Shares in aerospace giant Boeing (NYSE: BA) declined by 32.1% in 2024, according to data provided by S&P Global Market Intelligence. It was an eventful year for the company, marred by operational mishaps, industrial action, senior management changes, significant cash outflows, and disappointing airplane deliveries. Here's what happened in 2024 and a sneak peek at 2024.

Boeing's challenging year in commercial aerospace

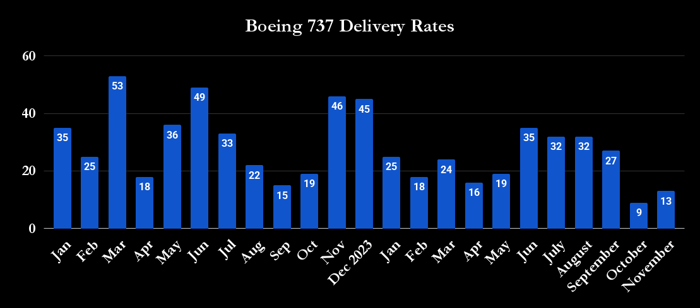

Last year had hardly begun before a high-profile door plug blowout on a Boeing 737 MAX on an Alaska Airlines flight raised renewed safety and quality concerns at Boeing. Then-CEO Dave Calhoun deliberately slowed deliveries while the company worked on improving quality control in the spring. Slowing 737 MAX deliveries is one of the last things Boeing wants to do and the last thing airlines wish to see, but everybody wants to see Boeing ensure the quality of their airplanes.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

It gets worse. A protracted dispute over a new labor contract led to strikes and the shutdown of production lines in the autumn, notably on the 737 MAX. The result is that Boeing got nowhere near its aim of achieving an initial rate of 38 deliveries a month for the 737 MAX.

Data source: Boeing presentations. Chart by author.

In addition, there was bad news on the widebody 777X airplane program. The successor to the widebody 777, the new airplane was initially supposed to have its first delivery in 2020. But management pushed the timeline out again and expects the first delivery in 2026. That's not only an issue for airlines waiting for the planes, but it also means more costs for Boeing and cash tied up in inventory.

Boeing's challenging year in defense

As the chart below shows, it was another extremely challenging year at Boeing Defense, Space & Security (BDS). The segment battled ongoing supply chain pressures and incurred charges and losses on problematic fixed-price development programs procured in less inflationary times.

Data source: Boeing presentations. Chart by author.

Boeing's fresh start in 2025

On a more positive note, industry veteran Kelly Ortberg replaced Calhoun as CEO in August, and Boeing parted company with its BDS CEO, Ted Colbert, in September.

Image source: Getty Images.

While Ortberg has his hands full turning Boeing around, the recent large order for the 737 MAX from Pegasus Airlines highlights that airlines still have the confidence to place orders. Also, the company still has a multiyear backlog of orders for the 737 MAX, it can work through the problematic defense programs (most of the defense segment revenue is profitable), and there's no shortage of demand for widebodies like the 777X.

If Ortberg can improve execution, Boeing could have a great 2025 as it works toward developing a new plane by 2035.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $363,307!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,963!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $471,880!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 6, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Alaska Air Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.