Help Build an Innovative Core With Funds That Access the NASDAQ-100 Index

Key takeaways

- Since 1999, the NASDAQ-100 has significantly outperformed two other large-cap indexes.

- The NASDAQ-100 provides exposure to more than just technology stocks.

- For long-term growth investors, finding companies with a commitment to innovation is essential.

At the core of a portfolio, most investors want investment strategies with three key attributes:

- An established record of delivering strong long-term performance

- Diversification within your portfolio

- An opportunity to pursue long-term growth

The Invesco portfolios that provide access to the NASDAQ-100 Index can potentially meet each of these criteria. The NASDAQ-100 are the 100 largest non-financial companies, ranked by market capitalization that are listed on the Nasdaq. The Invesco funds that provide access to this index are the Invesco QQQ ETF (ticker QQQ), the Invesco NASDAQ 100 ETF (ticker QQQM), and the mutual fund, Invesco NASDAQ 100 Index Fund (ticker IVNQX R6 Shares).

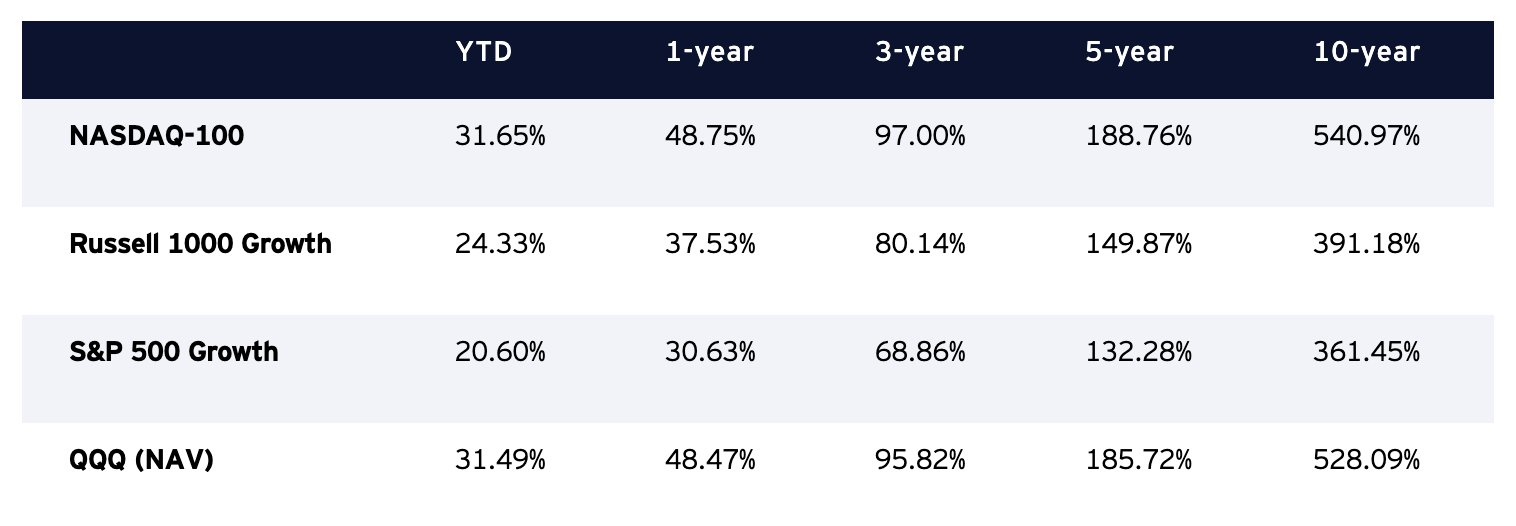

Decades of strong large-cap performance

Since the Invesco QQQ ETF was introduced in 1999, the NASDAQ-100 has significantly outperformed two other indexes of large-capitalization stocks – the S&P 500 Index and Russell 1000 Growth Index. It’s important to remember that this is a period spanning significant episodes of market volatility – including the dot.com collapse of the early 2000s, the Global Financial Crisis in 2008-2009, and the market volatility experienced during the early months of the global COVID-19 pandemic.

Figure 1: The NASDAQ-100 has outperformed both the S&P 500 and Russell Growth Indexes since 1999

Source: Bloomberg, L.P., as of 9/30/20. The information above is presented for the purpose of illustrating the long-term performance of large-cap growth markets over time. The Invesco NASDAQ 100 ETF and the Invesco NASDAQ 100 Index Fund are new funds, therefore they have no performance. Invesco QQQ ETF has an existing performance record, please see the link to QQQ standardized performance below. All funds track the NASDAQ-100 Index. Index performance is not indicative of Fund performance, nor is it an indication of how a Fund could or will perform. An investment cannot be made directly into an Index. Past performance is not a guarantee of future results.

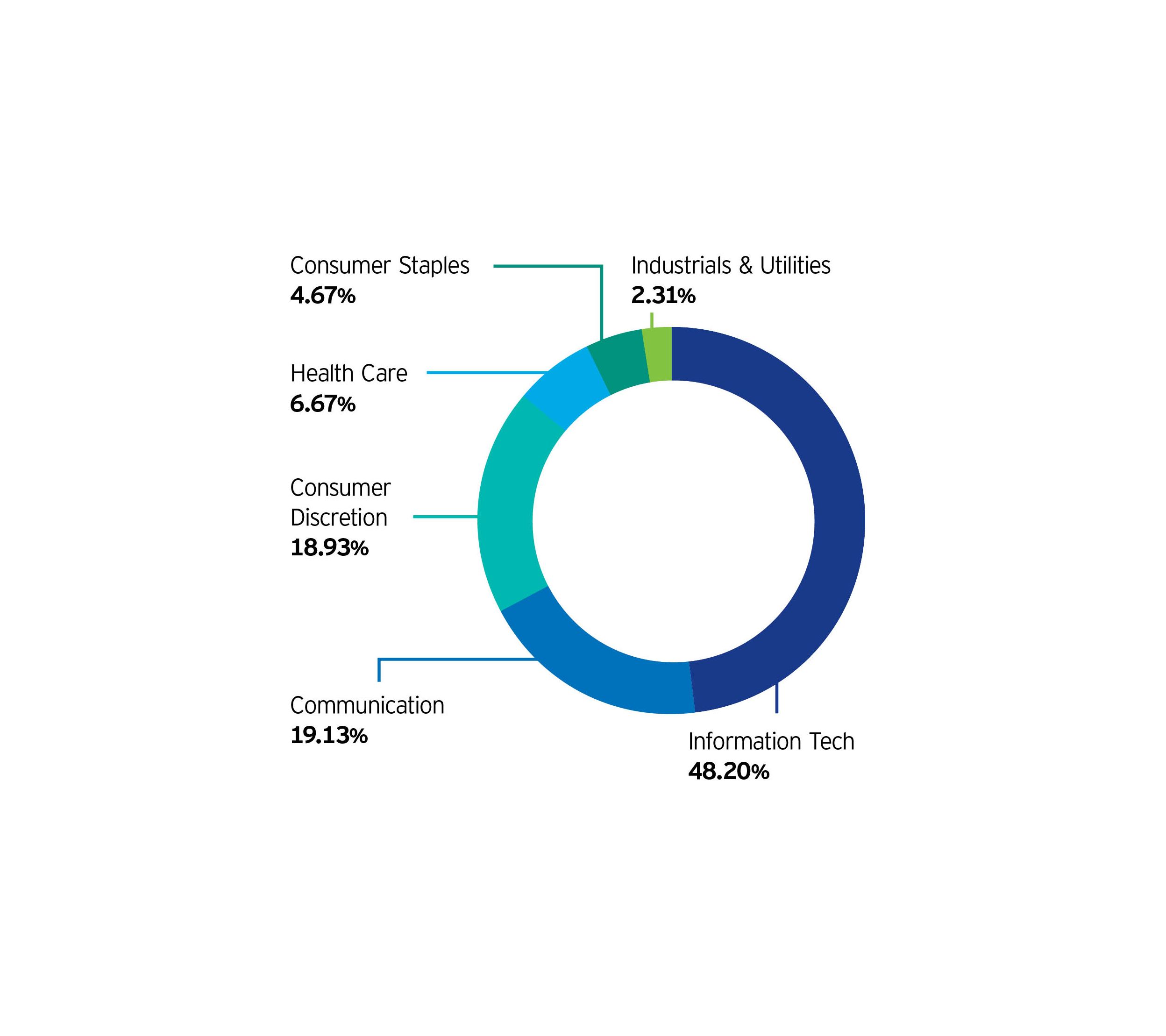

Exposure to a variety of sectors

It’s a common misperception that the NASDAQ-100 is a technology index. While companies in the Information Technology sector do represent nearly half of the index, the NASDAQ-100 comprises other sectors as well – including the Communication Services, Consumer Discretionary, Health Care, Industrials and Utilities sectors.

Figure 2: Exposure to more than just technology stocks

Source: Bloomberg L.P. as of 9/30/20.

Positioned for long-term growth potential

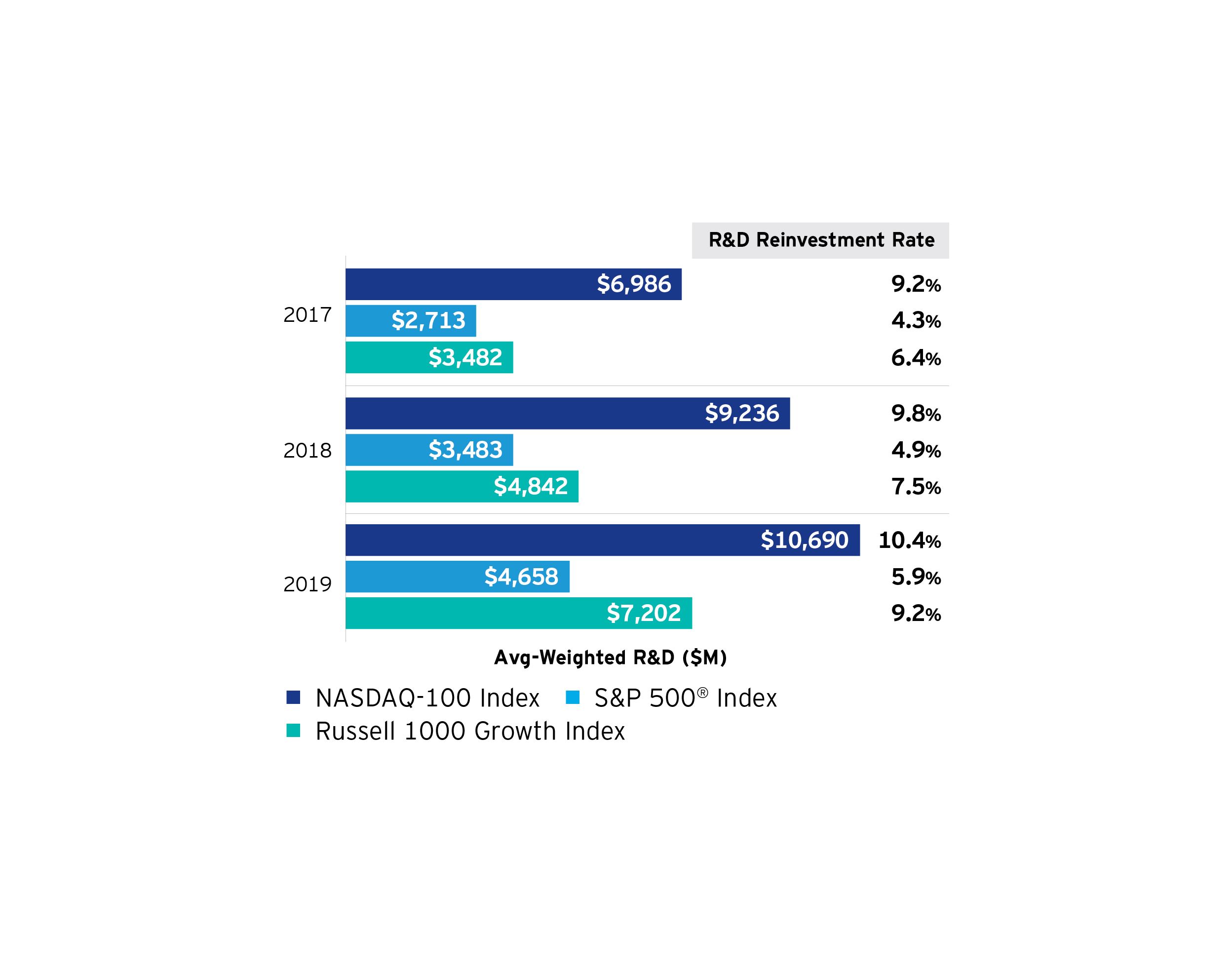

For investors seeking long-term growth for their portfolios, finding companies with a commitment to innovation is essential. In an age when industries are continually disrupted by major breakthroughs, companies must remain innovative to survive and thrive. Many of the companies that have set the standard for innovation are in the NASDAQ-100.

A main reason so many of these companies are recognized as innovators may be that they spend more on research and development (R&D) than companies in the S&P 500 and Russell 1000 Growth Indexes, on average, do. That investigation into what comes next may be what has enabled so many of the NASDAQ-100 companies to keep pace with – and ahead of – the constant change reshaping every industry.

Figure 3: The NASDAQ-100 companies spend more on research and development

Source: NASDAQ as of 3/31/20.

Finding a solid foundation

When considering investments for a portfolio’s core, investors and their advisors want a solid foundation that will enable them to diversify into investments with a range of risk and reward profiles. Investments that focus on companies with a strong record for innovation have the potential to provide that solid foundation.

Total Cumulative Return as of 9/30/20

QQQM and the Invesco Nasdaq 100 Index Fund are new funds, therefore they have no performance.

Past performance is not a guarantee of future results; current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. See invesco.com to find the most recent month-end performance numbers. Market returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times. Fund performance reflects fee waivers, absent which performance data quoted would have been lower. An investment cannot be made directly into an index. Index returns do not represent fund returns.

This article was originally published on Invesco.com.

IMPORTANT INFORMATION

-

Diversification does not guarantee a profit or eliminate the risk of loss.