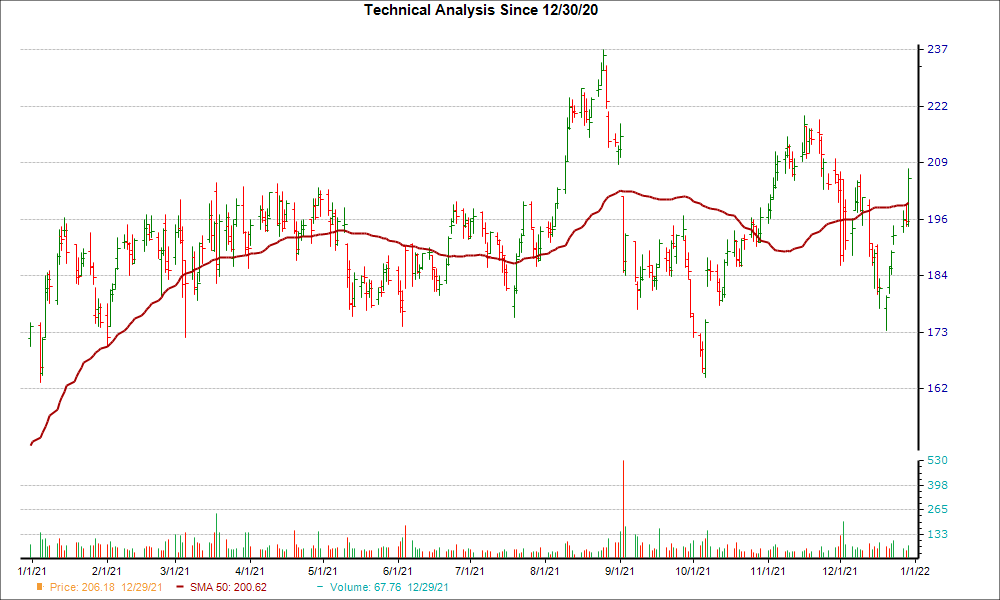

After reaching an important support level, Five Below (FIVE) could be a good stock pick from a technical perspective. FIVE surpassed resistance at the 50-day moving average, suggesting a short-term bullish trend.

The 50-day simple moving average is one of three major moving averages used by traders and analysts to determine support or resistance levels for a wide range of securities. But the 50-day is considered to be more important because it's the first marker of an up or down trend.

Shares of FIVE have been moving higher over the past four weeks, up 6.2%. Plus, the company is currently a Zacks Rank #2 (Buy) stock, suggesting that FIVE could be poised for a continued surge.

The bullish case solidifies once investors consider FIVE's positive earnings estimate revisions. No estimate has gone lower in the past two months for the current fiscal year, compared to 9 higher, while the consensus estimate has increased too.

Given this move in earnings estimate revisions and the positive technical factor, investors may want to keep their eye on FIVE for more gains in the near future.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Five Below, Inc. (FIVE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.