By Komson Silapachai, Research & Portfolio Strategy

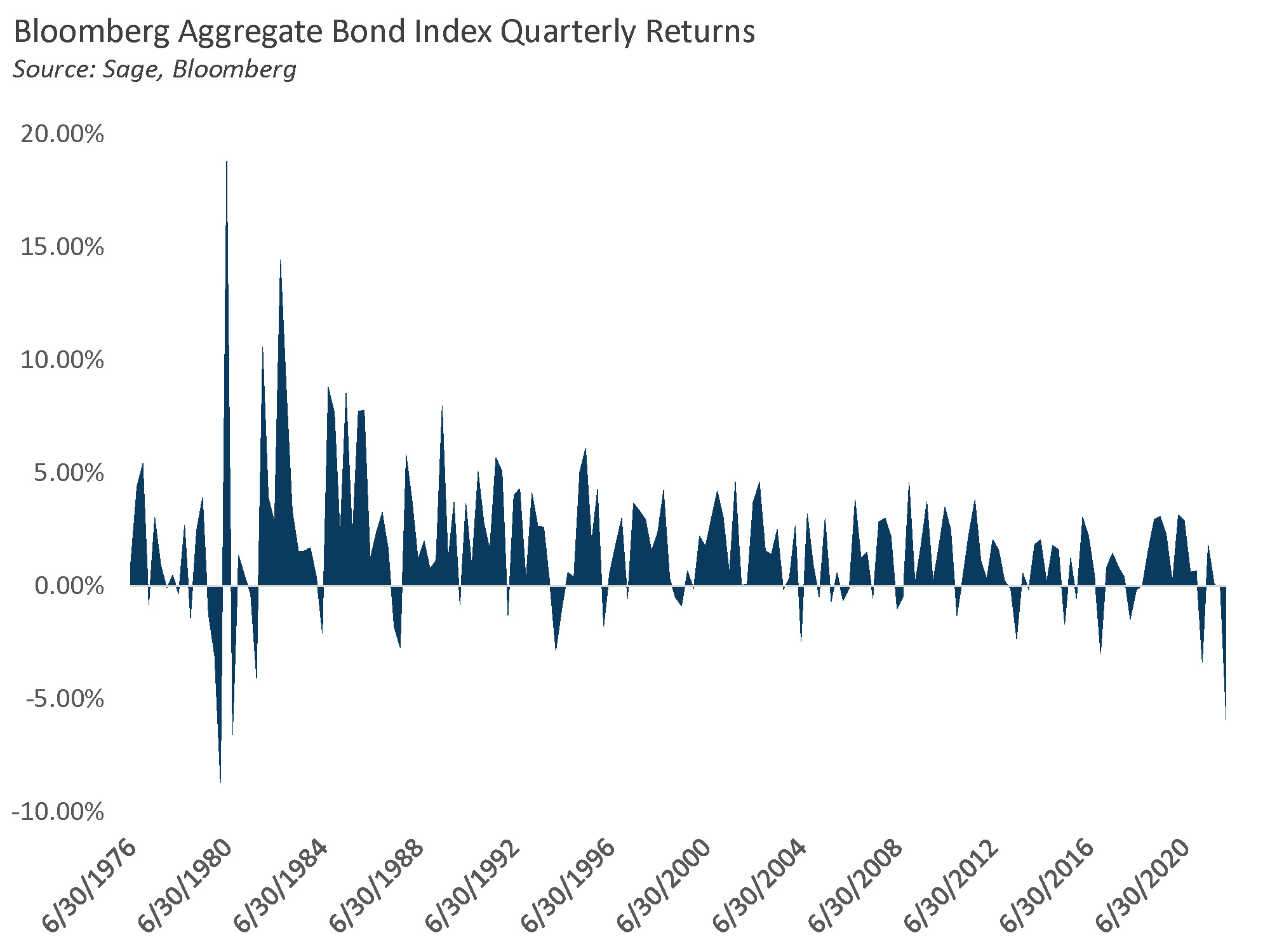

The first quarter of 2022 marked one of the worst quarters for the U.S. fixed income market since the Aggregate Bond Index’s inception in 1976. The worst quarters were Q1 and Q3 1980, during the hiking cycle in which Paul Volcker raised the fed funds rate to 20%. The move sent the U.S. economy into a slowdown to fight the “stagflation” dynamics that took hold in the late 1970s.

Bloomberg Aggregate Index Quarterly Returns

Source: Sage, Bloomberg

Investors are facing a similar environment in 2022. An increasingly hawkish FOMC has resulted in increasing risk premiums on all assets. Yields have risen sharply, and credit spreads and risk assets have weakened. Aggregate demand, which was already forecasted to decelerate, now faces additional pressure of lower consumer spending. The Fed continues to be hyper focused on inflation due to persistently higher inflation data, an ongoing labor shortage, and a commodity shock spurred by the Russia-Ukraine war. As a result, the yield curve priced in a much more aggressive Fed policy as the quarter progressed.

[wce_code id=192]

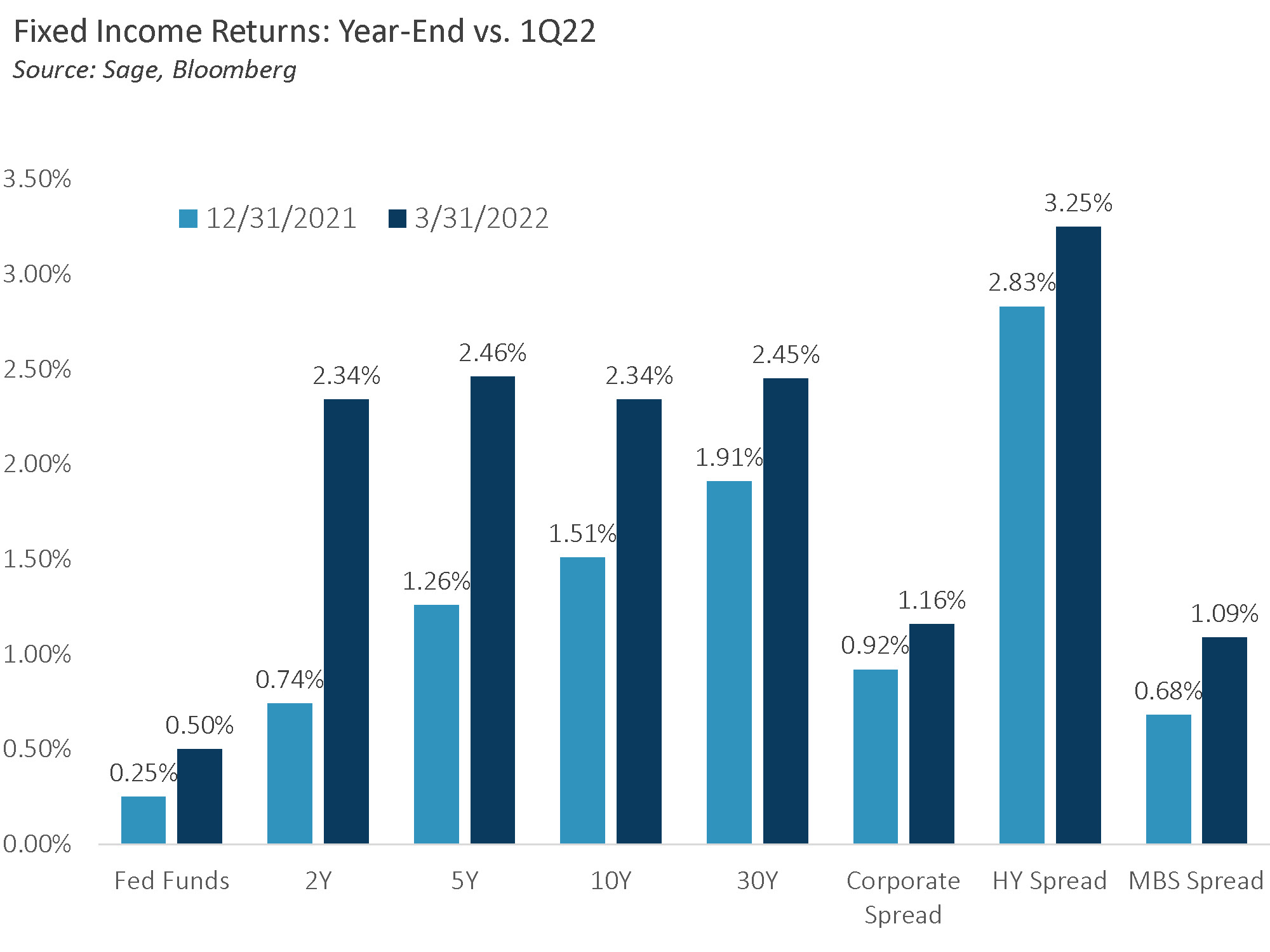

Fixed income assets were negatively impacted, as interest rates repriced to reflect an increasingly hawkish Fed. While yields shifted higher across the curve, the 2-year and 5-year points were the most negatively affected. The markets priced in a higher number of hikes sooner (8 hikes of 25bps each in 2022 alone) but longer maturity yields rose much less – flattening the yield curve to an inversion, which is typically a harbinger for an economic slowdown. Additionally, the Fed is expected to shrink its balance sheet, the expectation of which caused additional selling pressure in Treasuries and MBS, which widened dramatically.

Corporate credit was remarkably resilient on a spread basis, with investment grade and high-yield corporate spreads widening only 24 bps and 42 bps, respectively. Credit fundamentals have no doubt been strong during the stimulus-fueled recovery post-Covid; however, as the Fed continues to tighten conditions ahead of an economic slowdown, credit spreads could be primed to widen modestly. We believe the risk/reward picture for corporates is unattractive relative to other sectors that have already repriced, such as MBS.

Fixed Income Returns: Year-End vs. 1Q22

Source: Sage, Bloomberg

Next, we’ll take stock of the current market setting using the Sage Macro Framework (growth, policy, valuations, sentiment), which answers the question: What can investors expect over the coming quarter?

Growth: What is the underlying growth/inflation picture?

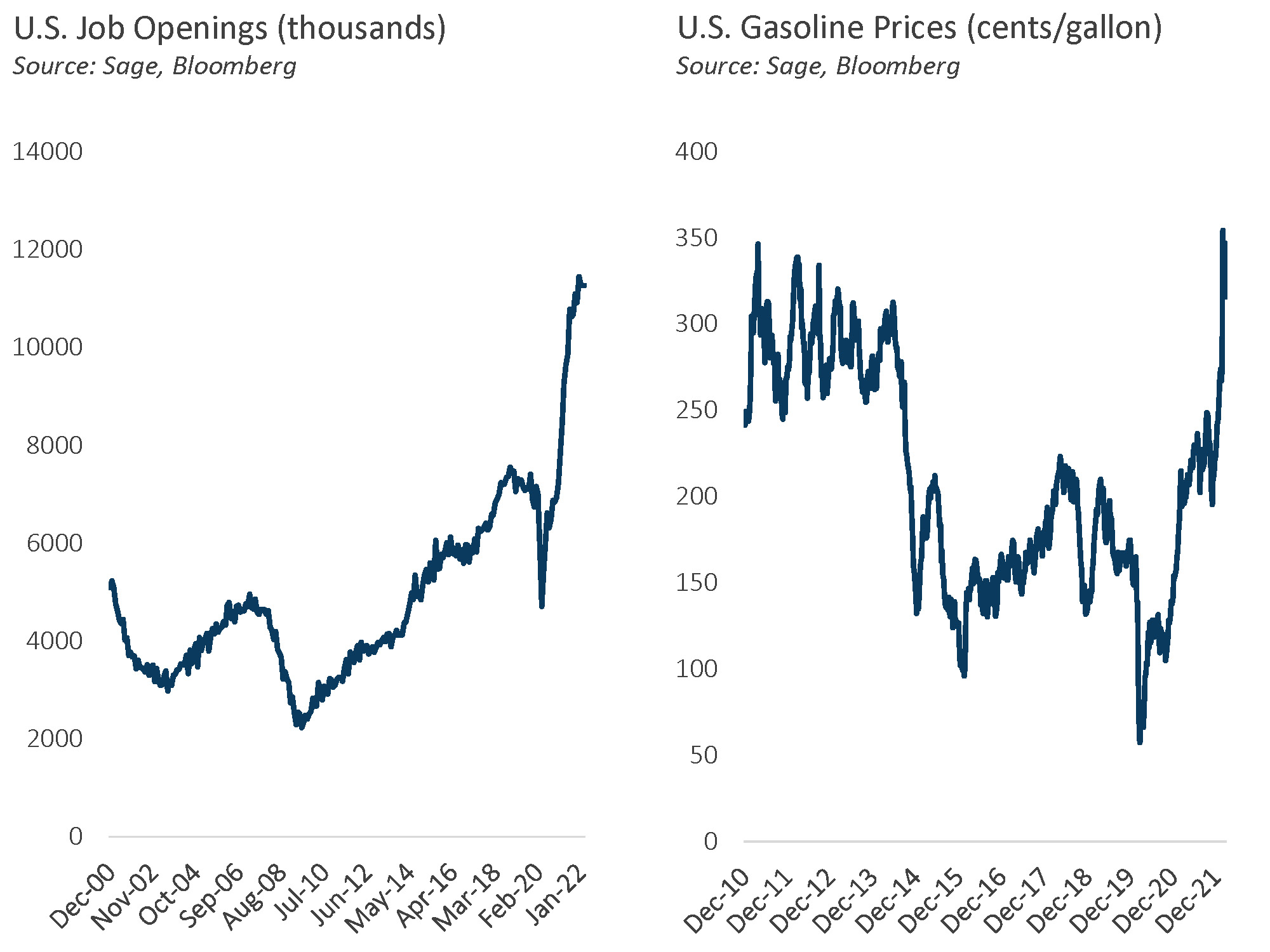

Inflation will remain the chief topic of interest for investors over the coming quarter, particularly rising input costs for the private sector. The consumer spending tailwind during the early expansion phase is largely depleted, as savings rates are near long-term averages and households will now have to contend with rising fuel, and potentially goods, prices. On the corporate front, rising input costs of labor and raw materials could pressure margins lower. The two key indicators that will clarify the inflation picture and its effect on aggregate demand over the coming months are job openings (represented by JOLTS) and gasoline prices. While we expect the labor market tightness to improve as consumers must replace income in the absence of stimulus, energy and commodity prices could remain elevated due to supply chain woes amid the Russia-Ukraine war.

U.S. Job Openings (thousands) U.S. Gasoline Prices (cents/gallon)

Source: Sage, Bloomberg

Policy: How are policymakers reacting?

As expected, the FOMC conducted its first rate hike in March, delivering a hawkish message both in terms of written/verbal communication as well as the FOMC “Dot Plot.” Median dots show seven hikes in 2022 and an above-neutral terminal rate of 2.75% by the time the FOMC stops hiking (as compared to its estimate of the neutral rate at 2.375%). One week after the March FOMC meeting, Chairman Powell hinted at a potential 50 bps hike in the near-term, revealing the Fed’s intention to tighten further than signaled during the March FOMC release. The Fed is solely focused on inflation and has very little sensitivity to slowing growth in the U.S. economy. While there have been signs of slowing economic growth in the U.S., as well as potential growth shocks from the Russia-Ukraine war, Powell repeatedly cited the strength of the U.S. economy and its ability to withstand much tighter financial conditions. To us, that was a hawkish signal – the bar for a slowdown will be very high to throw the FOMC off its tightening program. Additionally, other major central banks are following suit – the BoE, RBA, ECB, and BoC have all followed in the Fed’s footsteps and signaled their intentions to tighten conditions.

Valuation: What is currently priced into the market?

Interest rates have reflected the Fed’s hawkishness during the quarter. According to the Eurodollar curve, the fed funds rate is expected to reach 2.7% by the end of 2022, which is equivalent to nine 25 basis-point hikes. Since there are only six FOMC meetings left in the year, the market is pricing in multiple meetings in which the Fed raises rates by 50 bps. Additionally, markets are discounting three more 25 bps hikes in 2023, after which the Fed will immediately start easing policy by cutting rates.

Both the Eurodollar curve and the flattening of the yield curve are pointing to a Fed policy so tight that it causes an economic recession. Higher yields from current levels, particularly in the intermediate portion of the curve, would have to come from a further increase in inflation – hence the importance of the job openings and fuel price data as leading indicators to wages and CPI.

Evolution of Fed Policy Rates Implied by Interest Rate Markets

Source: Sage, Bloomberg

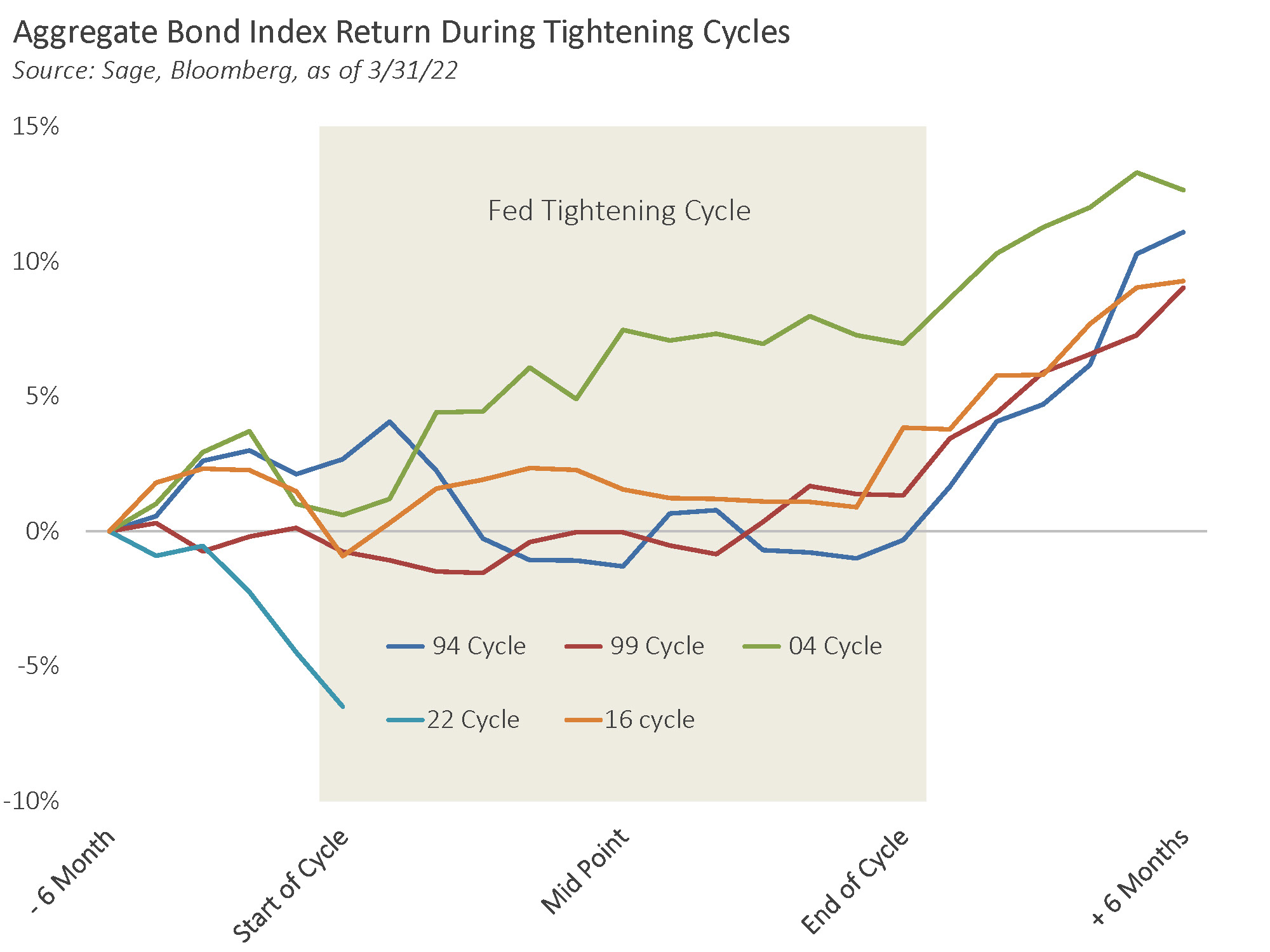

In a study of the last four rate hiking cycles, we found that most of the negative price action for U.S. fixed income took place either before or during the early part of the hiking cycle, recovering as the Fed wound down its hiking program. As the Fed has officially embarked on its tightening process with the first hike in March, we believe much of the negative return could already be baked in.

Aggregate Bond Index Returns During Tightening Cycles

Source: Sage, Bloomberg

Sentiment: What is prevailing investor sentiment?

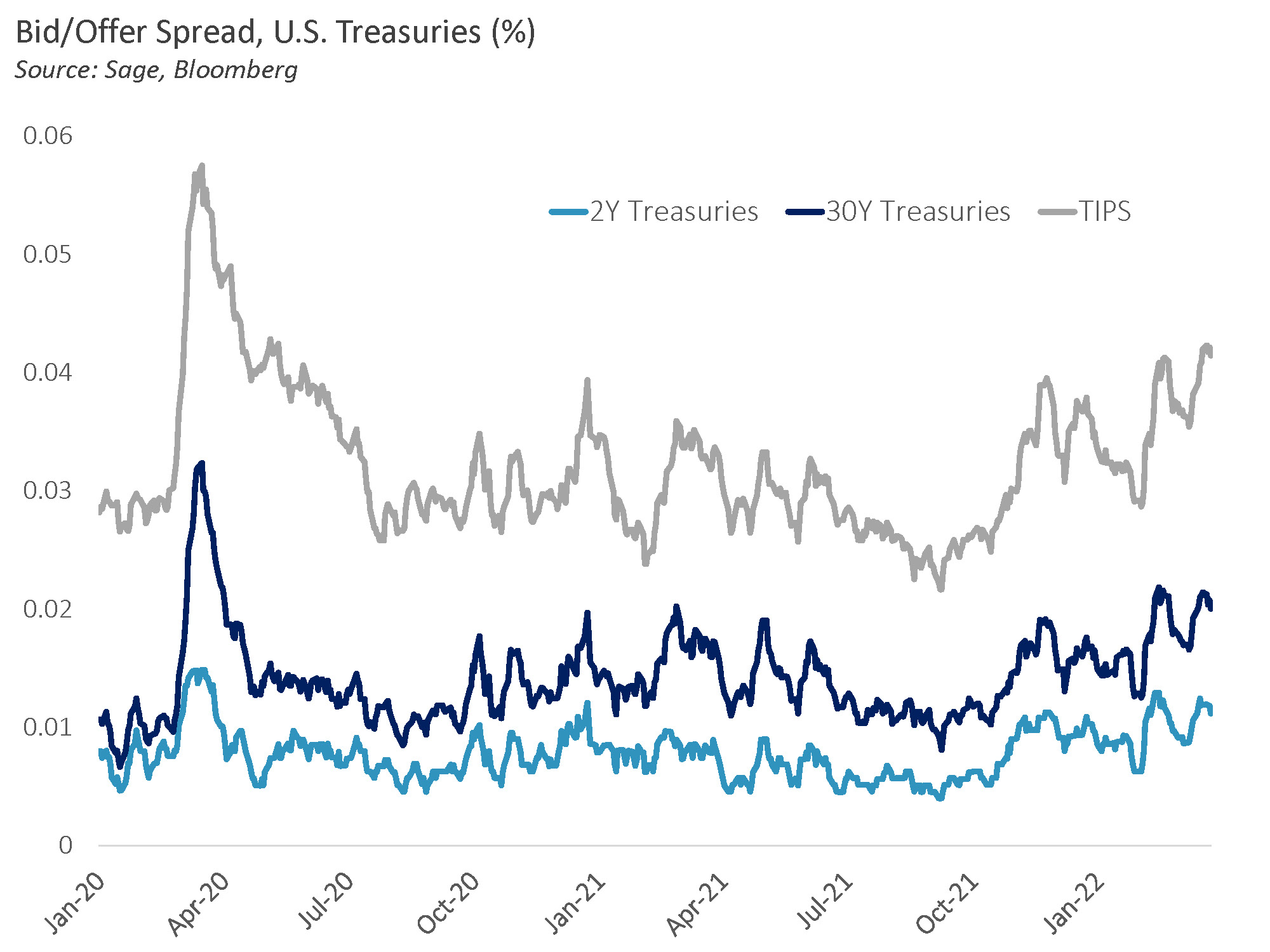

Investor confidence has squarely turned negative, as fears around FOMC tightening coupled with global growth uncertainty – due to the Russia-Ukraine war, China slowdown, and supply side inflation – have only injected more volatility into day-to-day movements and liquidity. Even for one of the most liquid markets in the world – the U.S. Treasury market – liquidity has deteriorated to the worst levels since the Covid crisis, illustrating the lack of conviction in the market from both investors and intermediaries.

Bid/Offer Spread, U.S. Treasuries (%)

Source: Sage, Bloomberg

Putting It Altogether

The Fed, emboldened by heightened inflation readings, has signaled its intention to raise rates aggressively and shrink its balance sheet, threatening the current economic expansion as well reversing the positive backdrop for financial assets over the past two years. The markets, particularly interest rates, have taken the Fed’s seriousness in fighting inflation at face value, pricing in 75 bps of additional hikes past the Fed’s indicated terminal rate of 2.75%. Consequently, the yield curve has flattened and MBS basis has increased. We believe the move in rates and MBS is mostly priced in, and while credit spreads have remained resilient thus far, we believe a modest widening for corporates could be in order.

We recognize that inflation has been running at its highest level since the 1980s, so few market participants have experienced the current market backdrop. On the margin, position sizes and total portfolio risk should be smaller in this environment given the unprecedented nature of the fiscal/monetary policy withdrawal, as well as the overlay of war in Ukraine.

Disclosures: This is for informational purposes only and is not intended asinvestment adviceor an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.