General Electric Company’s GE unit GE Renewable Energy recently announced the launch of its latest 3 MW onshore wind turbine platform Sierra.

GE’s share price increased 2.4% in Tuesday’s (May 17) trading, eventually closing the session at $76.40.

Inside the Headlines

GE’s new 3.0-3.4 MW turbine, which comes with a 140-meter rotor, is available with various hub heights. Its 68.7m two-piece blade improves serviceability, installation and logistics. With higher service efficiency and better wind energy production levels, General Electric’s new Sierra turbine will deliver more value to its customers. The turbine is uniquely designed to cater to the needs of the North America region.

The turbines will be manufactured in GE’s Florida-based Pensacola manufacturing unit while its blades will be made by both TPI and LM Wind Power. A large portion of the turbine’s components will be sourced from North America.

The latest development is based on the success stories of Sierra’s two prototypes, one in Lubbock, TX and the other in Kamataka, India, launched more than a year ago. It is worth noting that General Electric already secured orders above 1 GW for the Sierra onshore wind turbines.

Zacks Rank, Price Performance and Earnings Estimate Trend

General Electric with an $84.1-billion market capitalization, currently carries a Zacks Rank #3 (Hold). GE stands to benefit from its portfolio-restructuring program, expansion in digital business and efforts to deleverage its balance sheet in the quarters ahead.

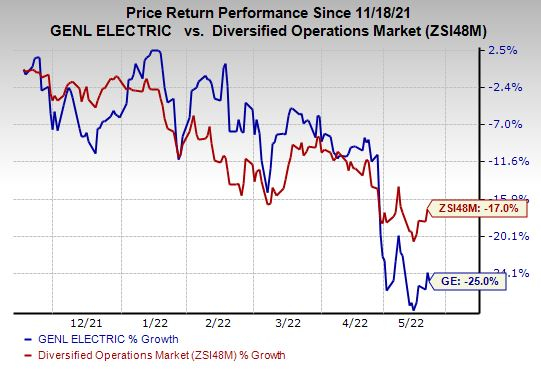

Image Source: Zacks Investment Research

Shares of General Electric have lost 25% compared with the 17% decline of its industry in the past six months.

The Zacks Consensus Estimate for second-quarter 2022 earnings has decreased 40.3% to 43 cents in the past 60 days. Also, earnings estimates for 2022 have moved 11.3% south to $2.9 during the same period.

Stocks to Consider

Some better-ranked companies are discussed below:

Griffon Corporation GFF presently sports a Zacks Rank #1. GFF’s earnings surprise in the last four quarters was 97%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, Griffon’s earnings estimates have increased 40% for fiscal 2022 (ending September 2022). The stock has gained 19.5% in the past six months.

Carlisle Companies Incorporated CSL presently flaunts a Zacks Rank of 1. Its earnings surprise in the last four quarters was 23%, on average.

In the past 60 days, Carlisle’s earnings estimates have increased 10.8% for 2022. CSL’s shares have gained 8.1% in the past six months.

Ferguson plc FERG presently carries a Zacks Rank of #2 (Buy). FERG delivered a trailing four-quarter earnings surprise of 14.2%, on average.

Earnings estimates of Ferguson have increased 2.8% for fiscal 2022 (ending July 2022) in the past 60 days. The stock has declined 23.6% in the past six months.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE): Free Stock Analysis Report

Carlisle Companies Incorporated (CSL): Free Stock Analysis Report

Griffon Corporation (GFF): Free Stock Analysis Report

Wolseley PLC (FERG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.