HCA Healthcare, Inc. HCA recently announced that its subsidiary, Galen College of Nursing, is expanding its footprint in North Carolina. The development comes when the country is suffering from a nursing shortage. Galen College, which joined HCA Healthcare in 2020, is adding its eighth new campus in Asheville, NC.

Over the next 10 years, the U.S. Bureau of Labor Statistics expects 194,500 nursing jobs to be available per annum. Given this backdrop, HCA Healthcare’s strategy to invest and expand its capacity in nursing education facilities seems prudent. The new facility from Galen College is expected to commence in late September.

Before joining HCA Healthcare, Galen College had five campus locations and an online campus. With the commencement of the Asheville campus, it will have 13 campus locations. Its total enrollment capacity is likely to jump to 10,000 in 2022. HCA Healthcare currently has over 93,000 registered nurses. The Galen College acquisition will add further value to HCA’s nurse base.

HCA Healthcare has been emphasizing acquisitions to expedite growth. In 2020 and 2021, HCA Healthcare paid $568 million and $1.1 billion each on acquiring hospitals and health care entities. In the first quarter of 2022, the healthcare provider spent $2 million on buyouts. In January 2022, HCA Healthcare announced the acquisition of MD Now Urgent Care, which boasts a network of 59 urgent care centers across Florida, to bolster its capabilities as one of the nation’s leading urgent care providers.

The company’s acquisitions are expected to add scale to its business. All these buyouts helped it to boost its portfolio and penetrate further into different geographies. Its diversified portfolio is differentiated across the industry.

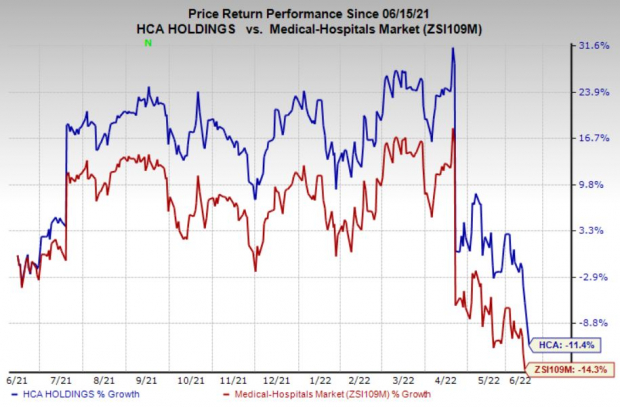

Price Performance

Shares of HCA Healthcare have decreased 11.4% in a year’s time compared with the industry’s fall of 14.3%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

HCA Healthcare currently has a Zacks Rank #3 (Hold). Some top-ranked stocks in the medical space are Select Medical Holdings Corporation SEM, Omega Therapeutics, Inc. OMGA and Progyny, Inc. PGNY, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Select Medical’s earnings is currently pegged at $2.19 per share. SEM has witnessed one upward estimate revision in the past 60 days against none in the opposite direction.

Select Medical’s earnings beat estimates in each of the last four quarters, the average being 42%.

The Zacks Consensus Estimate for Omega Therapeutics’ earnings indicates a 28.9% increase from the prior-year reported number. OMGA has witnessed three upward estimate revisions and no downward movement in the past 60 days.

Omega Therapeutics’ earnings beat estimates twice in the last four quarters and missed the mark on the other two occasions.

The Zacks Consensus Estimate for Progyny’s 2022 bottom line has improved 4.5 times in the past 60 days. PGNY has witnessed three upward estimate revisions during the same time against none in the opposite direction.

Progyny’s earnings beat estimates in each of the last four quarters, the average being 169.7%.

How to Profit from the Hot Electric Vehicle Industry

Global electric car sales in 2021 more than doubled their 2020 numbers. And today, the electric vehicle (EV) technology and very nature of the business is changing quickly. The next push for future technologies is happening now and investors who get in early could see exceptional profits.

See Zacks' Top Stocks to Profit from the EV Revolution >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HCA Healthcare, Inc. (HCA): Free Stock Analysis Report

Select Medical Holdings Corporation (SEM): Free Stock Analysis Report

Progyny, Inc. (PGNY): Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.