dr. Reddy’s Laboratories RDY is a major player in the generic drugs markets. The company reports its financial performance under three operating segments — Global Generics, Pharmaceutical Services & Active Ingredients and Others.

Let’s delve deeper to discuss four reasons why adding Dr. Reddy’s stock to your portfolio may prove beneficial in fiscal 2025.

RDY Boasts a Strong Pipeline of Generic Drugs

Dr. Reddy’s enjoys a strong position in the generics market. As of Sept. 30, 2024, cumulatively, 80 generic filings were pending approval from the FDA (75 abbreviated new drug applications [ANDAs] and five new drug applications). Of these 75 ANDAs, 44 were Para IVs.

In fiscal 2024, the company continued to witness positive traction in both base business and recent launches in North America and the EU. In the fiscal year, the company launched 21 products in North America. In the second quarter of fiscal 2025, Dr. Reddy’s launched four new products in the United States and expects the launch momentum to continue in the balance of the year.

RDY’s Marketed Biosimilars to Boost Revenues

Dr. Reddy’s has expanded its biosimilars facility in India to meet growing demand in emerging markets. In the fourth quarter of fiscal 2024, the company launched Versavo (bevacizumab), a biosimilar of cancer drug Avastin, in the United Kingdom.

In July 2024, Dr. Reddy’s received a positive opinion from the advisory committee to the regulatory body in the EU, recommending the approval of its proposed biosimilar candidate, DRL_RI, for Roche’s RHHBY Rituxan/MabThera (rituximab) to treat the same, currently approved, indications. DRL_RI will be marketed under the brand name Ituxredi in the EU markets. A final approval is expected soon. Subject to approval, the rituximab biosimilar will further contribute to revenues. RDY also markets Hervycta (trastuzumab), a biosimilar of Roche’s Herceptin in India, which is indicated for the treatment of HER2-positive cancers.

Last month, Dr. Reddy’s, in collaboration with Senores Pharmaceuticals, launched Ivermectin Tablets USP, 3 mg, a biosimilar of Merck’s Stromectol (ivermectin) Tablets in the United States to treat parasitic infections in the intestines caused by some worms. RDY also recently launched a biosimilar of Coherus’ CHRS Loqtorzi (toripalimab) in India under the brand name Zytorvi for the treatment of adults with recurrent or metastatic nasopharyngeal carcinoma (RM-NPC), a rare form of head and neck cancer. Loqtorzi, developed by Coherus in collaboration with Junshi Biosciences, received FDA approval for the RM-NPC indication in 2023.

Dr. Reddy’s remains focused on building a global pipeline of valued products, including several generic injectables and biosimilars.

Year to date, shares of Dr. Reddy’s have gained 1.6% compared with the industry’s 12.5% growth.

Image Source: Zacks Investment Research

RDY’s Several Strategic Initiatives

Dr. Reddy’s has undertaken multiple strategic initiatives to strengthen its core operations, diversify its portfolio, and address industry challenges. Key efforts include modernizing infrastructure, implementing a new quality management system, and automating critical processes to enhance efficiency and regulatory compliance.

In 2023, the company divested non-core dermatology brands to focus on its core business and launched a new division, RGenX, to expand into India's trade generics market, emphasizing affordability and accessibility. Strategic partnerships have been pivotal. Notable collaborations include agreements with Sanofi for vaccine distribution and Bayer for heart failure drug vericiguat, in India. RDY partnered with Alvotech for the commercialization of AVT03, which is the latter’s biosimilar candidate of Amgen’s Prolia and Xgeva (denosumab) and is currently under development. RDY alsoacquired Haleon's nicotine replacement portfolio outside the United States for GBP 458 million.

In product diversification, Dr. Reddy’s secured the rights to Takeda’s gastrointestinal drug, Vonoprazan, for India and initiated a collaboration with Novartis for anti-diabetes brands in Russia. A joint venture with Nestlé India in nutraceutical products and supplements in India and Nepal marked further diversification.

Global efforts include a licensing deal with Gilead Sciences GILD to manufacture and distribute lenacapavir, an HIV treatment, across India and 120 other countries. Gilead is also looking to expand lenacapavir’s indication to HIV prevention. Collectively, these measures position Dr. Reddy’s for sustained growth, leveraging innovation, partnerships and market-specific strategies.

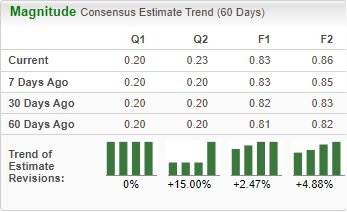

Dr. Reddy’s Constantly Rising Estimates

The Zacks Consensus Estimate for RDY’s fiscal 2025 earnings per share (EPS) has increased from 81 cents to 83 cents over the past 60 days. During the same time frame, the estimate for RDY’s fiscal 2026 EPS has increased from 82 cents to 86 cents.

Image Source: Zacks Investment Research

Invest in RDY Stock

Dr. Reddy’s faces significant rivalry due to the crowded nature of the generics market and pricing pressure in North America. Competition looms large on the company from players like Viatris, Teva, Sandoz and Aurobindo Pharma among others. However, RDY’s deep pipeline of generic drugs, accompanied by efforts to strengthen its position in the generic and biosimilars market, should provide the company the edge it needs over its competitors. Several generic filings are currently under review by the FDA. Dr. Reddy’s expects the approval of these filings by the regulatory body in the upcoming quarters, thereby bolstering its superiority in the market.

Additionally, consistently rising earnings estimates highlight analysts’ optimistic outlook for further growth. Therefore, investors should consider capitalizing on this opportunity by buying this Zacks Rank #2 (Buy) stock for long-term gains. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dr. Reddy's Laboratories Ltd Price and Consensus

Dr. Reddy's Laboratories Ltd price-consensus-chart | Dr. Reddy's Laboratories Ltd Quote

Must-See: Solar Stocks Poised to Skyrocket

The solar industry stands to bounce back as tech companies and the economy transition away from fossil fuels to power the AI boom.

Trillions of dollars will be invested in clean energy over the coming years – and analysts predict solar will account for 80% of the renewable energy expansion. This creates an outsized opportunity to profit in the near-term and for years to come. But you have to pick the right stocks to get into.

Discover Zacks’ hottest solar stock recommendation FREE.Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Coherus BioSciences, Inc. (CHRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.