Investors have long overlooked the U.S. automotive industry because of its track record of poor returns. And with shares down around 29% over the last 10 years (not including dividends), Ford Motor Company (NYSE: F) is a quintessential specimen in this lackluster industry.

That said, an ambitious pivot to electric vehicles (EVs) could shake things up. Let's explore the pros and cons of Ford to see if it could have millionaire-maker potential.

A leaner and meaner Ford

Compared to most of its rivals, Ford quickly realized the importance of larger vehicles. In 2018, the company discontinued all its sedans to focus on more profitable trucks, SUVs, and crossovers.

This turned out to be the correct move. Not only are larger vehicles more profitable, but they also are better suited to evolving customer tastes. Other automakers like General Motors eventually followed Ford by cutting sedan models.

Ford also aggressively scaled back its failing international operations by leaving Brazil and India while reducing its footprint in Europe. The result has been a leaner company that can focus on its electrification strategy. Third-quarter earnings give insights into how the transition is playing out.

Revenue grew by a modest 5% year over year to $46 billion, representing Ford's 10th consecutive quarter of top-line growth.

The company's internal combustion engine (ICE) business has become a stable cash cow, with the Ford Pro segment (which focuses on commercial vehicles) generating $1.8 billion in earnings before interest and taxes (EBIT). The Ford Blue Oval segment generated an EBIT of $1.63 billion. However, while its legacy ICE business is booming, its EV transition has been challenging.

The electrified business burns cash

Instead of creating value, Ford's new EV business (represented by the Model E segment) is dragging down company performance. In the third quarter, Model E sales fell 33% year over year to $1.2 billion with an EBIT loss of $1.22 billion.

Much of the weakness can be blamed on its flagship Mach-E crossover, which has experienced flagging sales and price cuts to deal with more competition in the market.

Over the coming years, Ford's EV business will probably resume its longer-term growth as battery technology improves and consumers become more willing to embrace the new technology. But it is unclear how much shareholder value this will create.

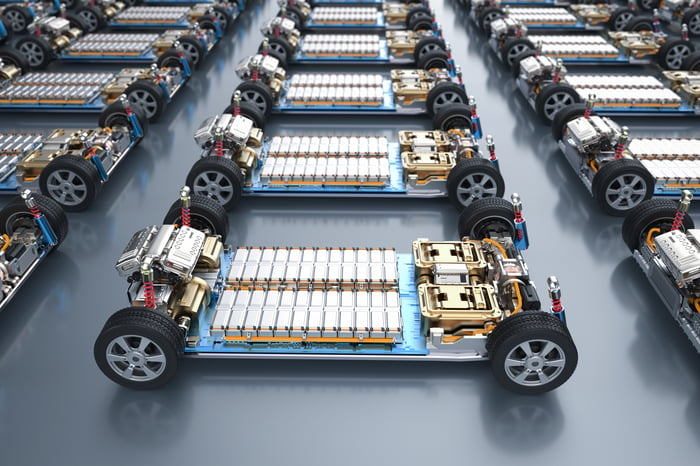

EV powertrains. Image sources: Getty Images.

For starters, most EV growth is expected to come from consumers switching away from ICE vehicles, so this trend will likely cannibalize Ford's profitable legacy segments. Furthermore, industry competition is rising, with pure-play EV companies like Tesla, Rivian Automotive, and Lucid Group encroaching on Ford's truck and SUV niche in the U.S.

The biggest threat will come from China, where a bevy of low-priced automakers seem poised to use their vertically integrated supply chains, government subsidies, and low-cost labor to turn EVs into a form of cheap electronics, much like toaster ovens and flat-screen TVs. While U.S. tariffs could keep these rivals at bay in Ford's home market, they could decimate what is left of its operations in Asia and Europe.

Is Ford a millionaire-maker stock?

Ford is undergoing a massive transition, and it is unclear how the chips will fall. In the best-case scenario, Its EV business will have a rapid growth rate that keeps up with expected declines in ICE sales and allows it to maintain market share. In the worst-case scenario, the company will be overshadowed by nimble rivals in the U.S. and China.

Either way, Ford is not a millionaire maker because neither scenario looks likely to generate market-beating equity growth. Long-term investors should probably sell or avoid the stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 2, 2024

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.