Fintel reports that on July 27, 2023, Goldman Sachs maintained coverage of Lithia Motors, Inc. - (NYSE:LAD) with a Neutral recommendation.

Analyst Price Forecast Suggests 2.72% Downside

As of July 6, 2023, the average one-year price target for Lithia Motors, Inc. - is 299.62. The forecasts range from a low of 199.98 to a high of $378.00. The average price target represents a decrease of 2.72% from its latest reported closing price of 308.01.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Lithia Motors, Inc. - is 30,259MM, an increase of 3.16%. The projected annual non-GAAP EPS is 37.16.

What is the Fund Sentiment?

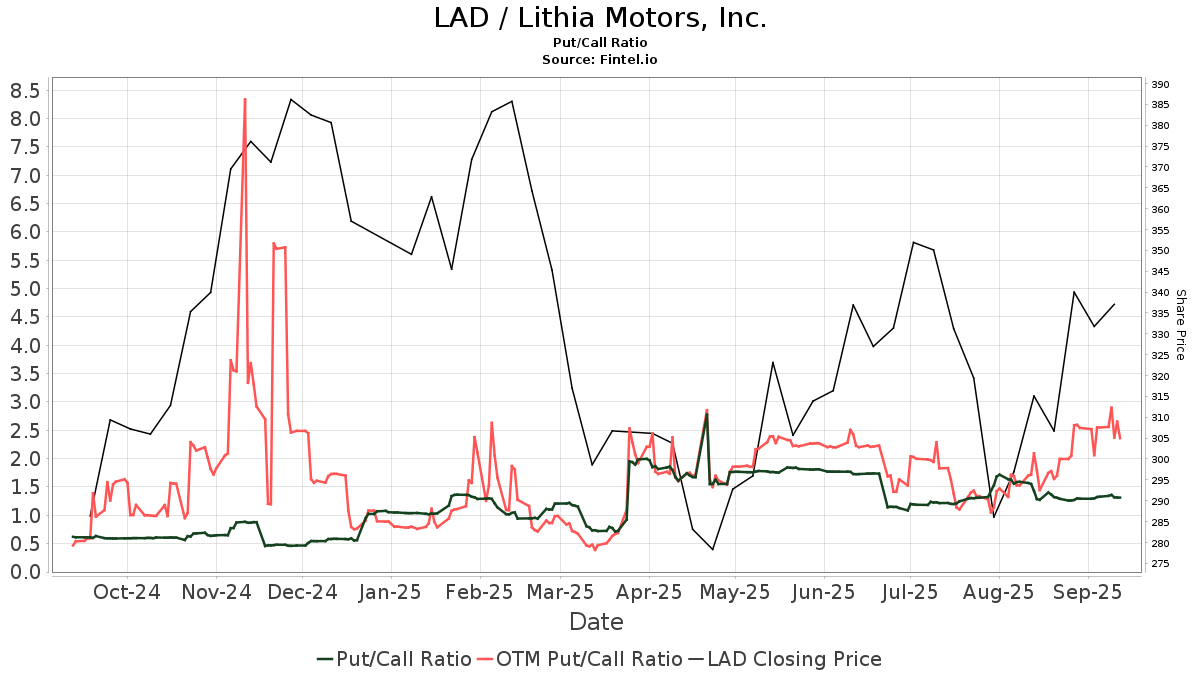

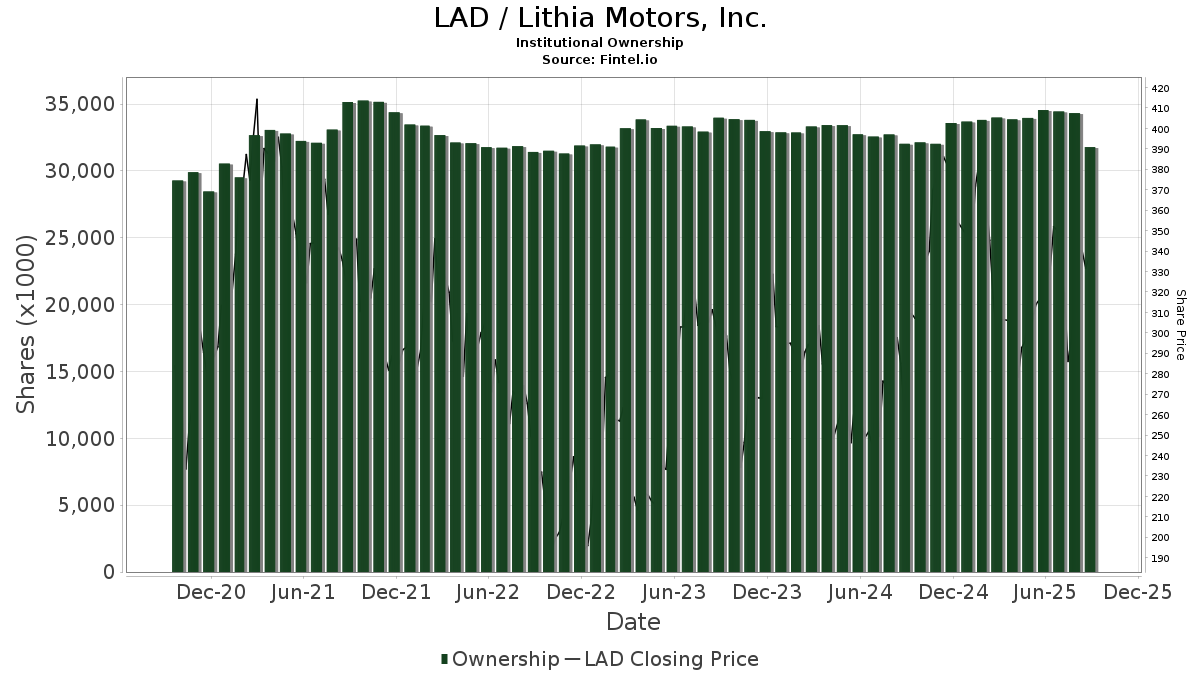

There are 840 funds or institutions reporting positions in Lithia Motors, Inc. -. This is a decrease of 28 owner(s) or 3.23% in the last quarter. Average portfolio weight of all funds dedicated to LAD is 0.32%, a decrease of 6.84%. Total shares owned by institutions decreased in the last three months by 0.32% to 32,972K shares.  The put/call ratio of LAD is 0.87, indicating a bullish outlook.

The put/call ratio of LAD is 0.87, indicating a bullish outlook.

What are Other Shareholders Doing?

Abrams Capital Management holds 2,351K shares representing 8.54% ownership of the company. No change in the last quarter.

MFN Partners Management holds 1,551K shares representing 5.63% ownership of the company. No change in the last quarter.

Harris Associates L P holds 1,503K shares representing 5.46% ownership of the company. In it's prior filing, the firm reported owning 1,333K shares, representing an increase of 11.30%. The firm increased its portfolio allocation in LAD by 18.33% over the last quarter.

Barrow Hanley Mewhinney & Strauss holds 1,406K shares representing 5.11% ownership of the company. In it's prior filing, the firm reported owning 1,382K shares, representing an increase of 1.73%. The firm increased its portfolio allocation in LAD by 17.27% over the last quarter.

OAKLX - Oakmark Select Fund Investor Class holds 1,153K shares representing 4.19% ownership of the company. In it's prior filing, the firm reported owning 1,028K shares, representing an increase of 10.84%. The firm increased its portfolio allocation in LAD by 12.59% over the last quarter.

Lithia Motors Background Information

(This description is provided by the company.)

Lithia Motors, Inc. is one of the largest providers of personal transportation solutions in the United States and is among the fastest growing companies in the Fortune 500 (#265-2019). Lithia is a growth company powered by people and innovation. By purchasing and building strong businesses that have yet to realize their potential, Lithia generates significant cash flows while maintaining low leverage. Operational excellence is achieved by refocusing the business on the consumer experience and by utilizing proprietary performance measurements to increase market share and profitability. Lithia's unique growth model reinvests to expand its nationwide network and to fund innovations that create personal transportation solutions wherever, whenever and however consumers desire.

Additional reading:

- Lithia & Driveway (LAD) Reports 12% Revenue Increase and Diluted EPS of $10.78 Announces Dividend to $0.50 per Share for Second Quarter

- LITHIA MOTORS, INC. RESTRICTED STOCK UNIT AGREEMENT (Time Vesting)

- Lithia & Driveway (LAD) Increases Revenue 4% and Reports Diluted EPS of $8.30 Increases Dividend to $0.50 per Share for First Quarter

- SUBSIDIARIES OF LITHIA MOTORS, INC. (as of December 31, 2021)

- LITHIA MOTORS, INC. RESTRICTED STOCK UNIT AGREEMENT

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.