For most retirees, Social Security provides more than just a check each month. The money seniors receive serves as a financial foundation that helps many of the program's beneficiaries make ends meet.

Considering how important Social Security has been to the financial well-being of our nation's seniors for decades, it's no surprise that the annual cost-of-living adjustment (COLA) is the most anticipated announcement each year. In 2023, Oct. 12 was the date in question beneficiaries had circled.

Image source: Getty Images.

How is Social Security's cost-of-living adjustment (COLA) calculated?

In simple terms, Social Security's COLA is a mechanism aimed at ensuring that Social Security income doesn't lose purchasing power over time. If a basket of goods and services that seniors regularly buy increases in price, Social Security checks should, in a perfect world, increase by the same amount. COLA is the tool that provides these inflation-matching "raises" most years.

Prior to 1975, cost-of-living adjustments were arbitrarily assigned by special sessions of Congress. During the 1940s, not a single benefit increase was passed along to recipients to account for inflation.

Since 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been the inflationary measure used to calculate annual COLAs for America's top retirement program. The CPI-W has eight headline spending categories, along with dozens upon dozens of subcategories, all of which have their own respective weightings. These individual weightings are what allow the CPI-W to be expressed as a single figure, which makes for easy year-over-year comparisons to determine if inflation (rising prices) or deflation (falling prices) has taken shape.

Although the U.S. Bureau of Labor Statistics (BLS) reports the CPI-W on a monthly basis, Social Security's COLA calculation only factors in readings from the third quarter (July through September). If the average CPI-W reading from the third quarter of the current year is higher than the average CPI-W reading from Q3 of the previous year, inflation has occurred -- and when inflation occurs, beneficiaries receive a higher payout in the upcoming year.

The year-over-year percentage difference between average Q3 CPI-W readings, rounded to the nearest tenth of a percent, determines how much benefits will increase next year.

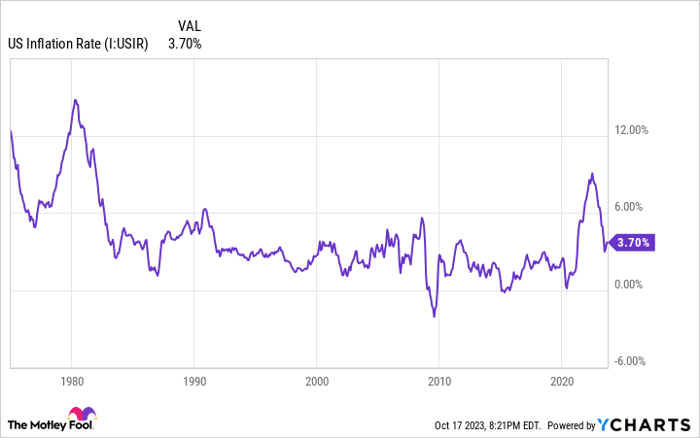

An above-average inflation rate means an above-average payout increase for Social Security beneficiaries in 2024. U.S. Inflation Rate data by YCharts.

What does a 3.2% COLA in 2024 actually mean in dollar terms for beneficiaries?

On Oct. 12, 2023, the BLS released the September inflation report, which was the last puzzle piece needed to calculate Social Security's cost-of-living adjustment for 2024. The end result of this announcement was a 3.2% COLA for Social Security's more than 66 million beneficiaries next year.

On a percentage basis, a 3.2% COLA is a major letdown from the 8.7% cost-of-living adjustment passed along this year. Nevertheless, next year's increase still comes in modestly above the 2.6% average COLA over the past 20 years.

What does a 3.2% cost-of-living adjustment look like in dollar terms for the average retired worker, worker with disabilities, and survivor beneficiary? Let's take a closer look.

As of September, nearly 50 million retired workers were receiving a monthly Social Security check. Prior to applying the 3.2% COLA, these retirees were expected to bring home an average of $1,848 per month. But after the 3.2% increase, the average retired worker will see their payout rise $59 per month to a Social Security Administration (SSA)-estimated $1,907/month.

Over 7.4 million workers with long-term disabilities are receiving a monthly Social Security benefit as well. By the end of the year, the SSA estimates that the average disabled worker will collect $1,489 per month. Come January 2024, the 3.2% COLA should lift the average check to workers with disabilities by $48 per month to $1,537.

Lastly, more than 5.8 million survivors of deceased workers are paid a benefit each month. Whereas the average survivor benefit is expected to be $1,458 by the end of the year, a 3.2% COLA added on top will increase the monthly payout for survivors by an estimated $47 to $1,505 in 2024.

Image source: Getty Images.

There's not much of a silver lining for Social Security's beneficiaries in 2024

Next year's 3.2% COLA is, statistically, a step up from the average cost-of-living adjustment since 2004. But while most beneficiaries should be happy, on paper, with the benefit bump they're about to receive, looking at the bigger picture leaves little to cheer about.

Although the CPI-W is tasked with accurately measuring the inflation beneficiaries are contending with, data shows that it's doing a terrible job. According to The Senior Citizens League, a nonpartisan group focused on advancing issues important to seniors, the purchasing power of Social Security income has plunged by 36% since January 2000.

The reason the CPI-W is failing America's top retirement program so badly can be found in its name: Consumer Price Index for Urban Wage Earners and Clerical Workers (emphasis on the italics). Urban wage earners and clerical workers are typically working-age Americans who aren't currently receiving a Social Security benefit.

More importantly, they spend their money differently than the 86% of Social Security recipients who are aged 62 and over. Although seniors devote a higher percentage of their monthly budget to medical care and shelter expenses than the average American, the CPI-W doesn't account for this in its calculation. The end result is a persistent loss of purchasing power for retired workers that may get even worse in 2024.

To make matters worse, Medicare Part B premiums -- Medicare Part B covers outpatient services -- are set to rise by almost 6% in 2024 (from $164.90/month in 2023 to $174.70/month next year). Part B premiums fell for only the second time this century in 2023, which allowed some beneficiaries to hang onto more of their historic 8.7% COLA. This is unlikely to be the case in 2024, with a meaningful uptick in Part B premiums gobbling up some or all of next year's 3.2% cost-of-living adjustment.

The $21,756 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $21,756 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.