The concept of “garden variety pullback” refers to a minor or moderate decline of an asset in a bull market. Garden variety pullbacks are a “necessary evil” in bull markets because they:

Eliminate Froth & Shakeout Weak Hands

Wall Street is one of the few places where people get more excited as prices increase. Late, over-excited investors chase moves that are long in the tooth. Corrections can be healthy in that they provide a healthy correction that can cool down a market (from a sentiment and price perspective)

Build a Strong Base

Anyone familiar with the fable “The Tortoise and the Hare” understands that often, consistency can lead to longevity. In other words, a steady “stair-stepping” market can last much longer than an erratic market with few pullbacks. In addition, pullbacks can provide investors savvy investors with large open winners to pyramid further into positions.

Image Source: TradingView

Pictured: Nvidia and other leaders are providing low-risk base resets.

Prevent Bubbles

In the long term, valuations matter for investors. Though equity markets are forward-looking, bull markets with few pullbacks can lead to speculative bubbles where asset prices disconnect from their underlying fundamentals.

Below are 3 reasons the current pullback is “garden variety” and not the start of a new bear market:

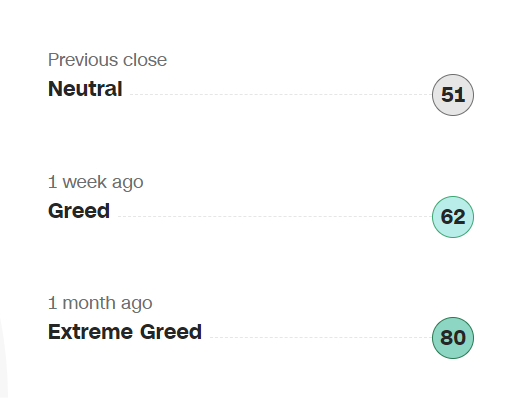

Sentiment

The latest sentiment readings from the “CNN Fear & Greed Index” show investors have one foot out the door. Despite the relatively mild pullback markets have endured, sentiment has plunged from “extreme greed” to a “neutral” reading in just a few days. According to the Fear/Greed Index, sentiment is at its lowest levels since late March.

Image Source: CNN

Pullbacks are Normal at this Stage in a Raging Bull Market

On average, dating back to 1950, when the S&P 500 has 10% or more in the first half of the year as it has in 2023, the average drawdown in the second half is -8.8%.

Image Source: All Star Charts

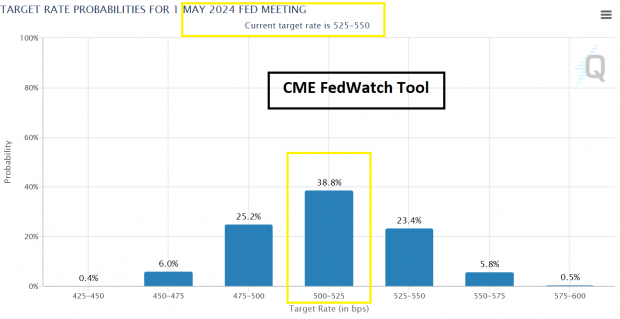

The Odds Favor a Rate Cut in Early 2024

Interest rate policy impacts equity markets by influencing borrowing costs, corporate profitability, and investor sentiment. All else equal, lower interest rates equate to higher stock prices. The “CME FedWatch Tool” is a financial market indicator provided by the Chicago Mercantile Exchange (CME) that tracks the probability of future interest rate movement by analyzing the Fed Funds futures market. Currently, the odds suggest that the Fed will cut interest rates in May 2024.

Image Source: CME Group

Bottom Line

Corrections are a necessary evil in bull markets. However, technician Walter Deemer warns that “when the time comes to buy, you won’t want to.” Several factors suggest that the current correction is a “garden variety” correction that can provide investors with low-risk entry points in winners they may have missed, like Nvidia (NVDA), Microsoft (MSFT), and Tesla (TSLA).

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.Microsoft Corporation (MSFT) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.