Cybersecurity is one of the most lucrative corners of the market to invest in. If the economy goes through a downturn, these companies would still be set up for success, as cybersecurity is one area of software where businesses can't afford to skimp out on spending.

While there are multiple ways to invest in cybersecurity, only one is my favorite: CrowdStrike (NASDAQ: CRWD). It's been a top performer in this industry and is seen as a leader in many ways. But is it worth buying right now?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

CrowdStrike has multiple cybersecurity offerings

CrowdStrike started with endpoint security. Endpoint security protects network access points (like a laptop) from digital intruders, and it uses artificial intelligence (AI) to determine what is normal activity and what is a threat.

But that's just one part of CrowdStrike's business now. It has nearly 30 modules, which give customers access to different capabilities across the CrowdStrike Falcon platform. These capabilities range from exposure management to data protection to cloud security.

With each additional module, CrowdStrike makes more revenue, making multiple module adoption a critical part of its growth. It has done just that, as 66% of customers have at least five modules, with 31% using at least seven. Compared to last year's Q3, when 63% of clients were using five modules and 26% were using seven, this is solid growth.

Existing customer expansion combined with new customer acquisition drove annual recurring revenue (ARR) 27% higher to $4.02 billion for the company's fiscal 2025 third quarter (ended Oct. 31). But that's just the beginning. Management expects to achieve $10 billion in ARR by the end of fiscal 2031 and reach an operating margin of 28% to 32% and free cash flow margin of 34% to 38% by fiscal 2029, on a non-GAAP (generally accepted accounting principles) basis.

That's an incredibly strong business that will likely reward shareholders handsomely. But it's also a significant way down the road. Is CrowdStrike worth buying right now?

The stock is far from cheap

Currently, CrowdStrike bounces between profitable and unprofitable during any quarter. So, using earning-based metrics to value the company isn't possible. However, we can value it using free cash flow (FCF) and sales. From these two perspectives, one thing is clear: CrowdStrike's stock is very expensive.

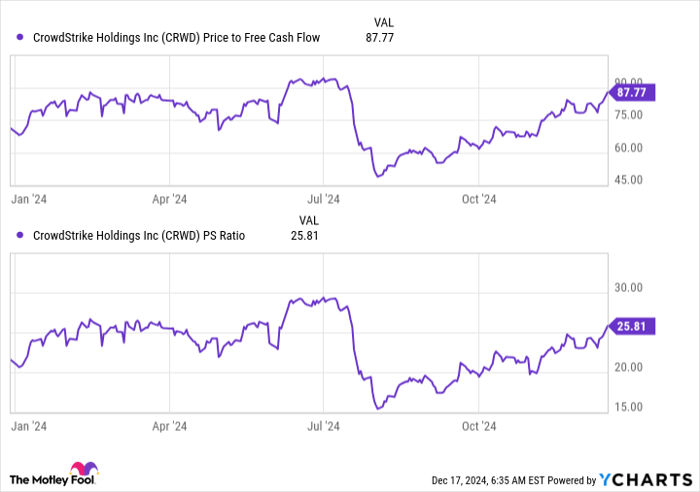

CRWD Price to Free Cash Flow data by YCharts

At 88 times FCF and 26 times sales, CrowdStrike has a ton of high expectations built into it. This likely makes it a poor purchase for 2025. However, I'm not focused on a one-year stock return. Instead, I'm keeping my eye on its long-term potential.

If CrowdStrike grows its ARR at a constant rate between now and its 2031 projection, that means it will have a compound annual growth rate of around 16%. That puts ARR on a trajectory to hit $7.5 billion by 2029, when CrowdStrike is set to optimize its financials. If it hits the midpoint of its guidance, that would give it an FCF of around $2.7 billion -- a substantial increase from its current $1.1 billion mark.

An investment in CrowdStrike now is a bet on the long-term growth of the cybersecurity industry and its success within it. However, CrowdStrike has remained on top of this world, making it a good pick for 2025, but an even better one if you have a long-term mindset.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $800,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Keithen Drury has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.