Investing money into the stock market every month can be a great way to grow your portfolio's value over the long run. Rather than trying to time the market and wait for ideal conditions, by investing every month and creating that routine, you no longer have to worry about deciding when to buy. While you might buy at times when valuations are high, you'll also buy when they're low. And thus, over the long term, that trend will balance out.

Aiming to invest $200 per month can be a good amount to target as that is the equivalent to saving $2,400 per year. That can help you build up a strong nest egg. Below, I'll show you how much that type of an investment could realistically grow to over the years.

Investors should be careful not to set expectations too high

The S&P 500 has been hitting record highs this year, and while that's great news for stock valuations, it also means that if you invest in the market today, it may be more difficult to earn a high return than if valuations were much cheaper. And so while the index has averaged a long-run return of around 10% for decades, you may want to scale back your expectations if you start investing right now. If for no other reason, it factors in some conservatism and can ensure you don't set your expectations too high, possibly setting yourself up for disappointment down the road.

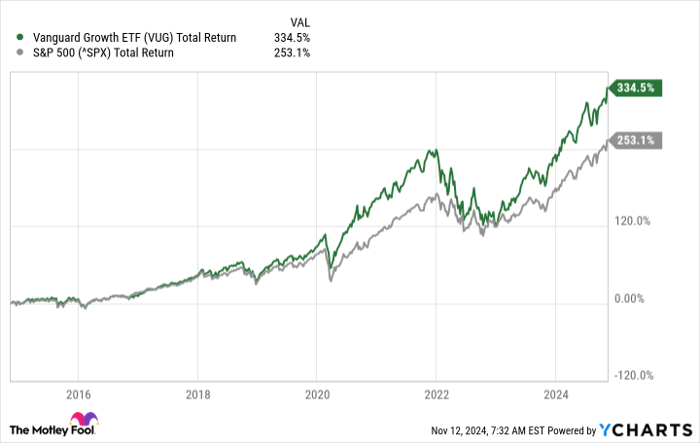

You can increase the odds of achieving a better-than-expected return by investing in a good exchange-traded fund (ETF).The Vanguard Growth Index Fund (NYSEMKT: VUG) is a great option for investors. Its low expense ratio of 0.04% and a focus on top growth stocks, including big names such as Apple, Alphabet, and Tesla, can make it a fairly safe fund to buy and hold. Over the past 10 years, here's how it has done against the broad index when looking at its total returns (which include dividends).

VUG Total Return Level data by YCharts

During that stretch, it has averaged a compound annual growth rate of 15.8%.

It might be a bit too optimistic to assume that this growth rate will continue over the long haul given how expensive many stocks are right now. Instead, let's assume that things will slow down and that the rate will be around 8%, which is lower than the S&P's long-run average. Next, I'll look at what your portfolio balance might grow to assuming that annual rate of return.

How quickly your portfolio balance might grow

Assuming you regularly invest $200 per month into the Vanguard Growth fund and it generates an annual return of 8%, here's a breakdown of what your investment in that ETF might be at the end of each decade and how it compares with a more typical 10% annual return.

| Year | Balance at an 8% CAGR | Balance at a 10% CAGR |

|---|---|---|

| 10 | $36,589 | $40,969 |

| 20 | $117,804 | $151,874 |

| 30 | $298,072 | $452,098 |

Calculations by author. CAGR = compound annual growth rate.

As you can see, even a couple of percentage points can add up to a big difference when looking at a long period of 30 years. But it's important to be a little conservative as you might be doing yourself a disservice by not expecting at least some slowdown in the markets given how hot they have been in recent years.

Investing more is the safest way to accelerate your portfolio's growth

If these balances aren't high enough to motivate you to invest on a regular basis, remember that you can put yourself in a better position in the long run by investing more money. This doesn't have to be on a monthly basis, but perhaps anytime you have an influx of cash, such as due to a tax refund or the sale of an asset, you may want to invest that money right away. That can be a way to give your portfolio a boost.

The larger that balance gets, the more it will be able to grow; every little bit counts when it comes to compounding. Saving and investing more money can be the best way to ensure you end up with a higher portfolio balance in the end, as opposed to targeting riskier investments.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $870,068!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 11, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, Tesla, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.