For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in OneMain Holdings (NYSE:OMF). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

How Fast Is OneMain Holdings Growing Its Earnings Per Share?

Over the last three years, OneMain Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, OneMain Holdings's EPS shot from US$4.68 to US$10.89, over the last year. Year on year growth of 133% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

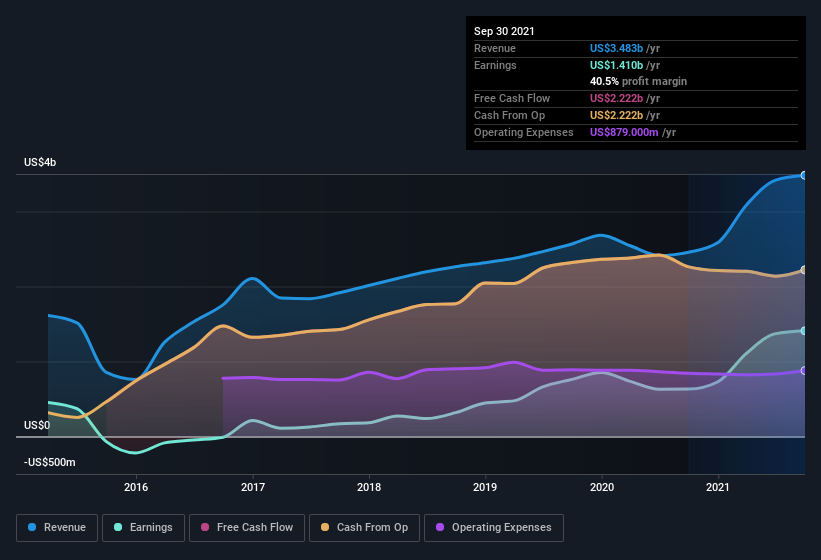

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that OneMain Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note OneMain Holdings's EBIT margins were flat over the last year, revenue grew by a solid 42% to US$3.5b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for OneMain Holdings.

Are OneMain Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell OneMain Holdings shares in the last year. Even better, though, is that the Chairman, Douglas Shulman, bought a whopping US$677k worth of shares, paying about US$57.26 per share, on average. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that OneMain Holdings insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$234m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does OneMain Holdings Deserve A Spot On Your Watchlist?

OneMain Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest OneMain Holdings belongs on the top of your watchlist. It is worth noting though that we have found 3 warning signs for OneMain Holdings (2 are a bit concerning!) that you need to take into consideration.

The good news is that OneMain Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.