Focus on ESG Investing Likely to Continue, Nordea Says

Sustainable investments in Europe have grown significantly over the past decade, especially as more institutional investors commit to responsible investing standards. As they look to integrate environmental, social and governance (ESG) factors into their investment strategies, financial services firm Nordea recently released a guide to sustainable investing, outlining key trends and several approaches for ESG investing.

“The global focus on sustainability is likely to continue, and one should not underestimate the demand effect as more investors allocate to companies well-positioned from an ESG point of view,” Nordea said in its report.

On a recent episode of TradeTalks, Eva Palmborg, Head of Sustainable Investments at Nordea, commented on the increasing prevalence of ESG investing.

“Sustainable finance is moving from niche regulations to more mainstream regulations, like MiFID II,” said Palmborg. “We can also see that more and more retail investors are allocating assets to sustainable investments as well, and that has been quite a sharp increase over the last couple of years.”

She noted that one of the key drivers of sustainable investing is more institutional investors have committed to PRI. “When you sign that, you commit to integrating ESG into the investment process.”

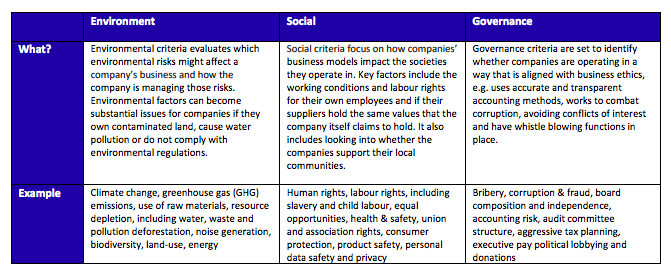

When integrating ESG analysis into portfolio construction, an investor may account for a range of factors. For example, if they are considering the company’s impact on the environment, they may consider energy and fuel use, water use and waste, or biodiversity impacts. Within social factors, they will analyse the company’s policy on human rights and community relations, health and safety, product quality, data security and privacy, etc. Or when considering corporate governance, an investor will be eager to understand a company’s competitive behavior, transparency, political influence, fairness, and more.

“Investors are applying [ESG] into their analysis and investment process, and, in a way, identifying key risk and growth opportunities,” said Palmborg.

Sustainable investing approaches “span from exclusion to impact investing,” Palmborg said. One of the oldest approaches to responsible investing is exclusion, in which an investor will exclude a certain company based on a set of criteria. However, as more investors start to integrate ESG analysis into their investment process, we are seeing a trend towards “impact investing” where investors seek tangible results for their sustainable investments.

Nordea says impact investing is about the connection between the allocation of capital by investors and the aim to solve environmental or societal problems as well as address opportunities within these areas. In its report, the firm noted that impact investing has grown substantially over the last couple of years, “from EUR 20 billion in assets under management in 2013 to EUR 108 bn in 2018.”

With the COVID-19 pandemic affecting all companies, investor focus on ESG has not abated. Palmborg noted that investors are paying particular attention to the social aspect, watching how companies and management prioritize their employees’ welfare and financial security during this crisis.

“From an ESG point of view, sustainable funds have performed better during the crisis, and the outflow has been less in those funds with a sustainable profile,” said Palmborg.