Henry Schein, Inc. HSIC recently announced that its subsidiary, Henry Schein One, has introduced a version of its dental analytics platform for dental service organization (DSO) -- Jarvis Analytics -- to help private dental practices accelerate business growth. The latest development will support Henry Schein’s objective to provide the best-quality solutions to dental practices.

Few Words on Jarvis Analytics

Jarvis Analytics is a software company that develops comprehensive business analytics tools to help dental practitioners and their teams use data to diagnose problems, strengthen decision-making, and improve business performance. In May 2021, Henry Schein One acquired an 80% ownership interest in Jarvis Analytics.

Jarvis Analytics works with several practice management systems, including Dentrix, Dentrix Ascend, Eaglesoft, Open Dental, Denticon, and others, making Jarvis Analytics a seamless solution for most practices in the United States with a practice management system.

More on the News

Jarvis Analytics simplifies the compilation of data from the practice management system and other sources and presents it in real-time reports, dashboards, and other methods. The forecast reports generated by Jarvis Analytics enables dental office managers to identify opportunities to improve revenue, including hygiene recall, patient retention, case acceptance, and bill collection.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Jarvis Analytics further extends the tools of its DSO version to the independent practice with new, simplified features that make it simple for every member of the dental team to see practice data, automate practice workflows, identify operational strengths and weaknesses, understand patient behavior, and make data-driven decisions with least training and IT investment.

Benefits of Jarvis Analytics for Private Practices

Data analytics is the new vehicle for accelerating dental business growth. The latest version of Jarvis Analytics provides private dental practitioners with a simple, powerful tool to help improve practice success through data-driven decisions. It helps dental teams maximize data to make more informed, strategic decisions that can impact operational success.

Per Henry Schein’s management, as more data is generated everywhere, businesses need analytics in every part of their operation to drive growth. With Jarvis Analytics, dental practices can turn data into dollars using analytics to help identify other revenue streams.

Industry Prospects

Per a report by Business Wire, theglobal marketfor Dental Practice Management Software was $1.70 billion in 2020 and is projected to reach $2.70 billion by 2026, at a CAGR of 8.2%. The increasing awareness of dental health and the ensuing demand for a range of dental care services are driving the market.

Recent Developments in Dental Business

During the fourth quarter, Henry Schein’s global dental sales increased 9.4% compared with the same period last year. Henry Schein noted that growth was strong in each of the dental specialty categories, including implants, oral surgery, endodontics, and orthodontics, in the reported quarter.

In December 2021, Henry Schein Orthodontics, the orthodontics business of Henry Schein, launched Studio Pro 4.0, a new web-based treatment planning software for Reveal Clear Aligners (Reveal). In November 2021, Henry Schein One released PhoneSight -- a voice over Internet protocol (VoIP) solution that integrates with Henry Schein One patient communication software Dentrix Patient Engage, Demandforce, and Lighthouse, to help dental teams streamline front office operations.

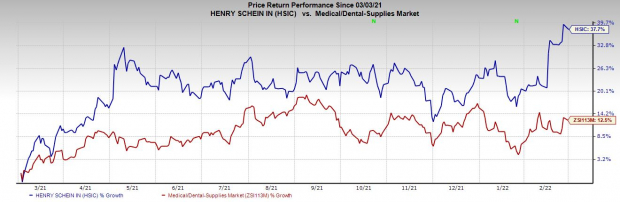

Price Performance

Shares of the company have gained 37.7% in a year compared with the industry's rise of 12.5%.

Zacks Rank and Other Key Picks

Henry Schein currently carries a Zacks Rank #2 (Buy).

Few other top-ranked stocks in the broader medical space are McKesson Corporation MCK, AMN Healthcare Services, Inc. AMN and Bio-Rad Laboratories, Inc. BIO.

McKesson, carrying a Zacks Rank #2, reported third-quarter fiscal 2022 adjusted EPS of $6.15, which beat the Zacks Consensus Estimate of $5.38 by 14.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

McKesson has a long-term earnings growth rate of 11.8%. MCK has gained 57.8% compared with the industry’s 12.4% growth in the past year.

AMN Healthcare, carrying a Zacks Rank #1, has a long-term earnings growth rate of 16.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 19.5%, on average.

AMN Healthcare has outperformed its industry over the past year. AMN has gained 45.4% versus the 54% industry decline.

Bio-Rad reported fourth-quarter 2021 adjusted EPS of $3.21, which surpassed the Zacks Consensus Estimate by 11.9%. It currently has a Zacks Rank #2.

Bio-Rad has an earnings yield of 2.3%, which compares favorably with the industry’s negative yield. BIO surpassed earnings estimates in the trailing four quarters, the average surprise being 66.9%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

BioRad Laboratories, Inc. (BIO): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.