Host Hotels & Resorts Inc.’s HST solid portfolio of luxury and upper-upscale hotels in the United States and abroad is well-poised to benefit from the ongoing recovery in the lodging industry. Also, the company’s strategic acquisitions and capital-recycling efforts bode well.

Host Hotels’ portfolio primarily comprises upscale hotels across the top 22 lucrative U.S. markets, with a strong presence in the Sunbelt region. With the hotel industry reviving, HST’s well-located properties in markets with strong demand drivers like central business districts of main cities, close to airports and in resort/conference destinations are likely to benefit.

Driven by the increase in leisure travel in Sunbelt markets, the company’s all-owned-hotel revenue per available room (RevPAR) during second-quarter 2022 almost doubled to $219.3 million sequentially. It was also the first time since the onset of the pandemic that the company’s quarterly RevPAR exceeded the 2019 levels. HST’s value-enhancement initiatives are likely to support the long-term growth in its RevPAR.

Also, over the past years, HST has made significant acquisitions of high-quality properties. Its total value of acquisitions for 2021 aggregated $1.6 billion. This January, HST acquired a 49% ownership interest in a joint venture with Noble Investment Group, a private hospitality asset manager focusing on upscale select-service and extended-stay properties. These buyouts aid the company in achieving higher earnings before interest, taxes, depreciation and amortization (EBITDA) and revenues.

HST has been making concerted efforts to dispose of non-strategic assets that have maximized their value through its capital-recycling program. It redeploys the proceeds to acquire or invest in premium properties in markets that are anticipated to recover faster, like leisure and drive-to destinations. From the beginning of 2021 to Aug 4, 2022, total dispositions aggregated $1.4 billion at 17.8 times EBITDA multiple.

HST maintains a healthy balance sheet with no material debt maturities until January 2024. As of Jun 30, 2022, the company had $2.4 billion in total available liquidity. Moreover, it is the only company with an investment-grade rating among lodging REITs. This financial flexibility will aid capital deployment for long-term growth opportunities and facilitate redevelopment activities.

Analysts seem bullish on this Zacks Rank #2 (Buy) stock. The estimate revisions trend in the past month for 2022 funds from operations (FFO) per share indicates a favorable outlook for the company as it has increased 6.1% in the past month to $1.73.

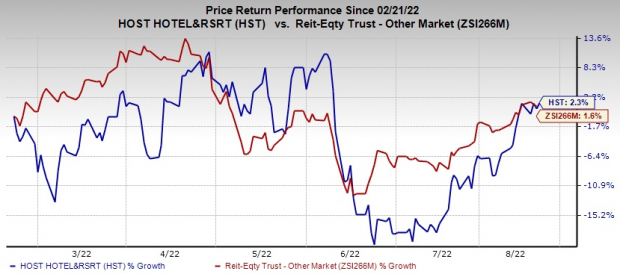

Shares of HST have gained 2.3% compared with the industry’s growth of 1.6% in the past six months.

Image Source: Zacks Investment Research

However, Host Hotels faces stiff competition from other owners and investors in upper upscale and luxury full-service hotels, including other lodging REITs. Moreover, the supply in the lodging industry has increased due to a spike in online short-term rentals.

Although the urban markets witnessed a sequential improvement in group demand during second-quarter 2022, the recovery of the transient business and group travel is likely to be tepid in the near term due to a delayed return to the office and a slow return to conferences. Also, any further disruptions in the economy could prolong the ongoing recovery of the lodging industry.

Other Stocks to Consider

Some other top-ranked stocks from the REIT sector are Prologis PLD, Public Storage PSA and Extra Space Storage EXR.

The Zacks Consensus Estimate for Prologis’ 2022 FFO per share has moved marginally upward in the past month to $5.17. PLD currently holds a Zacks Rank of 2.

The Zacks Consensus Estimate for Public Storage’s current-year FFO per share has marginally moved northward in the past week to $15.62. PSA carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Extra Space Storage’s ongoing year’s FFO per share has been raised 1.2% over the past week to $8.40. EXR sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST): Free Stock Analysis Report

Public Storage (PSA): Free Stock Analysis Report

Prologis, Inc. (PLD): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.