General Dynamics Corp.’s GD business unit, Land Systems, recently clinched a modification contract to offer technical support for Abrams Vehicles. The award has been provided by the U.S. Army Contracting Command, Detroit Arsenal, MI.

Valued at $26 million, this contract is projected to be completed by Sep 30, 2025. Work related to this deal will be executed in Sterling Heights, MI.

What’s Favoring General Dynamics?

Amid rising geopolitical tensions and the recent clash between Russia and Ukraine, the United States and other countries globally have increased their spending manifold for upgrading defense systems and improving warfare capabilities. In this context, main battle tanks form an integral part of any nation’s defense system.

General Dynamics’ Abrams battle tank enjoys significant demand from the U.S Army and several U.S. allies due to its advanced features and the company’s continuous efforts to configure it with additional advanced capabilities. The latest contract win is a bright example of that.

Growth Prospects

The global armored vehicle market’s size is likely to witness a CAGR of 6.9% over the 2022-2030 period, per a report from the Grand View Research firm. The expanding size of this market will not only benefit General Dynamics but also defense majors like Northrop Grumman NOC, Raytheon Technologies RTX, and BAE Systems Plc BAESY, which enjoy a prime position in the combat vehicle space.

Northrop Grumman specializes in innovating low-cost, highly reliable, precise weapons and ammunition for artillery and mortar systems, medium-caliber weapon platforms, and battle tanks. It is also a pioneer in hardened electronics technologies used in weapon applications and produces precision guidance kits that employ a common technology base to transform conventional artillery and mortar munitions into precise, Global Positioning System (GPS)-guided weapons.

Northrop Grumman has a long-term earnings growth rate of 2.2%. The Zacks Consensus Estimate for NOC’s 2022 sales implies an improvement of 2% from the 2021 reported figure.

Raytheon is currently teaming up with American Rheinmetall Vehicles to meet the U.S. Army’s current requirement of a true, next-generation Optionally Manned Fighting Vehicle, namely the Lynx Infantry Fighting Vehicle. The Lynx Infantry Fighting Vehicle is a next-generation, tracked and armored-fighting vehicle designed to address the critical challenges of future battlefields.

Raytheon’s long-term earnings growth rate is pegged at 10.4%. The Zacks Consensus Estimate for RTX’s 2022 sales indicates an improvement of 4.9% from the 2021 reported figure.

BAE Systems’ Challenger 2 is heavily armored, highly mobile, and designed for use in the direct fire zone. Its primary role is to destroy or neutralize armor. It can also engage both hard and soft targets and operate across a spectrum of high-intensity conflicts, counter-insurgency, and peacekeeping roles.

The long-term earnings growth rate of BAESY is pegged at 9.3%. The Zacks Consensus Estimate for BAESY’s 2022 sales indicates a surge of 24.2% from the prior-year reported figure.

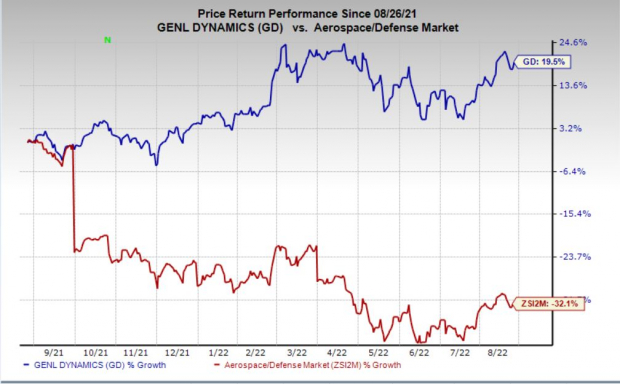

Price Performance

Shares of General Dynamics have rallied 19.5% in the past year against the industry’s decline of 32.1%.

Image Source: Zacks Investment Research

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Bae Systems PLC (BAESY): Free Stock Analysis Report

Raytheon Technologies Corporation (RTX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.