Fortuna Mining Corp. FSM reported third-quarter 2024 adjusted earnings per share of 16 cents, which beat the Zacks Consensus Estimate of 11 cents. The bottom-line figure marked a 60% improvement from the year-ago quarter, driven by higher gold and silver prices, which offset lower sales volumes.

After adjusting for non-cash and non-recurring items, adjusted attributable net income was $49.9 million compared with $29.6 million in the year-ago quarter. Attributable net income in the third quarter increased 84% year over year to $50.5 million (or 16 cents per share).

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Fortuna Mining’s Revenues Gain on Higher Prices

Fortuna Mining’s revenues improved 13% year over year to $275 million, as higher realized gold and silver prices partially offset the decline in gold sales volume.

Realized gold price was $2,490 per ounce, 29% higher than $1,925 per ounce in the year-ago quarter. Realized silver prices rose 24% year over year to $29.00 per ounce.

Gold equivalent production decreased 14% year over year to 110,820 ounces. Fortuna Mining produced 91,251 ounces of gold, 4% lower than the year-ago quarter. Silver production plunged 51% to 816,187 ounces.

Fortuna Mining Corp. Price, Consensus and EPS Surprise

Fortuna Mining Corp. price-consensus-eps-surprise-chart | Fortuna Mining Corp. Quote

The Séguéla mine contributed 34,998 ounces of gold in the third quarter, up 11% from the year-ago quarter. Lindero Mine produced 24,345 ounces of gold, 16% higher than the third quarter 2023’s output. Gold output at the Yaramoko Mine was down 18% year over year to 28,006 ounces.

In the third quarter of 2024, the San Jose Mine produced 510,741 ounces of silver and 3,771 ounces of gold, which reflected a 63% and 54% decrease, respectively, from the third quarter of 2023. This was per plan as mining continued in areas with increased geologic uncertainty, as the San Jose is operating at the tail end of its reserves. Caylloma’s silver output was down 1% to 305,446 ounces.

All-In Sustaining Cost per gold equivalent ounce was $1,696, up 29% from the year-ago quarter. Cash costs per ounce of gold equivalent sold were $1,059, 30% higher than the third quarter of 2023.

FSM Delivers Improved Profits

FSM reported a mine-operating profit of $87 million, reflecting year-over-year growth of 32%. The company reported an operating income of $72.7 million, marking a 60% jump from the year-ago quarter attributed to improved profits at Lindero, Yaramoko and Caylloma.

Adjusted EBITDA rose 26% year over year to $131 million. The adjusted EBITDA margin was 47.7% compared with 43% in the year-ago quarter.

Fortuna Mining’s Cash Position

Fortuna Mining ended the third quarter with around $180.6 million of cash and cash equivalents compared with $128 million held at the end of 2023. Net cash flow from operating activities was $93 million compared with $106.5 million in the third quarter of 2023.

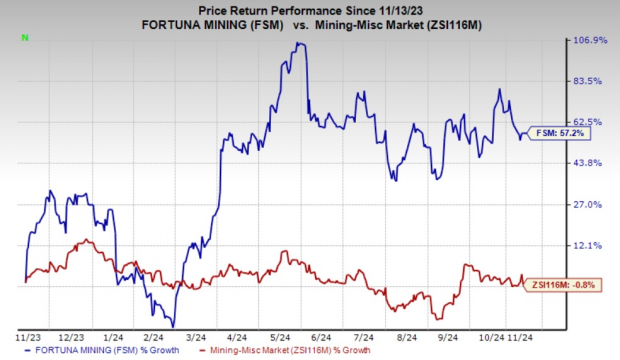

FSM Stock’s Price Performance

Shares of Fortuna Mining have gained 57.2% in a year against the industry’s 0.8% decline.

Image Source: Zacks Investment Research

Fortuna Mining’s Peer Performances in Q3

Pan American Silver Corp. PAAS reported adjusted earnings per share of 32 cents for the third quarter, which beat the Zacks Consensus Estimate of 21 cents. PAAS had posted adjusted earnings per share of 1 cent in the year-ago quarter.

Including one-time items, Pan American Silver reported earnings of 16 cents per share against the year-ago quarter’s loss of 5 cents per share.

PAAS’ revenues improved 16% year over year to $716 million. The top line missed the Zacks Consensus Estimate of $741 million. Silver production was down 4% year over year to around 5.47 million ounces. Gold output dipped 8% to 225,000 ounces.

The average realized silver price increased 27.7% year over year to $29.52 per ounce. The average realized gold price increased 28.4% year over year to $2,475 per ounce.

First Majestic Silver AG reported a third-quarter loss of 3 cents per share, which missed the Zacks Consensus Estimate of earnings of 9 cents per share. The company reported a loss of 2 cents per share in the second quarter of 2023.

Total production was 5.5 million silver equivalent ounces, which consisted of around 1.968 million silver ounces and 41,761 gold ounces. This was 13% lower from the year-ago quarter mainly due to lower production at San Dimas.

AG’s quarterly revenues rose 10% year over year to $146 million as a 33% increase in average realized silver price offset lower payable sales volumes.

FSM’s Zacks Rank & a Stock Worth Considering

Fortuna Mining currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the basic materials space is Carpenter Technology Corporation CRS, which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRS beat the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 14.1%. The consensus estimate for CRS’ fiscal 2025 earnings is pegged at $6.68 per share, indicating 41% year-over-year growth. The company's shares have gained 159% in the past year.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

Fortuna Mining Corp. (FSM) : Free Stock Analysis Report

First Majestic Silver Corp. (AG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.