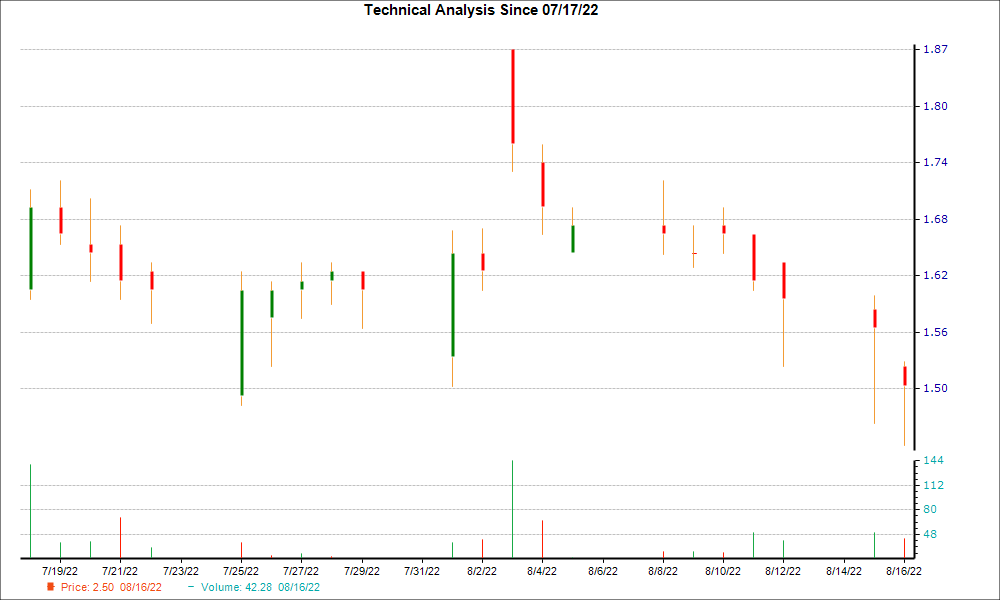

Shares of Ceragon Networks (CRNT) have been struggling lately and have lost 5.3% over the past week. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. So, it could witness a trend reversal down the road.

While the formation of a hammer pattern is a technical indication of nearing a bottom with potential exhaustion of selling pressure, rising optimism among Wall Street analysts about the future earnings of this provider of wireless backhaul services is a solid fundamental factor that enhances the prospects of a trend reversal for the stock.

Understanding Hammer Chart and the Technique to Trade It

This is one of the popular price patterns in candlestick charting. A minor difference between the opening and closing prices forms a small candle body, and a higher difference between the low of the day and the open or close forms a long lower wick (or vertical line). The length of the lower wick being at least twice the length of the real body, the candle resembles a 'hammer.'

In simple terms, during a downtrend, with bears having absolute control, a stock usually opens lower compared to the previous day's close, and again closes lower. On the day the hammer pattern is formed, maintaining the downtrend, the stock makes a new low. However, after eventually finding support at the low of the day, some amount of buying interest emerges, pushing the stock up to close the session near or slightly above its opening price.

When it occurs at the bottom of a downtrend, this pattern signals that the bears might have lost control over the price. And, the success of bulls in stopping the price from falling further indicates a potential trend reversal.

Hammer candles can occur on any timeframe -- such as one-minute, daily, weekly -- and are utilized by both short-term as well as long-term investors.

Like every technical indicator, the hammer chart pattern has its limitations. Particularly, as the strength of a hammer depends on its placement on the chart, it should always be used in conjunction with other bullish indicators.

Here's What Increases the Odds of a Turnaround for CRNT

There has been an upward trend in earnings estimate revisions for CRNT lately, which can certainly be considered a bullish indicator on the fundamental side. That's because a positive trend in earnings estimate revisions usually translates into price appreciation in the near term.

Over the last 30 days, the consensus EPS estimate for the current year has increased 28.5%. What it means is that the sell-side analysts covering CRNT are majorly in agreement that the company will report better earnings than they predicted earlier.

If this is not enough, you should note that CRNT currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. And stocks carrying a Zacks Rank #1 or 2 usually outperform the market. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>>

Moreover, the Zacks Rank has proven to be an excellent timing indicator, helping investors identify precisely when a company's prospects are beginning to improve. So, for the shares of Ceragon, a Zacks Rank of 2 is a more conclusive fundamental indication of a potential turnaround.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Ceragon Networks Ltd. (CRNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.