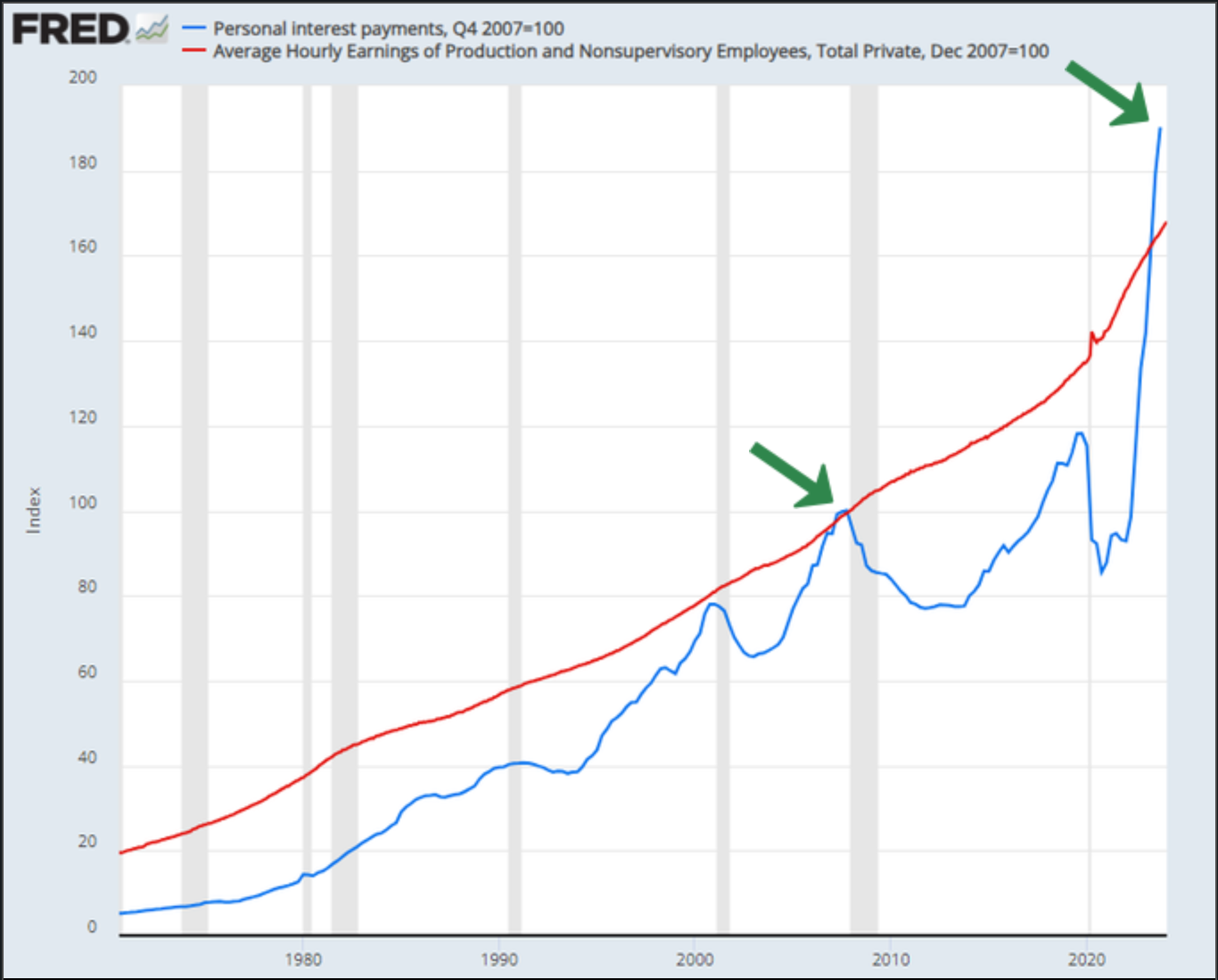

Interest Payments

Personal interest payments (blue) exceed wages (red) by a large margin. The last time debt payments surpassed wages were ahead of the 2008 financial crisis.

Source: https://twitter.com/SamanthaLaDuc/status/1770791896559800526/photo/1

Source: https://twitter.com/SamanthaLaDuc/status/1770791896559800526/photo/1

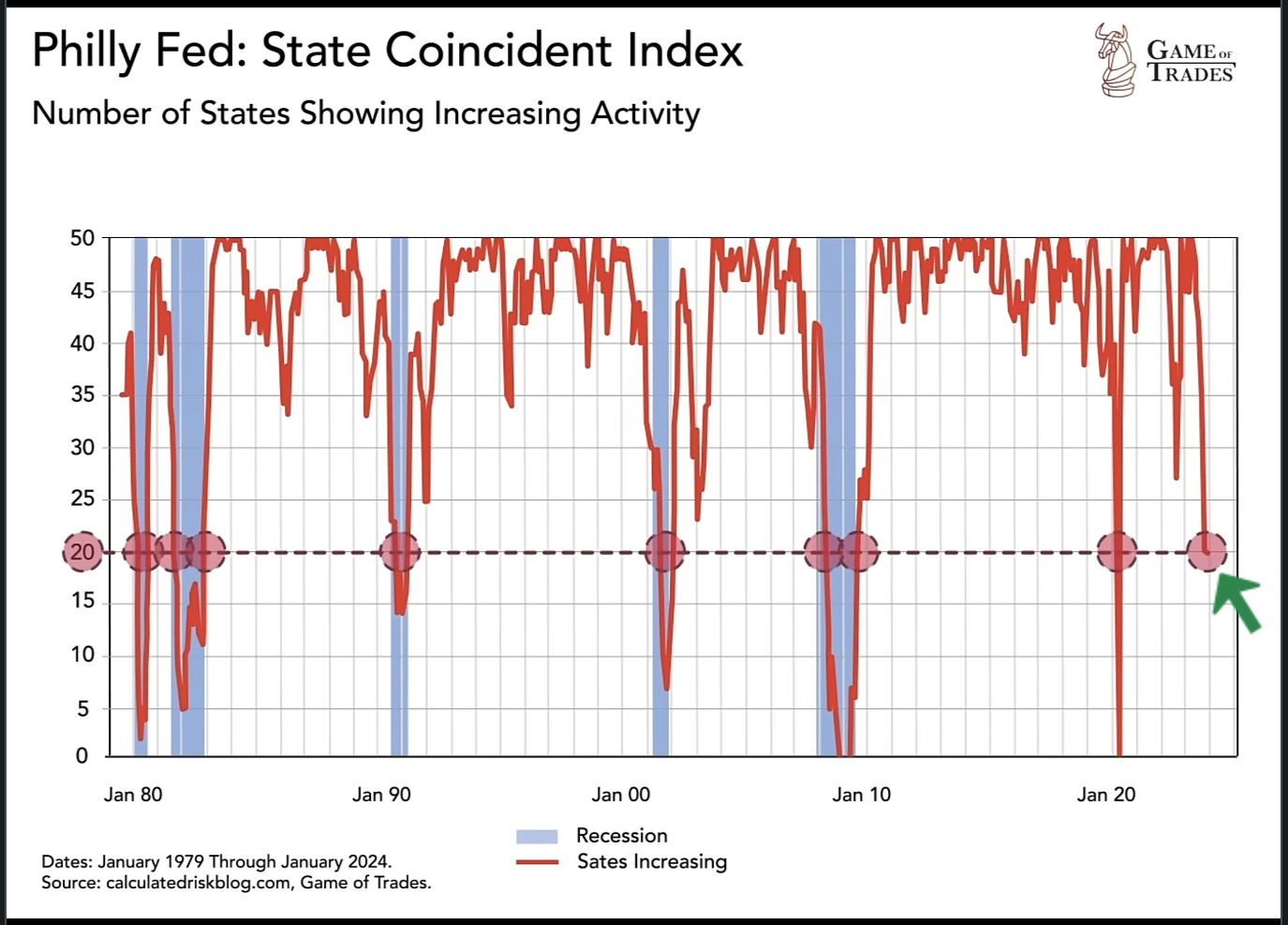

State Coincident Index

The Philly Fed estimates economic activity per State. Only 20 states are showing increasing activity, implying that 30 states are in decline. Historically, this level supports a recession.

Source: https://twitter.com/GameofTrades_/status/1770850472590451053/photo/1

Source: https://twitter.com/GameofTrades_/status/1770850472590451053/photo/1

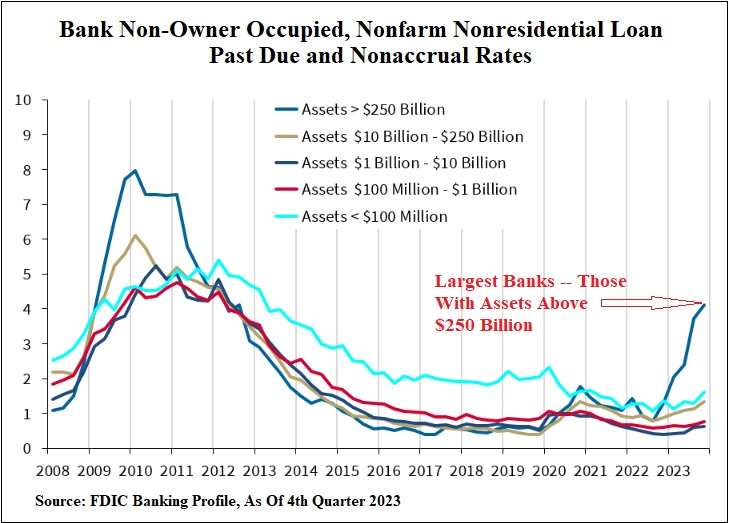

Commercial Real Estate

Past due loans on commercial real estate at the largest banks (>$250 billion) are at 4.11%. At this pace, delinquencies could meet or exceed the post-GFC peak of 8% in the next year or two.

Source: https://twitter.com/m3_melody/status/1770872311475794108/photo/1

Source: https://twitter.com/m3_melody/status/1770872311475794108/photo/1

Gold Cycle Indicator

Our gold cycle indicator finished at 224 and remains in neutral territory.

GOLD

Gold jumped when the Fed announced it would soon reduce the rate of QT, which is the first step before cuts. A daily close below $2150 would be negative and support a bearish post-Fed reversal. Overall, I expect a robust advance into at least July with periodic price corrections.

SILVER

We saw profit-taking in silver near $26.00, with prices forming a bearish engulfing candle. A decisive close above $26.00 is needed to unleash the bull.

PLATINUM

Platinum remains near its cycle low stuck on struggle street. Prices must get and stay above the 200-day MA to achieve traction.

GDX

Miners slipped after Wednesday’s powerful up day. To extend to the upside, a close above $30.56 is needed.

GDXJ

Juniors need a close above $37.25 to maintain upward momentum.

SILJ

Silver juniors need a close above $9.81 to maintain their upward trajectory.

AAPL

The US Justice Department and numerous States launched an antitrust lawsuit against Apple, alleging the company’s unlawful monopoly in the smartphone market. Things could get ugly, and slipping below the October $165 low would support a notable breakdown.

S&P 500

Another new closing high, and this is one of those market moves that defy gravity until things suddenly unravel; no sign of that yet.

Conclusion

The next big surge in gold has started, and sub-$2000 pricing may be a thing of the past. Gold miners are silly cheap and should play catch up in the coming months.

AG Thorson is a registered CMT and an expert in technical analysis. For daily market updates, consider subscribing www.GoldPredict.com.

This article was originally posted on FX Empire

More From FXEMPIRE:

- NASDAQ Index, SP500, Dow Jones Forecasts – Major Indices Pull Back From Historic Highs

- Natural Gas, WTI Oil, Brent Oil Forecasts – Oil Stays Flat Despite Strong Dollar

- S&P 500 Weekly Price Forecast – S&P 500 Continues to Look Strong

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.