Fresenius Medical Care AG & Co. KGaA FMS is one of the largest integrated providers of products and services for individuals undergoing dialysis following chronic kidney failure. Through its network of over 3,600 dialysis clinics worldwide, the company offers dialysis services and products in more than 120 countries and employs over 109,000 staff in more than 50 countries.

Solid Q2 Performance

Although Fresenius Medical Care second-quarter earnings missed estimates, revenues beat the same. The company benefited from revenue growth across North America, EMEA, the Asia Pacific and Latin America regions. Strength in both Health Care Services and Health Care Products businesses in the quarter under review is encouraging.

A wide range of dialysis products and services instill optimism in Fresenius Medical. The company has already achieved its 2022 target of providing 15% of its dialysis treatments in the United States in a home setting last year. By 2025, the company set a goal to perform 25% of all treatments in the United States at a patient’s home.

Acquisition Path for Future Growth

Fresenius Medical has a solid market hold in the regions of North America, Europe (EMEA), Asia Pacific and Latin America. To strengthen its market position, the company is resorting to various approaches, like enhancing its organic growth and making strategic and suitable acquisitions. Acquisitions have been a key catalyst for the company. In an initiative to boost its long-term strategy or the “Growth-Strategy 2020,” the company acquired NxStage Medical in 2020. FMS announced a mergerbetween Fresenius Health Partners, InterWell Health and Cricket Health in March is an example of how Fresenius Medical is carrying out its 2025 growth strategy while leading the market in value-based care. With the merger, the company currently targets 2025 to engage and manage the care of above 270,000 people with kidney disease and handle approximately $11 billion in medical costs. The merger is anticipated to get completed in the second half of 2022.

Fresenius Medical Care AG & Co. KGaA Price

Fresenius Medical Care AG & Co. KGaA price | Fresenius Medical Care AG & Co. KGaA Quote

2025 Strategy

The company’s new program to support its 2025 strategy, aimed at boosting profitability and compensating for the negative earnings impact of the pandemic, has been in line with its expectations. In October 2020, Fresenius Medical unveiled its 2025 strategy at its Capital Markets Day. This strategy is an appropriate one as it prioritizes patients' needs and the quality of care is in line with key drivers and developments for its industry. This, in turn, positions Fresenius Medical’s business well to deliver sustainable growth over the medium term and further. Per the third-quarter 2021 earnings release, the FME25 transformation is anticipated to achieve a substantial amount of savings by 2025.

Factors Hurting the Stock

Higher material and logistic costs in Health Care Products are hurting earnings growth. Earnings growth was impacted by significantly high labor costs and compounded by the impact of the Omicron variant on Health Care services during the second quarter. COVID-related excess mortality and the war in Ukraine have been affecting Fresenius Medical Cares' dialysis operations and patient care, thus hurting its top line.

Fresenius Medical has numerous competitors in the field of health care services as well as the sale of dialysis products. Tough competition in the niche markets is likely to impede the company’s sales opportunities and lose market share. However, per management, concerns that arise due to competition represent a low risk for the company in the short term as well as in the midterm.

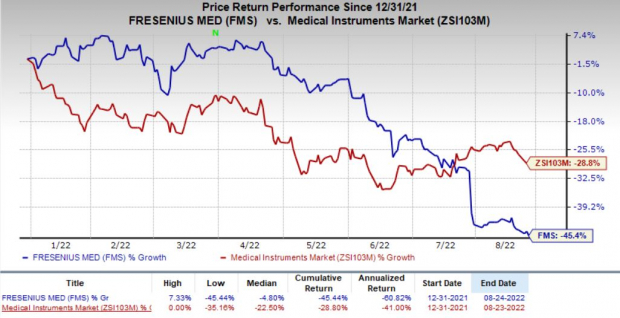

Price Performance & Zacks Rank

Shares of Fresenius Medical have declined 45.4% so far this year compared with the industry’s decrease of 28.8%. The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader medical space are AMN Healthcare Services AMN, McKesson MCK and Patterson Companies PDCO.

AMN Healthcare surpassed earnings estimates in each of the trailing four quarters, the average surprise being 15.7%. The company currently sports a Zacks Rank #1.

AMN Healthcare’s long-term earnings growth rate is estimated at 3.2%. AMN’s earnings yield of 10.7% compares favorably with the industry’s (2.4%).

McKesson beat earnings estimates in each of the trailing four quarters, the average surprise being 13%. The company currently carries a Zacks Rank #2 (Buy).

McKesson’s long-term earnings growth rate is estimated at 9.9% MCK’s earnings yield is 6.5% against the industry’s (4.1%).

Patterson Companies surpassed earnings estimates in each of the trailing four quarters, the average surprise being 16.5%. The company currently carries a Zacks Rank #2.

Patterson Companies’ long-term earnings growth rate is estimated at 7.9%. The company’s earnings yield of 7.7% compares favorably with the industry’s 4.1%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK): Free Stock Analysis Report

Fresenius Medical Care AG & Co. KGaA (FMS): Free Stock Analysis Report

Patterson Companies, Inc. (PDCO): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.