Few names command as much attention when it comes to investing as Warren Buffett. It's for good reason, too, when you consider the success he and his company, Berkshire Hathaway, have sustained through decades.

Given their success, it's no surprise that people often look to Buffett and Berkshire Hathaway for investing ideas. The average investor shouldn't blindly copy a billionaire's or a trillion-dollar company's investing strategy because their goals and resources are different, but there's nothing wrong with looking at their portfolios for inspiration.

One stock in particular that I consider my favorite in Berkshire Hathaway's portfolio is Visa (NYSE: V). Although it's not one of its top holdings, Visa has a competitive advantage and growth projections that make it a good choice to be a staple in many investors' portfolios for quite some time.

An asset-light business with industry-leading margins

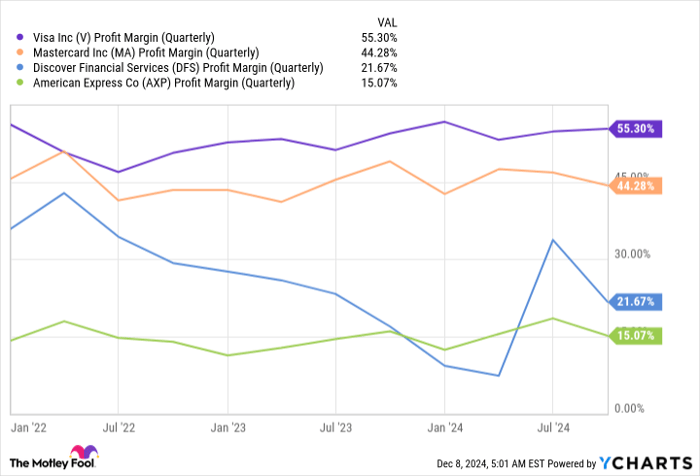

In its fiscal year 2024 (ended Sept. 30), Visa reported $35.9 billion in revenue, up 10% year over year. That's impressive, for sure, but what's even more impressive is Visa's margins. Its profit margin is more than 55%, which is something few companies can manage to accomplish.

V Profit Margin (Quarterly) data by YCharts

Since many of the investments required to expand Visa's network to this point have already been made, Visa enjoys industry-leading margins.

Pocketing $0.55 for each $1 of revenue is a recipe for long-term financial stability, and it's also why Visa's balance sheet is sitting nicely with $17.7 billion of cash, cash equivalents, and investment securities.

The network effect is the gift that keeps on giving

The network effect is a cornerstone for organic growth, and few companies benefit as much from it as Visa.

How often have you been somewhere that accepted cards but didn't accept Visa cards? For most people, I'm willing to bet you can count the times on a few fingers -- if ever. That's because Visa is by far the most accepted card globally, with more than 130 million merchant locations.

Because you don't generally have to worry about a business accepting your Visa card like you do with issuers like American Express and Discover, many people prefer to go the Visa route for convenience.

As a merchant, the same idea applies. Since Visa is the most common card globally, merchants are more incentivized to accept Visa than any other issuer. Not accepting Visa cards could lead to missed sales, which is another problem in itself.

This network effect has propelled much of Visa's organic growth, and there's no reason to believe this will stop in the foreseeable future. It's like a snowball rolling down a mountain; the more it rolls, the larger it gets. In this case, Visa's snowball is its cardholders and merchants.

Visa isn't cheap, but it's well worth the price

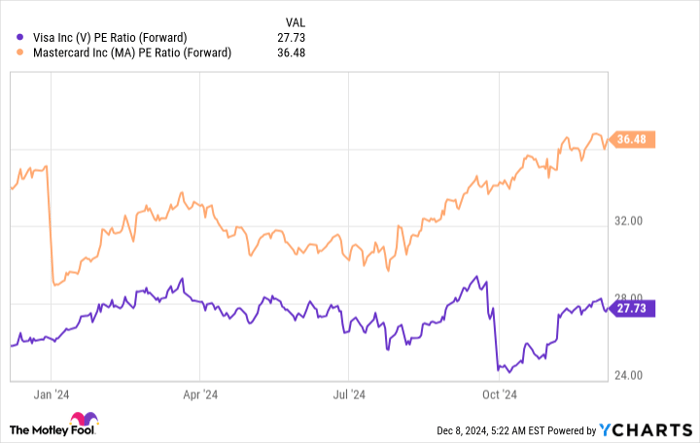

Visa's stock is far from a bargain, trading at about 27.7 times forward earnings. However, premium businesses typically command premium prices, and Visa is much cheaper than its biggest competitor, Mastercard (NYSE: MA).

V PE Ratio (Forward) data by YCharts

One thing that can help offset the risk that comes with premium-priced stocks is Visa's dividend. With a yield of just about 0.75%, I wouldn't view Visa as a "dividend stock," but any guaranteed income is welcome.

Visa recently said it would increase its quarterly dividend by 13% to $0.59 per share, marking the 16th consecutive year of increases. Given Visa's healthy bank account and current streak, it's safe to assume the company plans to make annual increases a part of its value proposition for investors.

If you have reservations about Visa's premium pricing, a good route would be to dollar-cost average, which is what I do. Visa will be a staple in my portfolio for the long haul, so I've learned to ignore prices (within reason) and remember a Buffett quote that has stuck with me: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $359,936!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,730!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $492,745!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

American Express is an advertising partner of Motley Fool Money. Discover Financial Services is an advertising partner of Motley Fool Money. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.