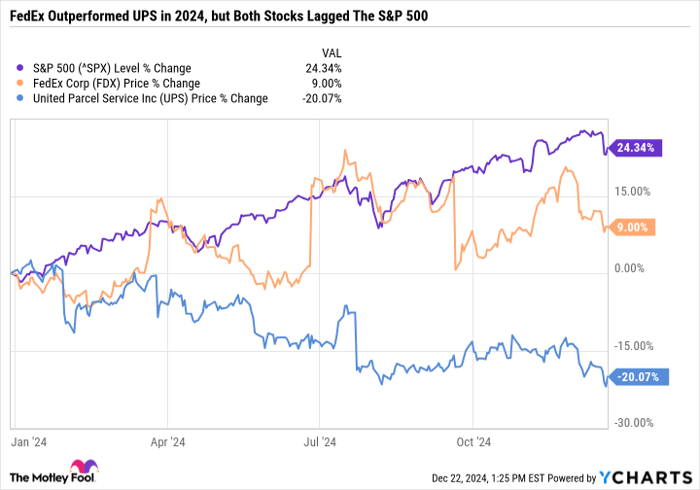

The holiday season is here, and that means FedEx (NYSE: FDX) and United Parcel Service (NYSE: UPS) are hard at work fulfilling peak order volumes. FedEx has produced decent gains on the year, but UPS is down big and is hovering around a four-year low. Here's why both have been underperforming the S&P 500 in recent years and why both dividend stocks could be worth buying now.

Navigating imbalances in supply and demand

FedEx has posted respectable gains on the year compared to a 20% sell-off in UPS stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Both companies have been under pressure in an oversupplied package delivery network. The pandemic threw a wrench into forecasting, and the industry overexpanded routes and capabilities in anticipation of sustained growth that never materialized. Throw in supply chain and inflation challenges in recent years, and it has been far from an easy time for these companies.

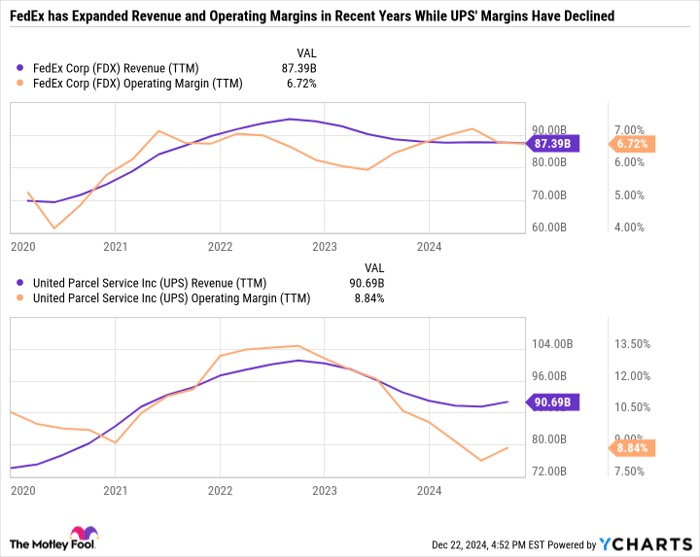

In general, FedEx has done a better job responding to industry challenges in the package delivery market. It has historically been a lower-margin business than UPS, but it has protected those margins in recent years, whereas UPS' margins are hovering around a 10-year low.

FDX revenue (TTM), data by YCharts; TTM = trailing 12 months.

Besides reporting decent second-quarter fiscal 2025 results on Dec. 19, FedEx announced plans to separate into two public companies: FedEx and FedEx Freight. FedEx cited improved focus, agility, and clearer value propositions as reasons for the separation.

FedEx Freight is significantly smaller than the rest of the business, contributing just $4.51 billion in revenue for the six months ended Nov. 30, compared to $37.15 billion for the Federal Express segment. However, freight has historically had higher margins and been more efficient than the broader business.

The move follows a wave of breakups across the industrial sector and a push for flexibility. Companies are looking to follow in the footsteps of GE's successful split into GE Aerospace, GE HealthCare Technologies, and GE Vernova. Honeywell International is considering spinning off its aerospace segment in response to disgruntled investors and years of underperforming the broader sector.

Image source: Getty Images.

Both companies are on the right track

FedEx lowered its full-year fiscal 2025 forecast, and now expects flat revenue compared to a prior forecast of a low single-digit increase. It also lowered its outlook on adjusted earnings per share to a new target range of $19 to $20 instead of $20 to $21. However, the company continues to make progress on cost-cutting and efficiency improvements.

On the latest earnings call, management said it is on track to deliver $4 billion in savings by the end of fiscal 2025 compared to a fiscal 2023 baseline, and another $2 billion in savings by fiscal 2027. UPS has realigned its business to focus on higher-margin parts of the industry, such as time- and temperature-sensitive healthcare products. It returned to volume growth in its second quarter and profit growth in its third quarter.

The company has an improved outlook for 2025. In addition to industrywide challenges, UPS has spent the last few years juggling higher costs due to a labor dispute that boosted expenses. With that issue largely resolved, it has removed a crucial layer of uncertainty.

Both businesses made their fair share of mistakes in recent years, so it's unsurprising that their stock prices have lagged behind the S&P 500. However, the industry does appear to be turning the corner.

Growing dividends and inexpensive valuations

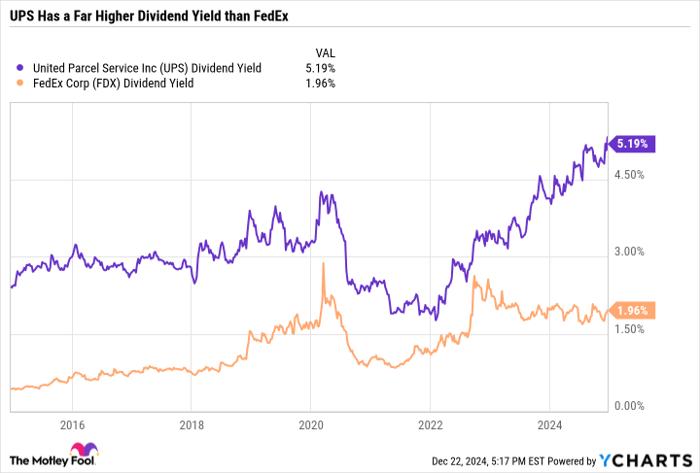

Both FedEx and UPS stand out as compelling values for patient investors. FedEx has a forward price-to-earnings ratio of just 14.3 compared to 16.8 for UPS. Both companies substantially increased their dividends during the expansion period a few years ago, with moderate increases since then. FedEx now yields 2%, but UPS has a whopping 5.2% yield.

The dividend has been a core element of UPS' investment thesis for some time, whereas FedEx was a low-yield, growth-focused company specializing in express shipping.

UPS dividend yield, data by YCharts.

UPS seems to have a better strategy than FedEx for unlocking long-term growth. It has overcome its labor challenges and is well positioned to progress on its 2026 goals for margin expansion and sales growth. However, given how this year has gone, I expect UPS to reach these goals by 2027 if not 2028.

Meanwhile, the spinoff of FedEx Freight presents a new unknown. The move makes sense on paper, but how it will play out in practice remains to be seen. Growth in package delivery volume and cost cuts across the industry should improve margins for both companies. But if interest rates stay higher for longer, or there's an economic slowdown, then they could be once again pressured.

Two value stocks worth buying now

UPS and FedEx both stand out as good buys now, but I'd prefer UPS if I could only pick one. The company has found its footing and looks well-positioned to progress toward its medium-term goals. When at its best, it has a nice balance among business-to-business accounts, small and medium-size businesses, and residential customers.

With costs in check, UPS should be able to afford its dividend although raises will likely be minimal in the near term. The turnaround is more defined, whereas FedEx has a lower yield and is undergoing a significant change with the spinoff of its freight segment.

UPS provides investors with a sizable incentive to hold the stock through challenging periods, making it a compelling buy even in the face of macroeconomic uncertainty.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $363,593!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,899!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $502,684!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 23, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends FedEx and GE HealthCare Technologies. The Motley Fool recommends GE Aerospace and United Parcel Service. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.