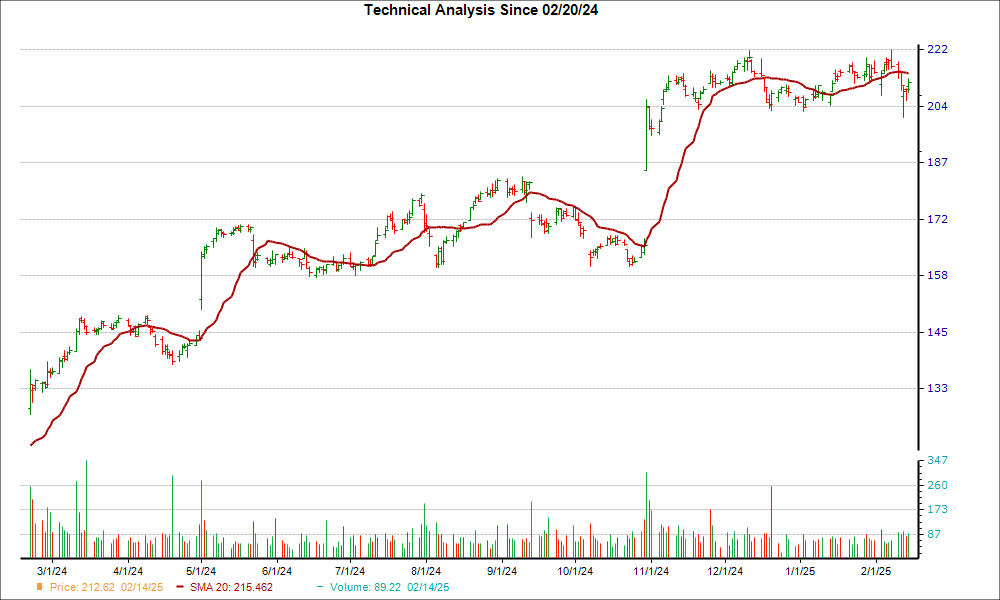

Garmin (GRMN) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, GRMN broke through the 20-day moving average, which suggests a short-term bullish trend.

A well-liked tool among traders, the 20-day simple moving average offers a look back at a stock's price over a 20-day period. This is very beneficial to short-term traders, as it smooths out short-term price trends and gives more trend reversal signals than longer-term moving averages.

The 20-day moving average can show signals that are similar to other SMAs as well. If a stock's price is moving above the 20-day, the trend is considered positive. When the price falls below the moving average, it can signal a downward trend.

Over the past four weeks, GRMN has gained 11.9%. The company is currently ranked a Zacks Rank #2 (Buy), another strong indication the stock could move even higher.

The bullish case only gets stronger once investors take into account GRMN's positive earnings estimate revisions. There have been 2 revisions higher for the current fiscal year compared to none lower, and the consensus estimate has moved up as well.

Investors should think about putting GRMN on their watchlist given the ultra-important technical indicator and positive move in earnings estimate revisions.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Garmin Ltd. (GRMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.