GE Aerospace GE recently announced that it has conducted a successful demonstration of a hybrid electric turboshaft propulsion system for the U.S. Army. The project was undertaken as part of a $5.1 million research and development contract—the Applied Research Collaborative Systematic Turboshaft Electrification Project (ARC-STEP).

GE Aerospace performed the research, development and testing of one megawatt class electrified powerplant to combine this with an existing CT7 turboshaft engine. It’s worth noting that GE’s CT7 family of engines includes the T700 series, which has equipped the U.S. Army’s two flagship helicopters, the Black Hawk and the Apache.

The testing, which was performed at the GE Aerospace Research Center in Niskayuna, NY, involved the inspection and integration of advanced technologies to develop a lightweight and reliable hybrid-electric propulsion system. The effectiveness of hybrid electric propulsion on several platform types was also inspected.

GE Aerospace believes that this project will complement the company’s involvement in other hybrid-electric propulsion projects that include the Hybrid Electric Experiment (HEX) program with Sikorsky and Electric Powertrain Flight Demonstration (EPFD) project with NASA.

GE’s Zacks Rank & Price Performance

The company currently carries a Zacks Rank #2 (Buy). GE Aerospace has been witnessing strength in its businesses, driven by robust demand for commercial engines, propulsion and additive technologies.

Increasing international and U.S. defense budgets, geopolitical tensions, positive airline and airframer dynamics, and robust demand for commercial air travel augur well for the company. For 2024, the company expects organic revenues to grow in the high-single-digit range from the year-ago level.

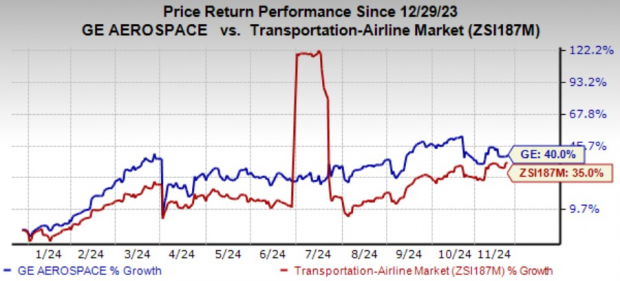

Image Source: Zacks Investment Research

In the year-to-date period, the company’s shares have gained 40% compared with the industry’s 35% growth.

The Zacks Consensus Estimate for GE’s 2024 earnings has inched up 2.2% in the past 60 days.

Other Stocks to Consider

Other top-ranked companies from the same space are discussed below:

Southwest Airlines Co. LUV currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Southwest Airlines delivered a trailing four-quarter average earnings surprise of 111.6%. In the past 60 days, the Zacks Consensus Estimate for LUV's 2024 earnings has increased 212.5%.

SkyWest, Inc. SKYW presently sports a Zacks Rank of 1. The company delivered a trailing four-quarter average earnings surprise of 79.1%.

In the past 60 days, the Zacks Consensus Estimate for SKYW’s 2024 earnings has increased 4.1%.

American Airlines Group Inc. AAL currently carries a Zacks Rank of 2. AAL delivered a trailing four-quarter average earnings surprise of 124.4%.

In the past 60 days, the consensus estimate for American Airlines’ fiscal 2025 earnings has increased 36.5%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

GE Aerospace (GE) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.