A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

#marketseverywhere | "“It requires a very unusual mind to undertake the analysis of the obvious.” -Alfred North Whitehead, English Mathematician (1861 - 1947)

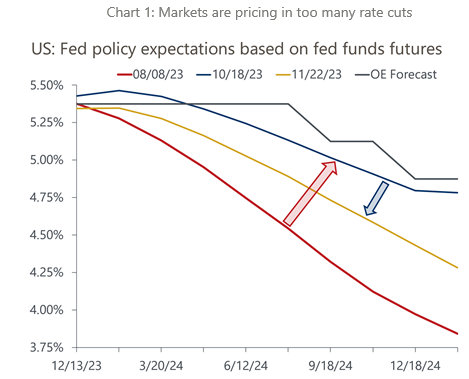

| Is this rally sustainable? Equities cheer falling yields, end of rate hikes, and expected rate cuts (at the expense of inflation potentially returning)...

| Investors sell US dollar at fastest pace in a year as market prices in more Fed rate cuts next year -FT

| ECB signals end of rate hikes? -BBG

* source: Emmanuel Cau, Barclays

* source: BofA's Michael Hartnett, The Flow Show

* source: Emmanuel Cau, Barclays

* source: Deutsche Bank

* source: Oxford Economics

* source: CNBC

| Monetary policy lags to shape 2024 earnings / economy / markets?

"We believe that it’s way too soon to poster the walls with “mission accomplished” signs. With the majority of the cumulative lag of higher rates ahead of us, investors should remain patient and cautious before they overweight the recovery trade (e.g., autos, banks, retail, deep value, small caps, etc.)." -Piper Sandler's Michael Kantrowitz

all eyes on the job market?

We now have a growing number of folks that are unemployed while Wall Street still expect 11% EPS growth in 2024.

* source: Piper Sandler's Michael Kantrowitz

| Unsustainable?

"A record number of ESG funds have shut in 2023 so far — with JP Morgan becoming the latest money manager to announce the closure of 2 such funds — as investors continue to turn away from sustainable investments.

Compared to the heady days of 2021, when investors were pouring tens of billions every quarter into funds that fronted issues like clean energy and emissions, interest in sustainable investing has dropped off. Indeed, according to data from Morningstar Direct via the WSJ, investors have pulled more than $14 billion from sustainable funds since the end of 2022."

*source: Chartr

| 2023 tracks as the weakest buyback annoucement year since before 2016... -Factset Insight

* source: Factset Insight

| Food for Thought

*source: Chartr

| 2023 Winners & Losers:

inflows…$1.2tn to cash, $186bn to Treasuries, $145bn to IG bonds, $143bn to equities, $42bn to tech funds;

outflows of $9bn from HY bonds, $27bn from TIPS, $32bn from EM bonds."

-BofA's Michael Hartnett, The Flow Show

* source: BofA's Michael Hartnett, The Flow Show

| Goldman Sachs Global Investment Research on

4 themes from Q3 2023 conference calls:

-interest expense

-paying down down

-consumer spending

-AI

* source: Goldman Sachs Global Investment Research

| The secular shift from actively-managed to passively-managed funds has accelerated meaningfully in 2023

* source: Goldman Sachs Global Investment Research

1) KEY TAKEAWAYS

1) Equities + Oil MIXED | TYields HIGHER | Dollar LOWER

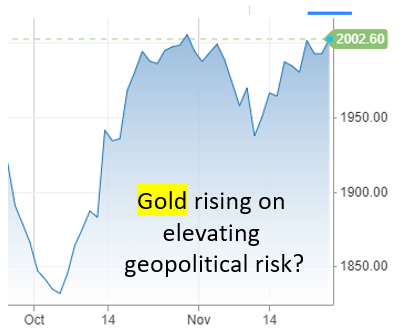

Themes: holiday shortened trading week | Earnings winding down | Nvidia reporting earnings this week = big expectations | Will the seasonal market rally last? | Continued geopolitical risks

-By Shon Wilk

* source: CNBC

* source: BofA, Michael Hartnett, The Flow Show

DJ +0.2% S&P500 -0.1% Nasdaq -0.2% R2K +0.3% Cdn TSX -0.0%

Stoxx Europe 600 +0.1% APAC stocks MIXED, 10YR TYield = 4.476%

Dollar LOWER, Gold $2,000, WTI -1%, $77; Brent +0%, $82, Bitcoin $37,777

2) NEXT WEEK:

"US growth dynamics will be in focus next week with releases including personal

income and spending data as well as the ISM manufacturing index.

In Europe, all eyes will be on the preliminary CPI reports for November. There will also be economic activity indicators in Japan and the PMIs in China.

Central bank speakers include Fed Chair Powell, ECB President Lagarde and BoE

Governor Bailey.

Notable corporate earnings include Dell and Salesforce"

.-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Asset Managers Quietly Add ‘ESG’ to Portfolios of Defense Stocks - BNN

-At the end of the third quarter, 1,238 funds claiming to “promote” ESG goals held stocks in the industry classification code Aerospace & Defense, according to Morningstar Inc. data. That’s roughly 25% more than in March last year, right after Russia invaded Ukraine. A large portion of those funds converted to “ESG” during the period, Morningstar said.

Oil and gas industry needs to let go of carbon capture as solution to climate change, IEA says - CNBC

-“The industry needs to commit to genuinely helping the world meet its energy needs and climate goals – which means letting go of the illusion that implausibly large amounts of carbon capture are the solution” - IEA Executive Director Fatih Birol.

3) MARKETS, MACRO, CORPORATE NEWS

- UK retailers increase Black Friday discounts while customers cut spending-FT

- China’s labor market seen as weaker than official data show-BBG

- China grapples respiratory illness spike, WHO no unusual pathogen found-RTRS

- Japan's factory activity shrinks for 6th month on weak demand – PMI-RTRS

- Japan’s inflation quickens, clouding price outlook for BOJ-BBG

- Germany's economy shrinks slightly in third quarter-RTRS

- Germany to suspend borrowing limits for fourth year after debt brake ruling-FT

- New Zealand per-capita retail sales fall to three-year low-BBG

- Villeroy says ECB won’t raise rates again, excluding surprises-BBG

- Bank of England must hold firm in battle against inflation, says top official-FT

- Letter: Expect more calls for rate cuts if pay and prices don’t pick up-FT

- China seen holding key rate until 2024, economists say-BBG

- Israel-Hamas truce takes hold ahead of planned hostage release-FT

- Israeli intelligence ‘dismissed’ detailed warning of Hamas raid-FT

- North Korean rocket stage exploded after satellite launch, video shows-RTRS

- EU and US delay key trade meeting amid deadlock in negotiations-BBG

- A more moderate Milei embraces trading partners he had shunned-BBG

- Adnoc is said to mull acquisition of BASF’S Wintershall Dea unit-BBG

- PCCW is said to explore $1 billion stake sale in fiber business-BBG

- Swisscom’s Fastweb is said to explore deal for Vodafone Italy-BBG

- Barclays working on $1.25 billion cost plan, could cut up to 2,000 jobs-RTRS

- Virgin Australia lifts Boeing 737 MAX fleet investment-AFR

- NZ Cabinet: Winston Peters, David Seymour share Deputy Prime Ministers-NZH

- Exclusive: Nvidia delays launch of new China-focused AI chip -sources-RTRS

- OpenAI turmoil exposes threat to Microsoft’s investment-FT

- Exclusive-Amazon to win unconditional EU nod for iRobot deal -sources-RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.