By Goran Damchevski

This article was originally published on Simply Wall St News

GlaxoSmithKline (LSE:GSK), is undergoing a transformation and the company is expected to split into 2 entities mid 2022. Shareholders had an underwhelming performance in the last 3 years, and the uncertainty of the outcome of the spinoff may be keeping the stock down. We will overview the current and future financial performance of the company and use a proxy to determine the disposition for the future of the company.

GlaxoSmithKline operates in three segments and had the following 2020 revenues per segment:

- Pharmaceuticals: UK£17b

- Vaccines: UK£6.9b

- Consumer Healthcare: UK£10b

The separation will split the consumer healthcare segment from the other two. Essentially creating one entity with revenue capacity of UK£24b, which is expected to grow to UK£33b as the New GSK, and the Consumer Healthcare company with a UK£10b revenue starting point. New GSK is set to be R&D heavy, while the Consumer Healthcare company will maintain a product portfolio and optimize efficacy of operations.

For investors this creates a rather complicated situation in estimating the future performance of either company, that is why we will look at the proxy of insider transactions, with the assumption that insiders might be well-informed and trading based on their experience with the company.

Although we don't think shareholders should simply follow insider transactions, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for GlaxoSmithKline

GlaxoSmithKline Insider Transactions Over The Last Year

The Senior Independent Non-Executive Director Manvinder Banga made the biggest insider purchase in the last 12 months. That single transaction was for UK£503k worth of shares at a price of UK£13.76 each. That means that an insider was happy to buy shares at around the current price of UK£13.88.

We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price.

The good news for GlaxoSmithKline share holders is that insiders were buying at near the current price.

Over the last year, we can see that insiders have bought 61.76k shares worth UK£840k. But they sold 39.99k shares for UK£509k.

In total, GlaxoSmithKline insiders bought more than they sold over the last year.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

GlaxoSmithKline is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at GlaxoSmithKline Have Bought Stock Recently

It's good to see that GlaxoSmithKline insiders have made notable investments in the company's shares. In the last 3 months, four insiders shelled out UK£70k for shares in the company -- and none sold. This is a positive in our book as it implies some confidence.

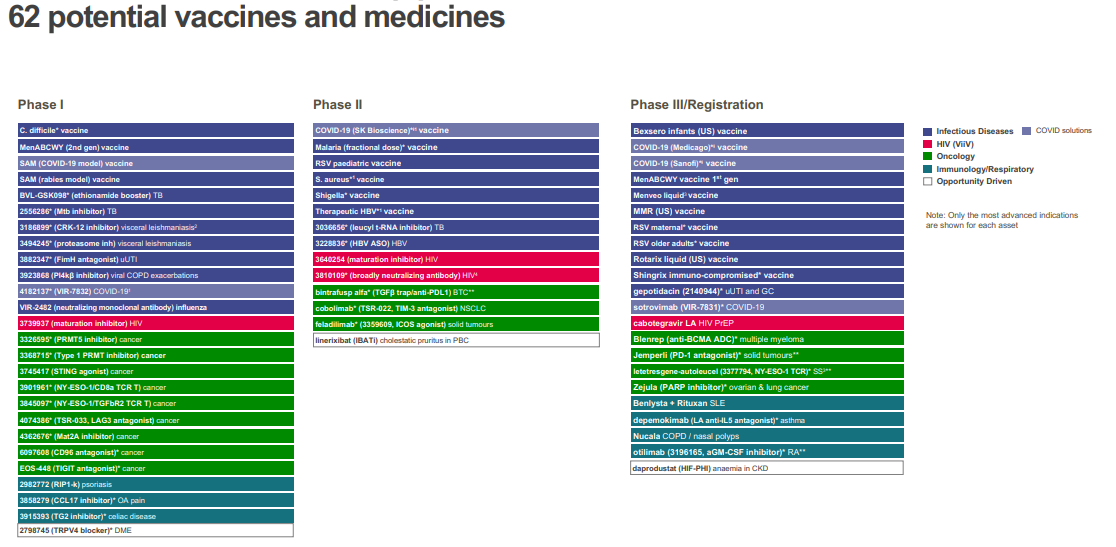

When we dig a bit deeper, we can see that besides the separation of the company, GSK has a rich pipeline of potential vaccines that are in various stages of clinical development. The estimated success of these vaccines could be pertly the reason why insiders are still buying the stock.

The image below shows what we can expect in their vaccine pipeline:

Note that GSK also has 3 vaccine candidates currently in phase 3 clinical trials.

Key Takeaways

GlaxoSmithKline is separating into 2 entities around mid 2022. Investors will get a portion of each business, but the future is hard to estimate directly.

By looking at how insiders are behaving, we see that there is some optimism for GSK shares, and there is some insider buying in the last 3 months.

GSK also has a rich product pipeline, and some of these might turn out to be future winners for revenue generation.

In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing GlaxoSmithKline. While conducting our analysis, we found that GlaxoSmithKline has 4 warning signs and it would be unwise to ignore them.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.