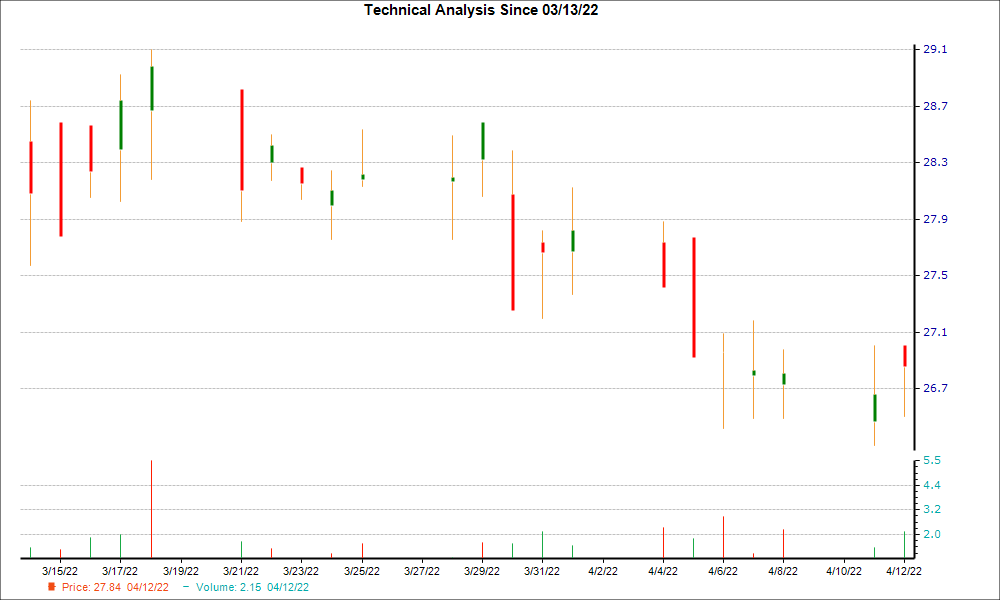

Shares of Bar Harbor Bankshares (BHB) have been struggling lately and have lost 8.7% over the past two weeks. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. So, it could witness a trend reversal down the road.

The formation of a hammer pattern is considered a technical indication of nearing a bottom with likely subsiding of selling pressure. But this is not the only factor that makes a bullish case for the stock. On the fundamental side, strong agreement among Wall Street analysts in raising earnings estimates for this bank enhances its prospects of a trend reversal.

What is a Hammer Chart and How to Trade It?

This is one of the popular price patterns in candlestick charting. A minor difference between the opening and closing prices forms a small candle body, and a higher difference between the low of the day and the open or close forms a long lower wick (or vertical line). The length of the lower wick being at least twice the length of the real body, the candle resembles a 'hammer.'

In simple terms, during a downtrend, with bears having absolute control, a stock usually opens lower compared to the previous day's close, and again closes lower. On the day the hammer pattern is formed, maintaining the downtrend, the stock makes a new low. However, after eventually finding support at the low of the day, some amount of buying interest emerges, pushing the stock up to close the session near or slightly above its opening price.

When it occurs at the bottom of a downtrend, this pattern signals that the bears might have lost control over the price. And, the success of bulls in stopping the price from falling further indicates a potential trend reversal.

Hammer candles can occur on any timeframe -- such as one-minute, daily, weekly -- and are utilized by both short-term as well as long-term investors.

Like every technical indicator, the hammer chart pattern has its limitations. Particularly, as the strength of a hammer depends on its placement on the chart, it should always be used in conjunction with other bullish indicators.

Here's What Makes the Trend Reversal More Likely for BHB

There has been an upward trend in earnings estimate revisions for BHB lately, which can certainly be considered a bullish indicator on the fundamental side. That's because a positive trend in earnings estimate revisions usually translates into price appreciation in the near term.

The consensus EPS estimate for the current year has increased 5.2% over the last 30 days. This means that the Wall Street analysts covering BHB are majorly in agreement about the company's potential to report better earnings than what they predicted earlier.

If this is not enough, you should note that BHB currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. And stocks carrying a Zacks Rank #1 or 2 usually outperform the market. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>>

Moreover, the Zacks Rank has proven to be an excellent timing indicator, helping investors identify precisely when a company's prospects are beginning to improve. So, for the shares of Bar Harbor, a Zacks Rank of 2 is a more conclusive fundamental indication of a potential turnaround.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpBar Harbor Bankshares, Inc. (BHB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.