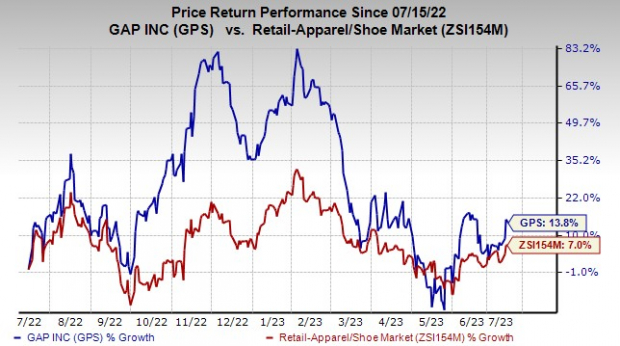

The Gap, Inc. GPS has been gaining from strength in the Athleta brand and its cost-cutting initiatives. The company remains on track with the execution of its Power Plan 2023 plan. Driven by these factors, shares of this Zacks Rank #3 (Hold) company have risen 13.8% in the past year compared with the industry’s growth of 7%.

Also, an uptrend in the Zacks Consensus Estimate echoes the same sentiment. The bottom-line estimate for the current financial year has increased 4.9% to 64 cents over the past 60 days. GPS delivered an average earnings surprise of 1,007.2% in the trailing four quarters.

Let’s Delve Deeper

The company has been long gaining from continued momentum across its Athleta brand. The brand’s values-driven active and lifestyle categories, increased digital marketing investments and focus on product strategy have been aiding sales.

Image Source: Zacks Investment Research

In the fiscal first quarter of 2023, sales for the Athleta brand grew 45% from the pre-pandemic level. Segmental results gained from continued share gains. Increased focus on activewear products to capitalize on the evolving shopping trends also bodes well.

Athleta has also emerged as one of the fastest-growing women's athleisure brands in North America. Driven by these factors, the brand remains on track to reach $2 billion in net sales by fiscal 2023.

Gap has been aggressively undertaking cost-management actions. It has been making efforts to simplify and optimize its operating model and structure, including increasing span of control and decreasing management layers to improve the quality and speed of decision-making. The company has also been creating a consistent organizational structure across all four brands.

These actions are expected to generate $300 million in annualized savings, half of which is expected to be realized in the latter half of fiscal 2023. Apart from these, GPS is expected to realize $250 million in annualized savings, as announced in the third quarter of fiscal 2022. The company revealed plans to further optimize its marketing spend and rationalize its technology investments over the next few years.

Its Power Plan 2023, which focuses on opening highly-profitable Old Navy and Athleta stores while closing the underperforming Gap and Banana Republic stores, has been progressing well. As part of the plan, GPS expects the Old Navy and Athleta brands to account for approximately 70% of sales by 2023.

As part of its 350-store closure plan, the company expects to close 50-55 Gap and Banana Republic stores this year. The company is likely to fulfill its closure plan by the end of 2023. It already achieved 90% of the target in 2022. With the closing of underperforming Gap and Banana Republic stores, Gap expects to realize $100 million in EBITDA savings on an annualized basis by the end of 2023.

Further, the company expects to leverage its powerful platform to deliver competitive omni capabilities to meet customers’ needs, all fueled by its scaled operations. It expects the e-commerce business to contribute 50% of sales by 2023-end. Gap expects to deliver consistent sales growth, margin expansion and strong operating cash flow through this plan.

Also, reduced air freight expenses, lower advertising costs and technology investments resulting from cost-saving initiatives bode well.

Conclusion

Although uncertain macro and consumer environments are likely to persist in the near term, strength in the Athleta brand, cost saving efforts and reduced air freight expenses are likely to aid GPS’ growth going ahead. Moreover, a VGM Score of A and a long-term earnings growth rate of 12% raise optimism in the stock.

Stocks to Consider

Some better-ranked stocks in the industry are Abercrombie & Fitch ANF, Urban Outfitters URBN and Walmart WMT.

Abercrombie & Fitch, a specialty retailer of premium, high-quality casual apparel for men, women, and kids, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANF’s 2024 earnings and sales indicates growth of 732% and 3.4%, respectively, from the previous year’s reported numbers. The company has a trailing four-quarter average earnings surprise of 480.6%.

Urban Outfitters, which engages in the retail and wholesale of general consumer products, currently sports a Zacks Rank #1. It has a long-term (three to five years) earnings growth rate of 18%.

The Zacks Consensus Estimate for Urban Outfitters’ fiscal 2023 earnings indicate an increase of 57.1% from the year-ago reported number. URBN has a trailing four-quarter average earnings surprise of 12.2%.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2 (Buy). It has a long-term (three to five years) earnings growth rate of 5.5%.

The Zacks Consensus Estimate for Walmart’s fiscal 2023 sales implies an improvement of 4.2% from the previous year’s reported actual. WMT has a trailing four-quarter average earnings surprise of 12%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.