A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

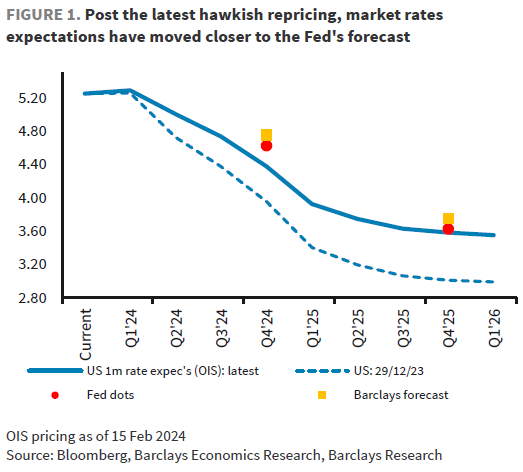

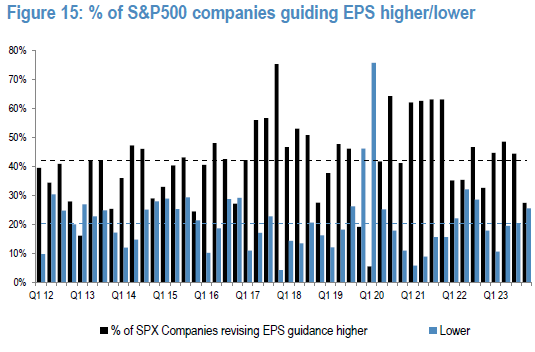

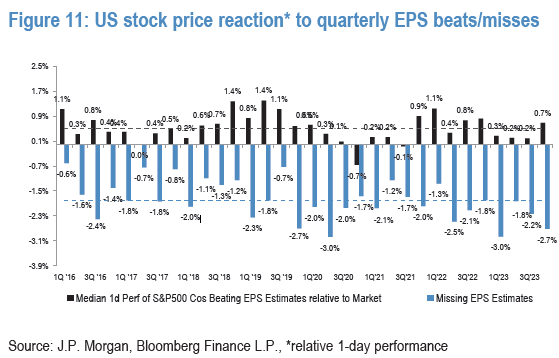

#marketseverywhere | "Sticky US inflation keeps goldilocks in check, but post the latest hawkish repricing, rates expectations have converged more towards the Fed forecasts. Q4 earnings have helped equities to cope with rates volatility. Although results are a mixed bag, EPS growth is inflecting higher and guidance is more positive."

-Barclays' Emmanuel Cau

* source: Goldman Sachs Global Investment Research

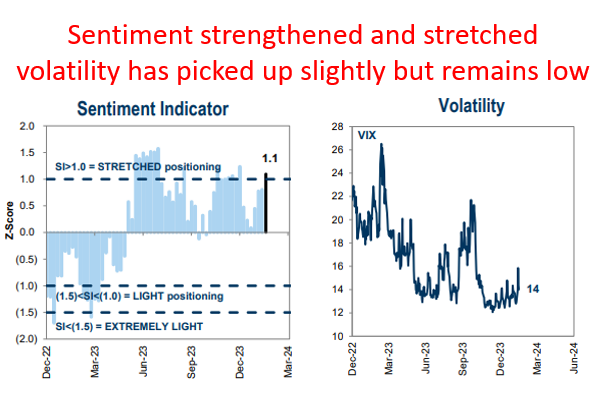

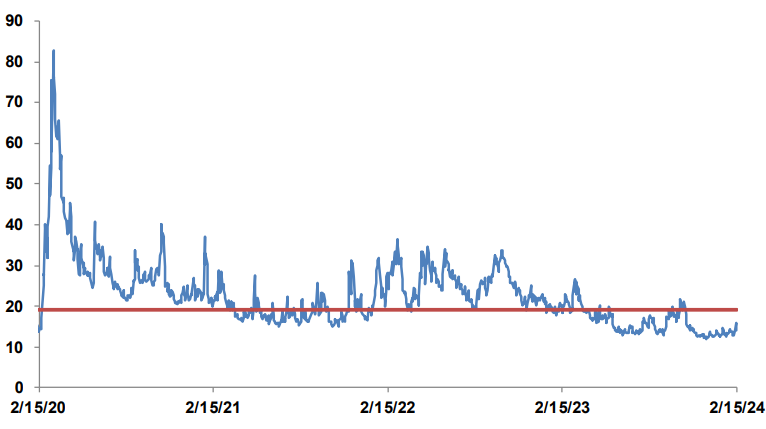

Volatility remains low - will the market throw a tantrum if Fed does not cut rates as much as the markets want it to cut rates?

* source: John Stoltzfus, Oppenheimer Asset Management

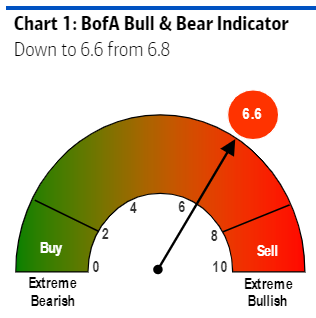

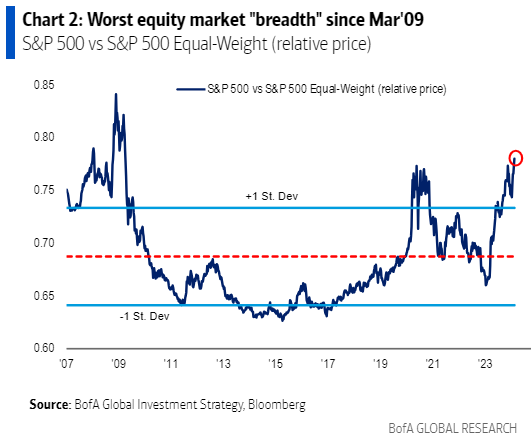

Bull & Bear Indicator dips to 6.6 from 6.8 on

lower equity market breadth

* source: BofA, The Flow Show, Michael Hartnett

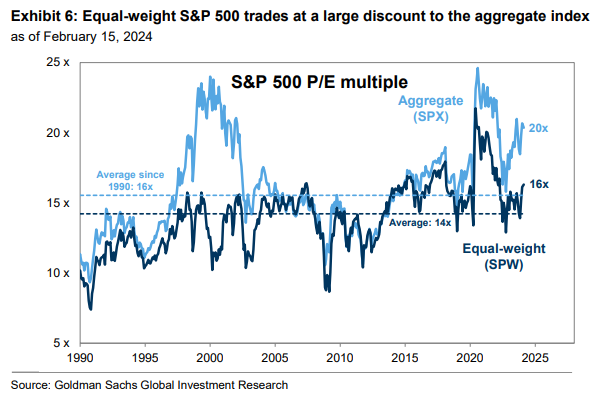

equity market breadth poor = mega caps driving returns

visible in valuation also, a dispersion - has been a consistent theme

* source: Goldman Sachs Global Investment Research

worst market breadth since March '09!

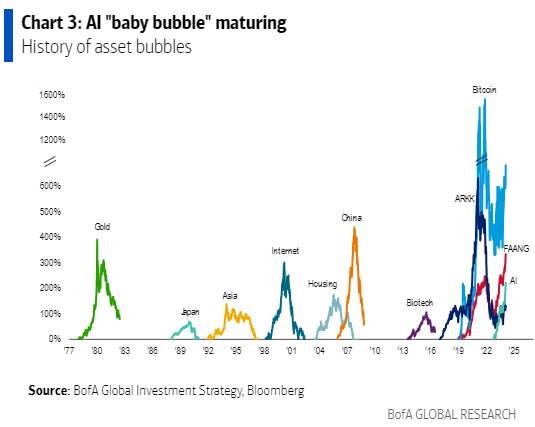

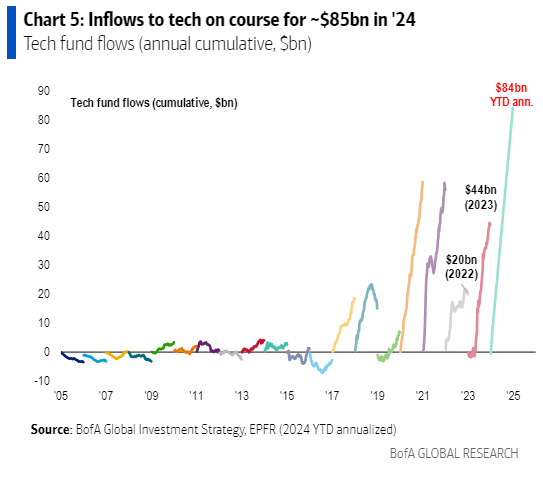

An AI bubble?

everyone loves tech since 2017...

* source: BofA, The Flow Show, Michael Hartnett

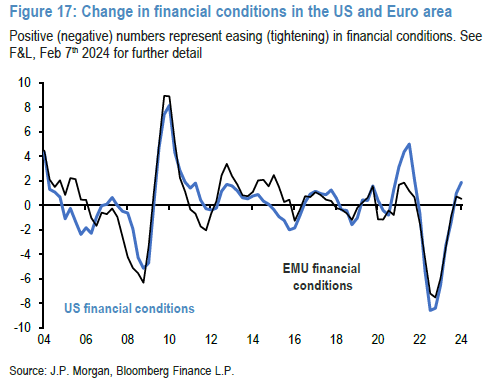

improving financial conditions (end of central bank tightening) has been a large contributor to the market rally

* source: JP Morgan

hawkish repricing of rates...

* source: Barclays' Emmanuel Cau

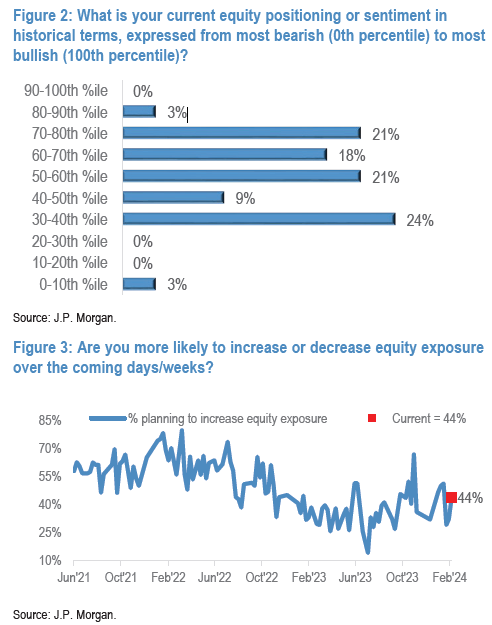

JPM survey based sentiment = mixed

44% plan to increase equity market exposure

* source: JP Morgan

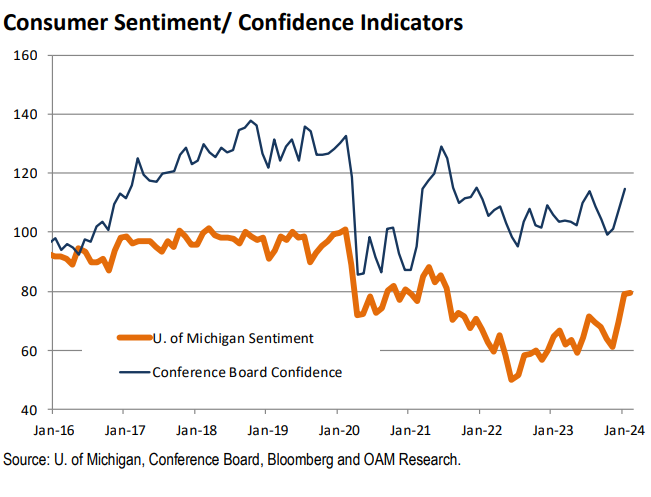

consumer sentiment weak but improving

consumer confidence doing better as jobs markets still strong

* source: John Stoltzfus, Oppenheimer Asset Management

1) KEY TAKEAWAYS

1) Equities + Dollar + TYields LOWER / Oil MIXED / Gold HIGHER

-FOMC minutes this week / NVDA earnings tomorrow

-China cuts mortgage rate to stimulate property market

-Euro's STOXX 600 at fresh 2YR highs, Euro IG + HY spread at tightest level in 2 years

DJ -0.1% S&P500 -0.6% Nasdaq -1.0% R2K -1.3% Cdn TSX +0.1%

Stoxx Europe 600 -0.2% APAC stocks LOWER, 10YR TYield = 4.269%

Dollar LOWER, Gold $2,026, WTI +0%, $80; Brent -0%, $83, Bitcoin $51,996

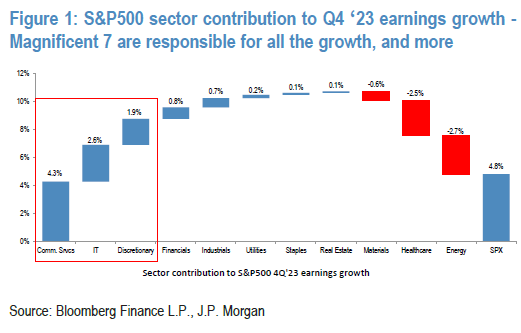

2) Earnings...

"78% of S&P500 companies that have reported beat EPS estimates. EPS growth for these companies is at +5% y/y, surprising positively by 8%.

Crucially, the bulk of earnings growth can be attributed to Communication

Services , Tech and Discretionary.

If one were to exclude the Magnificent 7 stocks' Q4 earnings results, EPS growth for the US is at -4% y/y.

-JPMorgan

punishment > reward

* source: JP Morgan

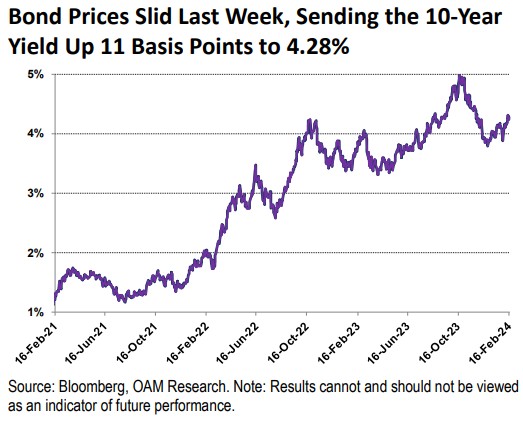

3) 10YR bond yield remaining above 4% | a hawkish repricing due to sticky inflation

* source: John Stoltzfus, Oppenheimer Asset Management

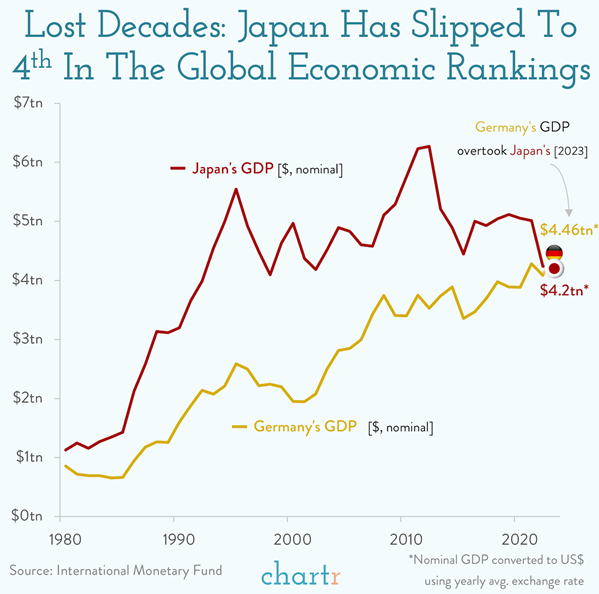

4) Food for thought: Germany outpaces Japan but Nikkei 225 at bubble era highs...

*source: Chartr

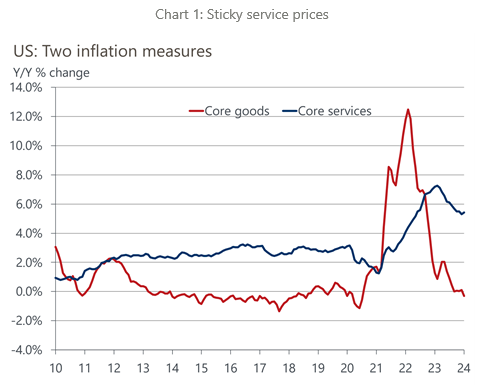

5) Services inflation remains > goods inflation

* source: Oxford Economics

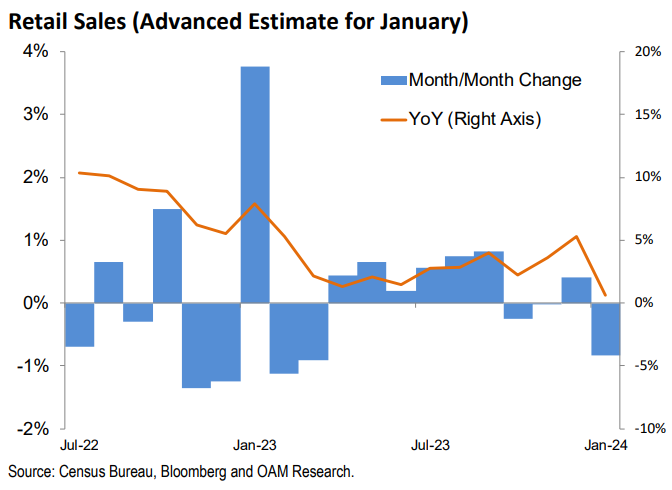

6) "Retail sales fell 0.8% in January, a much weaker result than expected; the consensus was calling for a -0.2% slide. In addition, December’s result was revised lower: to +0.4% m/m from +0.6% previously estimated."

* source: John Stoltzfus Oppenheimer Asset Management

7) THIS WEEK:

Fed FOMC meeting minutes (21 Feb); US existing home sales for Jan (22 Feb) - BBG Cons (3.97m); Preliminary PMI's (22 Feb); China central bank policy decision (18-20 Feb); China new home prices for Jan (23 Feb).

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Natural gas prices plunge as US set for warmest winter on record - FT

-US natural gas prices have plunged to a near-three-decade low as what is set to be the country’s warmest winter on record slashes demand for the heating fuel just as production surges to record levels.

-The number of heating degree days — a measure of coldness based on how often temperatures fall below a certain reference point — has dropped 7 per cent over the past two decades, according to the US Energy Information Administration.

Gresham House Fund Targets $380 Million for ‘Novel’ ESG Credits - BNN

-The Gresham House Biodiversity Co-Invest LP, will invest into habitat banks — plots of land ranging from 10 to more than 500 hectares — where changes to land management are expected to improve biodiversity.

-The fund will generate returns from the sale of biodiversity credits by Environment Bank Ltd. (EBL), which created the habitat banks. The UK government has said it expects the market for the so-called biodiversity net-gain credits to eventually reach about £280 million ($350 million).

3) MARKETS, MACRO, CORPORATE NEWS

- Data show the economy is booming. Wall Street thinks otherwise-MSN

- Semiconductor suppliers say Biden’s chips plan leaves them out-POL

- Container lines ‘struggling’ with port congestion and ship shortages-FT

- ECB says Euro-Zone wage growth slowed in fourth quarter-BBG

- China cuts mortgage-linked lending rate by record amount-FT

- China's securities watchdog solicits proposals to revive market-RTRS

- China exerts grip on tech as Beijing expands economy control-BBG

- RBA considered interest-rate hike, saw pause case as stronger-BBG

- A $6 trillion wall of cash is holding firm as Fed delays cuts-BBG

- Goldman lifts S&P 500 target with profit optimism to drive rally-BBG

- Iron Ore battered to three-month low as China concerns escalate-BBG

- US circulates rival UN resolution for temporary Gaza cease-fire-POL

- Crew abandons ship in most damaging strike yet by Yemen’s Houthis-FT

- U.S. considering sanctioning Chinese firms aiding Russia’s war-CNBC

- Biden's reset moment-AXIOS

- S&P Global close to acquisition of research platform Visible Alpha-FT

- Happy hour looms for KKR’s AVC sale; new price on table-AFR

- Zee, Sony huddle in dramatic twist to salvage merger-ECON

- TPG in talks on €4.5 billion deal for Permira’s Alter Domus-BBG

- ExxonMobil warns EU that red tape might push it to invest elsewhere-FT

- Putin allows sanctioned Expobank to buy HSBC’s Russian unit-BBG

- Lufthansa faces EU warning shot over $350 million ITA Deal-BBG

- JSW Steel in talks to buy 20% in Australian coal mine for $1 billion-ECON

- ED has not yet found forex breaches at Paytm unit, source says-ECON

- Bad property debt exceeds reserves at largest US banks-FT

- Ozempic may force junk food makers to rewrite their game plans-BBG

- Capital One to acquire Discover Financial Services in $35.3 billion all-stock deal-CNBC

Oil/Energy Headlines: 1) China's travel spending during Lunar New Year holidays beats pre-COVID levels-RTRS 2) Russian oil refining falls further in wake of drone attacks-BBG 3) Russia’s seaborne crude flows at risk as India shuns key grade-BBG 4) Biden warns Israel against Rafah attack without plan to protect civilians-POL

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.