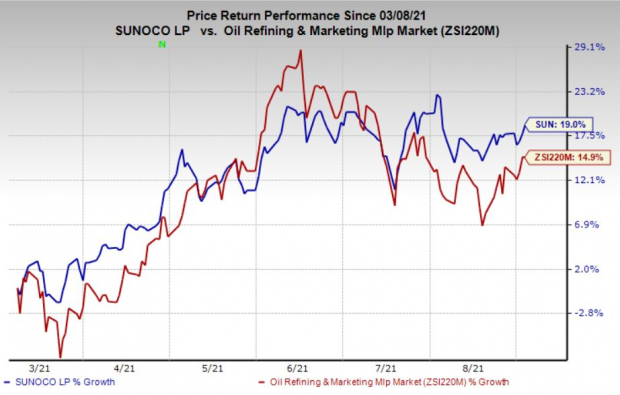

Sunoco LP SUN stock appears to be a solid bet now, based on strong fundamentals and compelling business prospects. The partnership’s units have popped 19% over the past six months, outperforming the industry’s 14.9% rally. A rise in unit price and strong fundamentals signal the stock’s potential bull run.

Image Source: Zacks Investment Research

So, if you want to take advantage of its stock price appreciation, it’s time you add the stock to your portfolio. Headquartered in Dallas, TX, Sunoco is a master limited partnership with a market cap of $3.8 billion. Its prime business comprises the distribution of motor fuel to roughly 10,000 customers that include independent dealers, commercial customers, convenience stores and distributors. The leading refining and marketing firm currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Let's see what makes Sunoco’s stock an attractive investment option at the moment.

Northbound Estimates

Earnings estimate revisions have the greatest impact on stock prices. Over the past two months, the Zacks Consensus Estimate for Sunoco’s earnings for the current year has improved 5.4%. During this time period, the stock has witnessed one upward revision and no downward movement.

The Zacks Consensus Estimate of revenues for the current year is pegged at $15.9 billion, signaling a 48.5% year-over-year rise.

Positive Earnings Surprise History

Sunoco outpaced the Zacks Consensus Estimate in three of the trailing four quarters, while missing the same once. It delivered a four-quarter average earnings surprise of 52.3%.

Growth Drivers

Sunoco is one of the largest motor fuel distributors in the wholesale market of the United States in terms of volume. Through distributing more than 10 fuel brands under long-term distribution contracts, with around 10,000 convenience stores, the partnership will continue to generate stable cash flows. Its distribution networks, spanning across 30 states in the domestic market, reflect strong business with sustainable and predictable cash flows. Its Brownsville terminal addition will further diverse revenue sources.

The partnership is expected to gain from recovering gasoline demand and rising consumption of diesel fuel. Due to multiple coronavirus vaccines being rolled out across the country, more consumption of fuels and increasing refining productions in the domestic market will likely drive demand for wholesale fuel distribution businesses. This, in turn, can boost the partnership’s profits. The firm expects fuel volumes for the year within 7.25-7.75 billion gallons, indicating a rise from the 2020 level of 7.09 billion gallons. Also, it anticipates full-year 2021 adjusted EBITDA within $725-$765 million, the mid-point of which is higher than the 2020 level of $739 million.

The partnership is currently focused on reducing costs and expenses, which is expected to benefit its bottom line. Through 2020, total cost of sales decreased to $10,293 million from $16,132 million in the year-ago comparable period. The metric is expected to further decrease in 2021. Importantly, it expects operating expenses within $440-$450 million for 2021.

Sunoco entered into an agreement with NuStar Energy L.P. NS to acquire its eight refined product terminals for $250 million. The acquisition involves seven refined product terminals on the U.S. east coast and one in the Midwest, with an overall storage capacity of 14.8 million barrels. Additionally, the partnership agreed to acquire a refined product terminal from Cato for $5.5 million. The terminal, located in Salisbury, MD, has a storage capacity of 140 thousand barrels. These acquisitions will likely result in a significant expansion of the partnership's midstream business, enhance its platform for fuel distribution expansion, and enable it to remain within long-term leverage and coverage target levels.

Risks

There are some factors that are holding the stock back. Its balance sheet weakness comprising high debt burden can lead to a reduction in financial flexibility and hamper prospects. The partnership plans to expand the midstream business through the acquisition of logistic assets like product terminals and others. As such, its debt-ridden balance sheet can hinder this plan. Nevertheless, we believe that a systematic and strategic plan of action will drive long-term growth.

Other Stocks to Consider

Other top-ranked stocks from the energy space include Suburban Propane Partners, L.P. SPH and Comstock Resources, Inc. CRK, each having a Zacks Rank #2 (Buy).

Suburban Propane’s bottom line for 2021 is expected to rise 62.9% year over year.

The Zacks Consensus Estimate for Comstock Resources’ earnings for 2021 is pegged at $1.10 per share, signaling a major improvement from the year-ago figure of 23 cents.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK): Get Free Report

NuStar Energy L.P. (NS): Free Stock Analysis Report

Sunoco LP (SUN): Free Stock Analysis Report

Suburban Propane Partners, L.P. (SPH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.