By Goran Damchevski

This article was originally published on Simply Wall St News

Microsoft (NASDAQ:MSFT) has been in a long-term bull run over the years, and with the stock reaching a US$2.2t market cap, some investors are wondering if there is any basis for this to continue. We will overview the fundamentals of Microsoft, the efficacy of their performance and see what basis do they have for gaining higher stock returns in the future.

We will start with the money making capacity of the company, moving on to the efficacy in providing returns, and finally we will look at the possible ways that Microsoft can utilize to create value.

Fundamentals

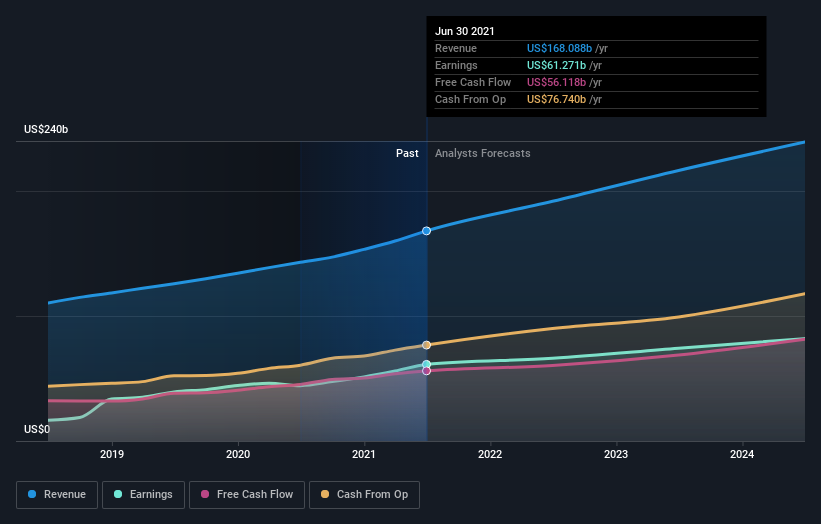

Microsoft is still on track to grow revenues and profits. The company made US$168b in the last trailing twelve months ending June 30th, and made US$61.3b in earnings. That is a profit margin of 36%.

See our latest analysis for Microsoft

Analysts are still optimistic on the company and estimate that Microsoft reaches US$240b revenues in three years. Annually, the expected revenue growth rate is 11% and 9.3% for earnings. Keep in mind that these are averages from analyst estimates and will not match perfectly the projections with the estimated growth rates.

In the chart below, we can see what can the company's income look like all the way to the first half of 2024.

A large company with a positive future ensures stability of the stock price. Even more importantly, a stable company is just what investors might be looking for in these uncertain times. Even if markets take a dive on the short term, Microsoft seems to have enough fundamental basis to withstand and recover from a larger drop.

Another aspect of performance is the return a company generates on the capital that is employed. This is a proxy for measuring decision-making in a company, as well as a change of efficacy in operations.

For Microsoft, we will analyze their return on capital employed, but you can also view their ROA and ROE measures HERE.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Microsoft, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.29 = US$70b ÷ (US$334b - US$89b) (Based on the trailing twelve months to June 2021).

So, Microsoft has an ROCE of 29%. In absolute terms, that's a great return, and it's even better than the Software industry average of 10%.

We like the trends that we're seeing from Microsoft. The data shows that returns on capital have increased substantially over the last five years to 29%. The amount of capital employed has increased too, by 82%.

Growing returns are a hallmark of increased efficacy and venturing in projects that provide a high rate of return. That is precisely what investors want to see in a company!

Microsoft seems to be running a very profitable company with ever-increasing efficiency. One can argue that this is the result of their current management approach, and their CEO Mr. Satya Nadella is known to have revitalized the company in the last 7 years of office.

Value Drivers

It seems that Microsoft is increasing the efficacy and quality in their main segments. Which means that the company can increase value just by improving the products and services that it already has.

We wanted to make a quick summary of driving projects:

- The Azure cloud service is successfully targeting large corporate clients and enabling them to cut costs by streamlining internal precesses. Microsoft has generally been flourishing in this front, and can both improve and expand, possibly targeting a whole industry that might need cloud services and is highly ineffective - such as the healthcare industry.

- As most investors already know, Microsoft is slowly rolling out Windows 11. This has large potential if done right. This is the main OS upgrade since the new CEO came to office, and will also reflect his vision for a quality OS. Considering his track record, investors might want to give the new OS a chance, and hopefully there isn't too much strong-arming and bloatware.

- Bethesda has been toned down after it got acquired by Microsoft, this may signal a top-down decision to focus on quality games, since the success of their new titles will be connected with the success of the Xbox segment. The company has been making steady progress in the gaming hardware segment, and releasing a well polished title will be exactly what they need.

We can see that Microsoft has a lot of room for improvement, both in depth and width. For investors this is great, because it means that the company is not done with creating value - and the ROCE we looked it, signals that it has only gotten better over the years.

Key Takeaways

To sum it up, Microsoft has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And a remarkable 446% total return over the last five years tells us that investors are not expecting the company to slow down.

The fundamentals show that Microsoft will still grow and create value. This is important, as the short-term market outlook may be volatile, and investors may be looking for safer prospects for their portfolio.

We can assume that, just by improving current operations, Microsoft will keep creating value. Of course, the company will still have to re-invest and make occasional large acquisitions. Investors might be looking forward to that since the company has a great track record of making smart decisions, led by Mr. Satya Nadella.

To find out how this ties in to the intrinsic value of Microsoft, view our DCF model HERE.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.