I grew up in a construction family. My dad emigrated from Ireland to the U.S. (Chicago specifically) in the mid-1960s. There were significant economic opportunities for those willing to work in construction. My dad landed a job at Case Foundations, and in 1965, they audaciously set out to construct the John Hancock Building. It would become the tallest building in Chicago and the second tallest in the world (at the time).

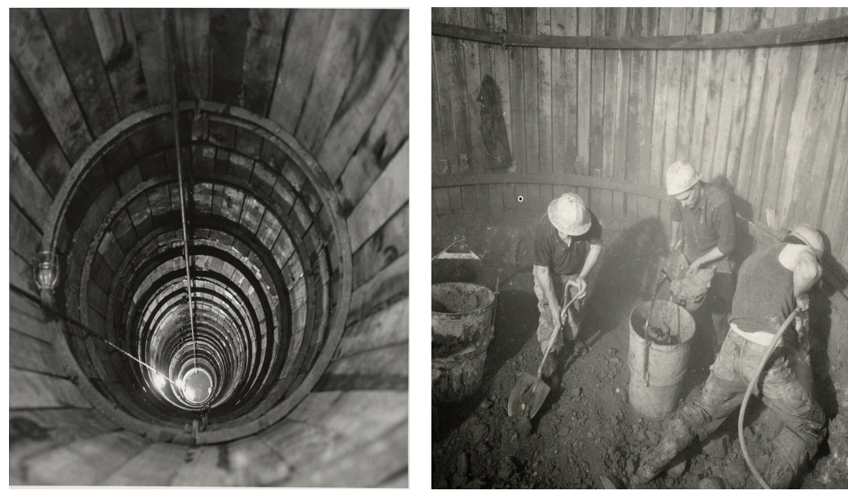

At its peak, more than 2,000 people worked on the building. My dad wasn’t an architect, nor was he an engineer. He was one of many construction workers who helped drill 200-foot holes into bedrock. He would then go down those channels and to ensure the caissons went in correctly.

It was necessary, thankless and dangerous work. There were extensive problems with soil settling and financing. The building’s original owners went bankrupt, and John Hancock took over the project and saw it to completion.

In time, the Hancock Building transformed the Chicago skyline. It was an engineering marvel and signaled to the world that Chicago was a city on the move. Six decades have passed, and it’s still the fourth tallest building in the city. The view from the top is beyond description, but that panorama is all thanks to the work that was done more than 50 years ago, a couple hundred feet beneath the ground.

Visible Growth

With that in mind, I’m thinking about the emergence of the second-largest index derivative ecosystem in the U.S. (notionally). The Nasdaq-100® Index Options (NDX) and related tradable products have grown significantly over the past year. They don’t yet match the more established S&P 500 Index (SPX) complex, but our “construction efforts” are becoming more visible.

The average daily volume in the Nasdaq-100 Index (NDX) is set to grow by ~55% on a year-over-year basis. For the sake of comparison, the Options Clearing Corporation (OCC)-cleared index options are likely to grow by about 29% relative to 2022. The product is experiencing upticks from all market participants.

Based on internal data, individual (retail) users have actively traded more spreads and shorter-dated options. Smaller wallet-share accounts have used the Nasdaq-100 Micro Index Option (XND) product. The NDX growth from institutional clientele continues to gain steam. Some of the largest market makers in the world are increasing their NDX use. Big banks are developing Quantitative Investment Strategies (QIS) referencing the NDX. A variety of exchange-traded (equity) products (ETPs) have been launched, assets have been gathered and they have embedded NDX optionality.

The derivative industry is responding to the demand for the potential benefits of optionality from the advisors/retail community. The growth in terms of assets under management (AUM) in products that “wrap” index options and exposure to a reference asset (like the NDX) has been staggering.

For context, the first “defined outcome” ETPs came to market around 2016. Seven years ago, there was effectively no money in equity products (ETFs, etc.) that embedded optionality and exposure. As 2023 concludes, it’s estimated that roughly $70 billion is allocated to these types of products. Not to mention, this year, we’ve seen a record number of new ETFs, with over 475 listings. Many offer exposure to the price returns (point-point basis) of an index, often with a buffer (protection) and a cap (point beyond which your returns are capped).

In my estimation, we’re in the early stages of the second great disruption brought on by exchange-traded funds (ETFs). In the early 1990s, ETFs shifted the investment landscape in a trend that continued 30 years later. They offered investors of all types affordable access to previously inaccessible tools. They democratized the equity markets in many ways.

Over the past years, ETFs have “wrapped” index (and equity) options strategies into highly accessible tickers. The market has responded favorably. The transparency, relatively low fee structure and (typically) tax-efficient wrapper is democratizing the structured product market.

Using one example, a year ago, if you had an interest in exposure to the NDX with a buffer against the first 10% in downside, there was an ETF available with that construction. The embedded protection naturally comes at some cost. Specifically, the upside gains for the vehicle would be capped at ~26.03% net of fees. The term was fixed for one year (December 15, 2023).

The holder would be exposed to losses beyond the 10% threshold on a point-to-point basis. The maximum upside target would be met if the reference asset (the NDX) gained 27.03% or more at expiration. The structure (in particular, the cap) and the net asset value/ETF price are sensitive to the prevailing implied volatility dynamic at inception (and throughout the year).

The NDX (reference asset) products typically offer a higher cap rate relative to other U.S. equity indexes because the options generally trade with higher implied volatility. Like any option strategy, you can only “know” what an option is worth at expiration. There is intrinsic value, or it’s worthless.

Historically, that type of product was only available to high-net-worth clients. They were sold by large financial institutions, and often, there were hefty fees and very little liquidity if you wanted to exit ahead of the term.

Psychologically Speaking…

There’s an inherent appeal to embedded protection. Seat belt laws have been incredibly effective at reducing the number of deaths in vehicle crashes. It’s why I make my son wear a helmet when we ride bikes. It’s why most rock climbers use ropes and carabiners that keep them from free falling if they lose touch with the earth. It’s why they offer bumper bowling for grade school birthday parties. Throwing nothing but gutter balls isn’t fun for kids (or adults).

The relative stakes are much higher in capital markets than at the local bowling alley. They are arguably lower than someone who chooses to free solo El Capitan or another challenging rock formation. Sometimes, equity markets decline. 2022 is a perfect example.

There is no way to know what path equity markets will forge in the coming year. However, there are products that allow investors to maintain exposure to an index like the NDX but with some protection against a potential “gutter ball” of a year.

Performance

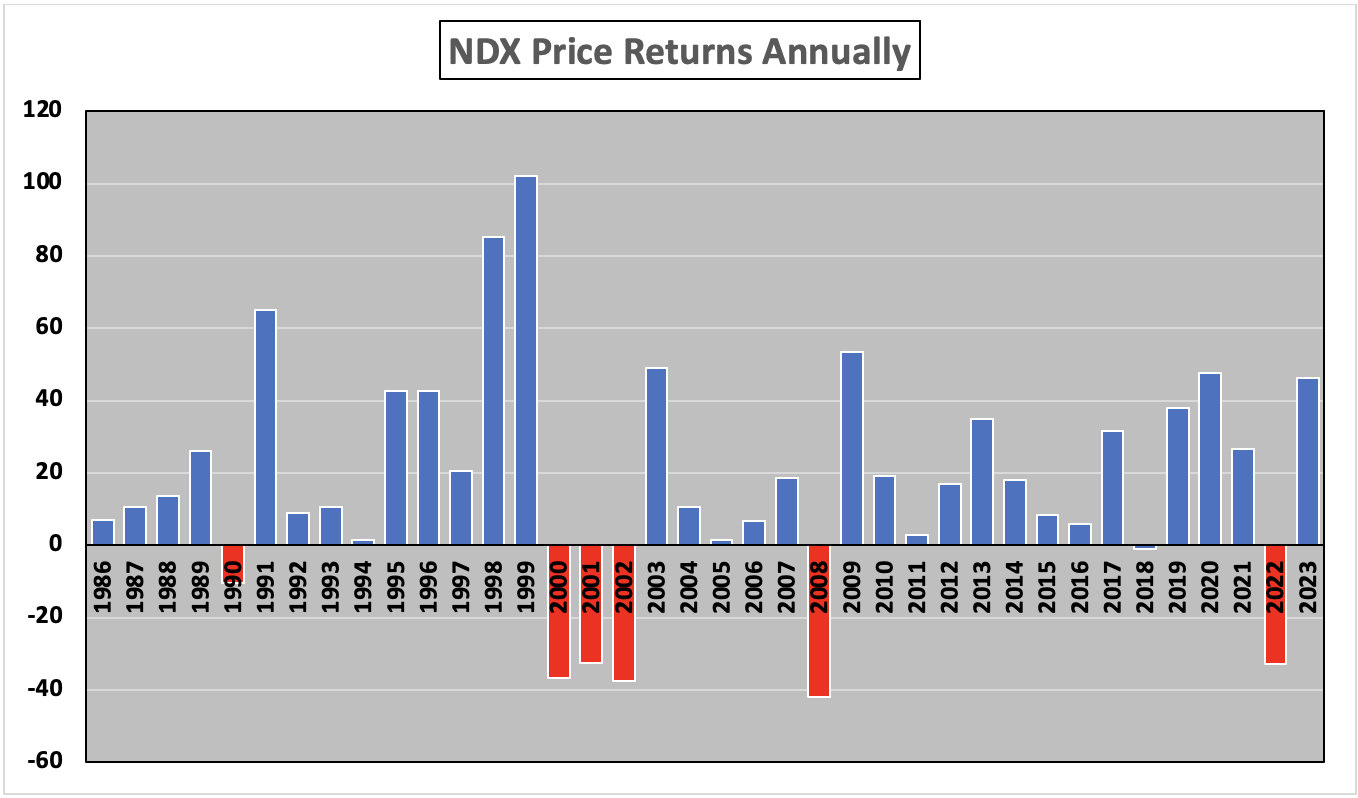

Perhaps some of the options growth is performance chasing. The “Magnificent 7” received an outsized amount of press this year. The NDX offers higher exposure to each of those names than other index counterparts. Year-to-date, the NDX is higher by ~45%. That compares to an SPX advance of ~20%, a Dow Jones Industrial Average Index (DJIA) increase of ~9% and a Russell 2000 Index (RUT) higher by ~7%.

Assuming markets don’t swoon in the last few weeks of the year, this should be the 9th time NDX advances 40% or more in a calendar year. The last time the SPX added 40% or more in a year was 1958. The NDX was launched in January of 1985. Since that point, the largest up year for the SPX came in 1995 when the index added 37.6%.

During the late stages of the “dot com” era (1999), the NDX jumped more than 100% in a calendar year. To be clear, the gains in 2023 are outsized. On a total return basis, the average year for the NDX (not including 2023) is ~+17.1%. There have been seven down years (out of 37), but the average decline was 27.6%.

There’s risk in every market. Period.

Index options can help allay the potential implications of a decline in broad market values.

Personally…

I’m so grateful for the work ethic my dad helped instill by the way he lived. I adore the fact that I can see some of that work when I head into the city to this day. The Hancock Building towers at the north end of the Magnificent Mile. It’s a testament to the hard work of thousands of engineers, architects and laborers. It was a lasting team effort.

I thought about my dad’s work on foundations two years ago when I considered the opportunity to join Nasdaq’s Index Options team. I really liked the group they had in place. They had laid the groundwork for the type of visible growth we’re observing in 2023. I’m incredibly excited to see the next few stories (literally and figuratively) of the growth of the NDX.

I’m proud to be a Chicagoan. This city pioneered in so many ways, including derivative products. I’m proud of my dad who worked hard so that I could have a job that kept me mostly inside and above sea level. I’m proud to be part of NDAQ and the group continuing to build up the NDX index options suite.

The building continues.

Many happy returns in 2023 and beyond.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.