PMIs signaling manufacturing recovery in US, Europe, and China

For the last couple years, there wasn’t much positive to say about the manufacturing sector. But that’s finally starting to change.

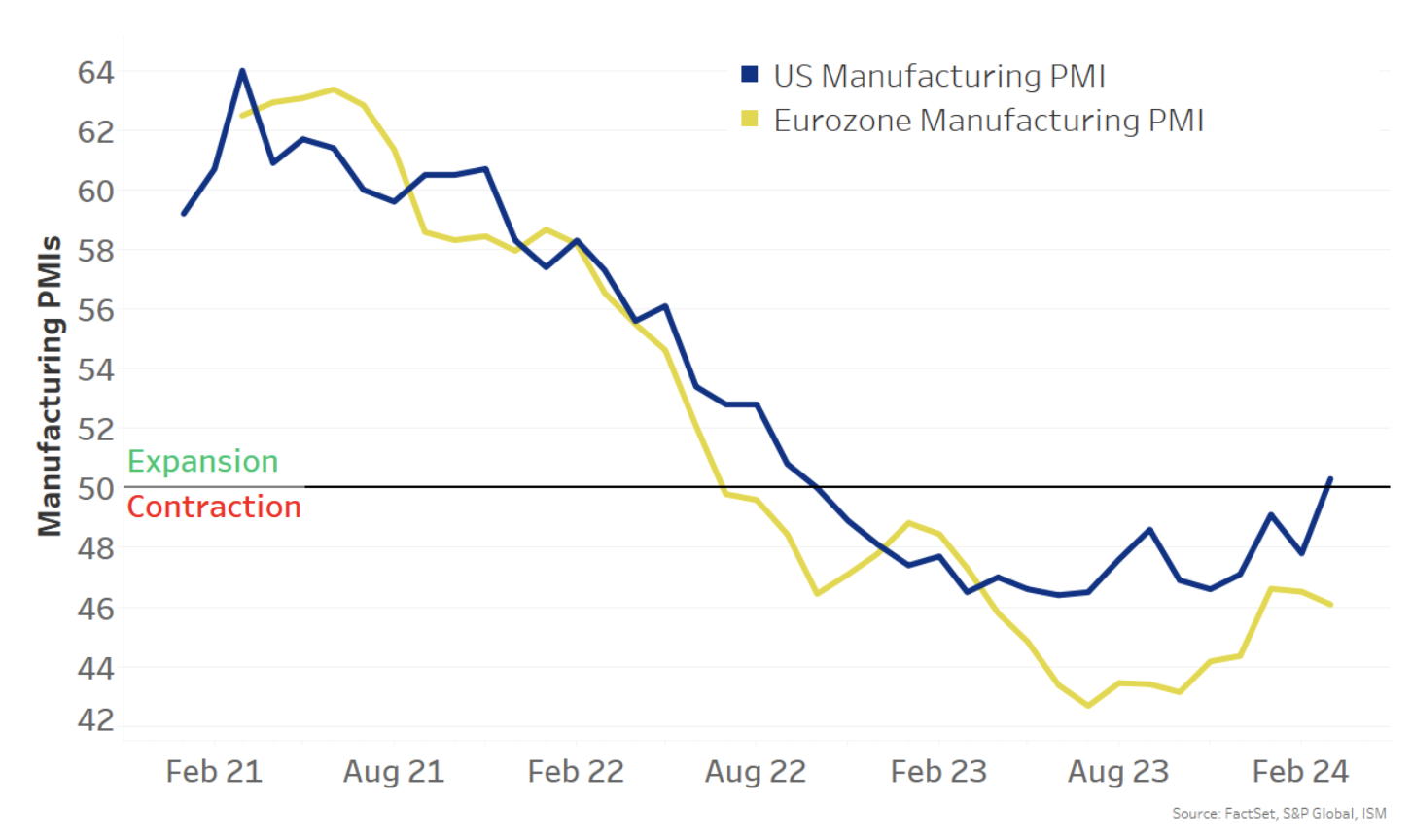

In the US, the manufacturing PMI returned to expansion in March after 16 months in contraction (chart below, blue line).

The Eurozone isn’t quite there yet – it’s still in the contraction that began nearly two years ago – but the PMI has clearly turned up since last summer (gold line). So at least things are getting less bad for Eurozone manufacturing.

And it’s not just the US and Eurozone. The Chinese manufacturing PMI is also back in expansion. Same for the UK, Canada, and Sweden, making this a globalmanufacturing upturn.

PMI overstated weakness in US manufacturing output, but not for Eurozone

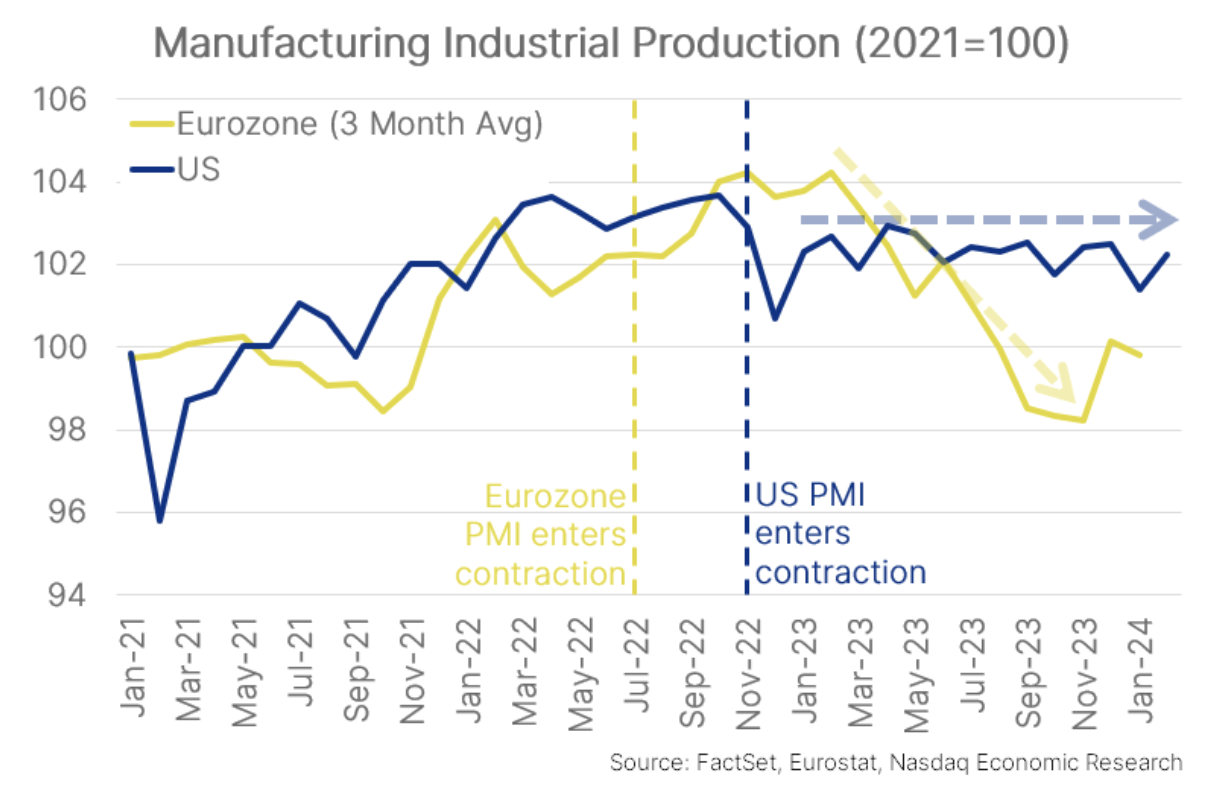

Importantly, the PMI is a survey of companies, and what they expect. It doesn’t necessarily reflect what really ended up happening.

For the US, the PMI actually overstated the weakness in the manufacturing sector. The hard data on manufacturing – industrial production – has essentially moved sideways over the last year or so (chart below, blue line). The resilient consumer demand we’ve seen in the US is likely a big reason why.

In Europe, however, manufacturing output fell about 6% from early 2023 to late 2023 (gold line) – consistent with the drop in the PMI. That’s partly because the energy price shock from the war in Ukraine reduced energy-intensive output by more than 10%.

Manufacturing avoided significant job losses

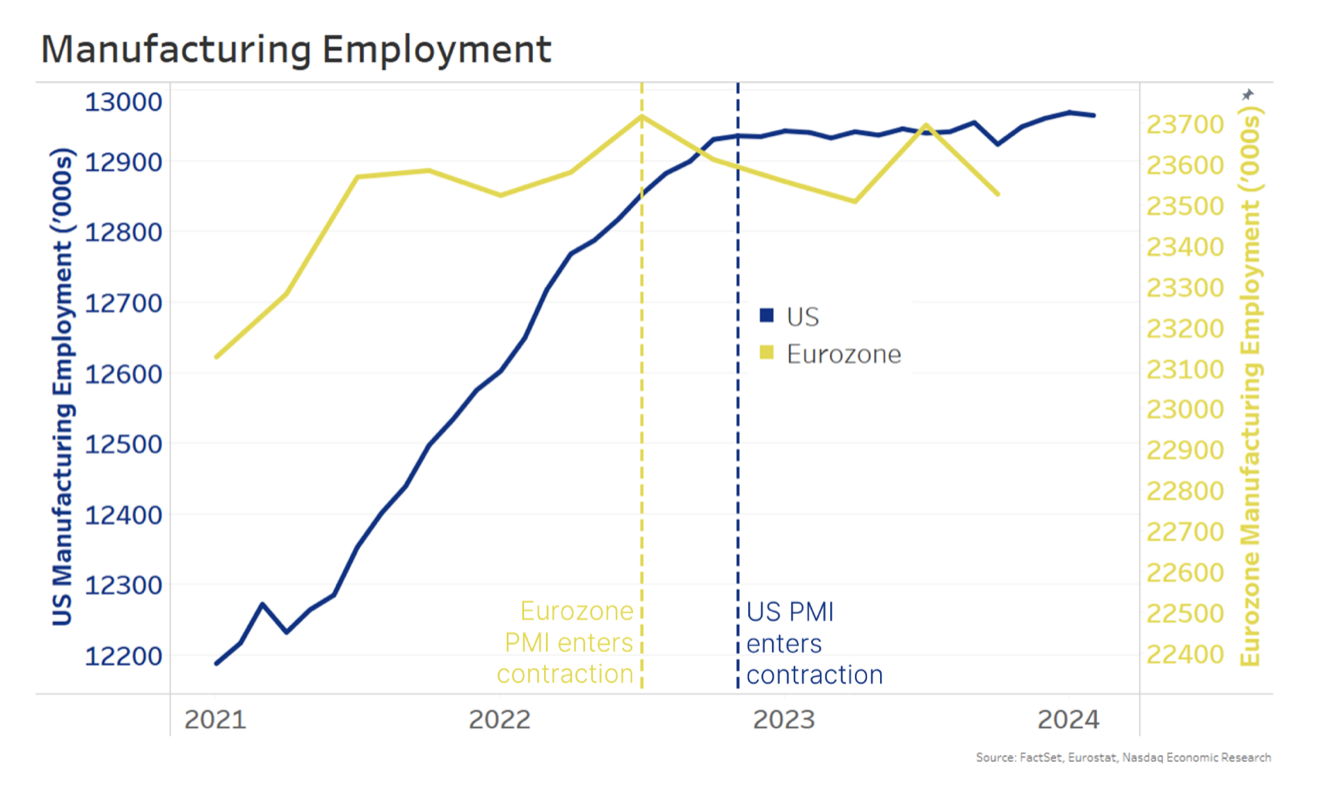

Interestingly, manufacturing employment has held up better too.

In the US, manufacturing employment is slightly higher than it was when the PMI slipped into contraction (chart below, blue line). For the Eurozone, it’s down less than 1% from its high (gold line).

That’s because labor markets are tight in the US and Eurozone (its unemployment rate is at a record low). So companies were reluctant to let go of workers, even when industrial output was falling (in Europe).

Manufacturing recovery welcome news, but still dwarfed in importance by services

The manufacturing recovery is welcome news for the US and Eurozone economies. But we note that manufacturing is just 11% of the US economy and 15% of the Eurozone economy.

In comparison, services is nearly 80% of the US economy and two-thirds of the Eurozone.

Fortunately for the US and the Eurozone, their services PMIs both point to expansion.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.