Manulife Financial Corporation’s MFC strong U.S. and Canada business, resilient Asia trade, expanding wealth and asset management domain, solid capital position and favorable growth estimates make it worthy of adding to one’s portfolio.

The life insurer has a decent track record of delivering earnings surprise in three of the last four quarters while missing once, the average beat being 1.6%.

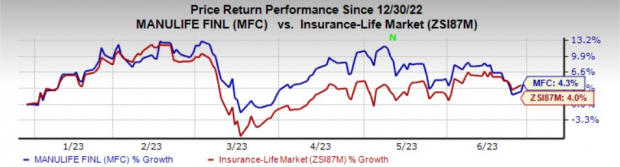

Zacks Rank and Price Performance

Manulife currently carries a Zacks Rank #2 (Buy). In the year-to-date period, the stock has gained 4.3% outperforming the industry’s increase of 4%.

Image Source: Zacks Investment Research

Return on Equity

Manulife’s return on equity (ROE) for the trailing 12 months is 12.8%, better than the industry’s average of 12.4%. This reflects Manulife’s efficiency in utilizing shareholders’ fund. The company targets 15% ROE over the medium term.

Key Drivers

Manulife, a leading life insurer in Canada, is continually growing its Asia business that contributes significantly to its core earnings. The life insurer remains focused on accelerating growth in the highest potential businesses and targets two-third of core earnings from these businesses. MFC’s Asia business is expected to benefit from an aging population and growth in household wealth.

Manulife is consistently expanding its Wealth and Asset Management business around the world that in turn has been driving its core earnings growth. Core net investment increased 14% in the first quarter.

MFC has an impressive inorganic growth story. Strategic acquisitions, transformational digital offerings and bancassurance partnerships are expected to fuel growth in future. Banking on solid financial position, Manulife is well poised to ramp up its inorganic growth profile.

In tandem with the industry trend, MFC invested $1 billion since 2018 to enhance its digital capabilities.

The Zacks Consensus Estimate for 2023 and 2024 earnings per share is pegged at $2.44 and $2.61, indicating increases of 2.5% and 7.2% year over year, respectively. The long-term earnings growth rate is currently pegged at 10%. Manulife targets core EPS growth to be between 10% and 12% over the medium term.

MFC boasts a strong capital position. Its dividend has increased at a six-year CAGR of 10%. It targets dividend payout in the range of 35-45% over the medium term.

The insurer returned $1.1 billion to shareholders through share buyback and dividends in the first quarter. MFC targets a leverage ratio of 25% over the medium term.

Manulife has a Value Score of A. Back-tested results have shown that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or #2, offer better returns.

However, MFC’s long-term debt has increased more than three-fold over the last five years. As of Mar 31, 2023, the company’s long-term debt increased 8.4% year over year. Nevertheless, we believe that a systematic and strategic plan of action will drive growth in the long term.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are Reinsurance Group of America RGA, Primerica PRI and Kinsale Capital Group, Inc. KNSL.

Reinsurance Group currently sports a Zacks Rank #1 (Strong Buy). RGA’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters and missed once, average beat being 57%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RGA’s 2023 and 2024 earnings per share indicates year-over-year increases of 23.2% and 1.9%, respectively.

Primerica presently carries a Zacks Rank #2. PRI’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters and missed once, average beat being 3.8%.

The Zacks Consensus Estimate for PRI’s 2023 and 2024 earnings per share implies year-over-year rises of 34% and 11.5 respectively. Year to date, PRI shares have gained 36.9%.

Kinsale Capital carries a Zacks Rank #2 at present. KNSL’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, average beat being 14.8%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings per share suggests year-over-year improvements of 36.2% and 21.4%, respectively. Year todate, KNSL’s shares have surged 40.1%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Manulife Financial Corp (MFC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.