There are plenty of people out there stashing a lot of stuff in the back of the closet with the intention of using them again someday (everything from a bowling ball they used once to that jacket that could one day come back in style again). But what about investments?

There is an investing suggestion that sometimes gets used which suggests that it's a good idea to buy certain stocks and "put them in the closet." This is basically the same thing. It effectively means to buy and hold for the long term.

The buy-and-hold strategy can be terrific when it comes to the more iconic companies out there. For instance, Had you invested $5,000 in Microsoft 10 years ago and "put it in the closet," that initial investment would have grown to $56,050 (including dividends) a decade later. That's a 27% compound annual growth rate.

Such high-performing closet investments are somewhat rare and no one really knows what investments made now will produce such fantastic results 10 years later. But some analysis can help you make a few educated guesses. Here are two suggestions for potentially great buy-and-hold stocks.

1. Airbnb

The travel industry bounced back nicely after being decimated by the COVID-19 pandemic, and the short-term rental industry is booming. Worldwide revenue for 2024 is expected to be 18% higher than 2019 at $100 billion, which is expected to grow steadily for years (see chart below).

Chart by Statista.

The growing market opportunity makes Airbnb (NASDAQ: ABNB) stock enticing. The company's financial results are also terrific. COVID-19 forced it to go lean, and it's never looked back.

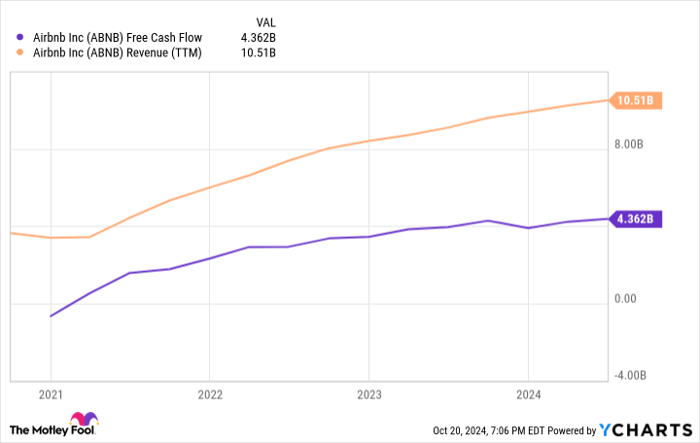

Cash flow and profits are soaring, thanks to the company's commitment to efficiency. Free cash flow reached $4.4 billion over the last 12 months on $10.5 billion in revenue, a 41% margin.

ABNB Free Cash Flow data by YCharts.

Airbnb maintains a fortress balance sheet with $11.3 billion in cash and investments against just $2 billion in long-term debt, thanks to its tremendous free cash flow. In addition, the company repurchased $2.8 billion in stock, or 3% of the current market cap, over the past 12 months, including $750 million in Q2.

Share buybacks reduce the shares outstanding, which increases earnings per share and typically supports a higher stock price. Management expects the buybacks to continue under a current $6 billion authorization.

The largest risk to Airbnb is regulatory. Municipalities and homeowners' associations aren't always amenable to short-term rentals. This problem isn't likely to disappear, so Airbnb must continue working with localities to promote common sense short-term rental regulation that doesn't outright ban it.

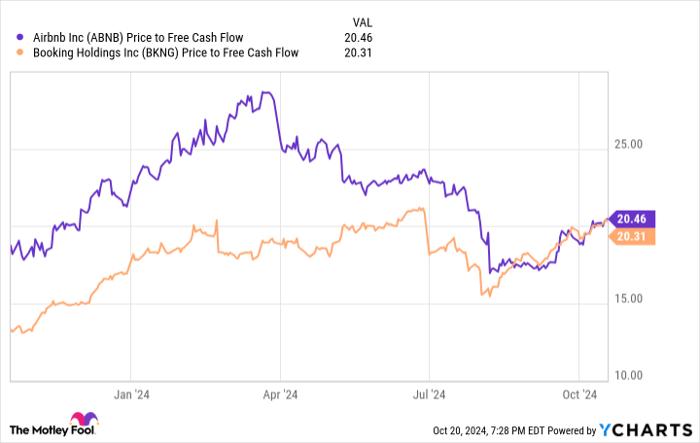

Airbnb stock trades at 20x free cash flow, which is identical to Booking Holdings (see chart below).

ABNB Price-to-Free-Cash-Flow data by YCharts.

Both companies enjoy excellent cash flow, enviable margins, and the ability to buy back a lot of stock, so this makes perfect sense.

Airbnb's growth plan includes expanding into underserved global markets, promoting experiences (such as food tours), upgrading the platform and app, and promoting the benefits of hosting so that there is enough supply. Once you package together the market, results, and growth opportunity, Airbnb looks like an excellent buy-and-hold stock.

2. Amazon

A $5,000 investment in Amazon (NASDAQ: AMZN) 10 years ago is worth more than $61,000 today, an even better return than Microsoft's. But just because it was so successful in the prior 10 years doesn't mean its strong performance won't continue. Amazon is expected to benefit significantly from artificial intelligence (AI).

Amazon Web Services (AWS), the globe's largest cloud services provider, still has a long runway for growth since data processing power and storage are in high demand to handle the massive requirements of AI software. This is already coming to fruition as AWS revenue growth accelerated from 12% year-over-year growth in Q2 2023 to 19% ($26 billion) in Q2 2024.

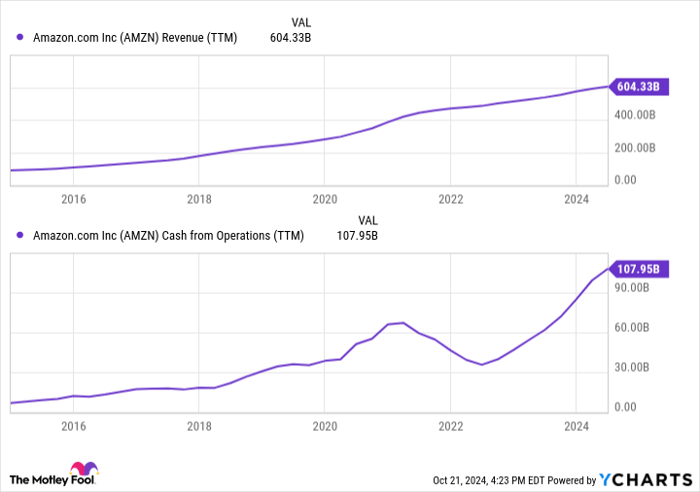

Total sales last quarter hit $148 billion on solid 10% growth. Trailing-12-month revenue and operating cash flow again hit new highs (see below).

AMZN Revenue (TTM) data by YCharts.

The company is running on all cylinders with industry tailwinds, as well.

Amazon is building its AI offerings through Amazon Bedrock, which allows its customers to build on existing foundational models to create unique AI tools. Amazon is developing its own AI chips and accelerators and has the expertise and resources to be one of the major players in the space, competing with the other Big Tech companies.

On the valuation front, Amazon is historically undervalued, based on five-year and 10-year averages, on operating cash flow and earnings, so the market doesn't seem to be fully pricing in the AWS acceleration or AI potential.

Amazon was a terrific stock to put in the closet before and looks like it is now, too. If you have $5,000 or another amount, splitting between these two terrific companies and locking them away in your investing closet is a great move.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,803!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,654!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $404,086!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Bradley Guichard has positions in Airbnb, Amazon, and Booking Holdings. The Motley Fool has positions in and recommends Airbnb, Amazon, Booking Holdings, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.