A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

-S&P 500 closed at a record high for a 5th consecutive session

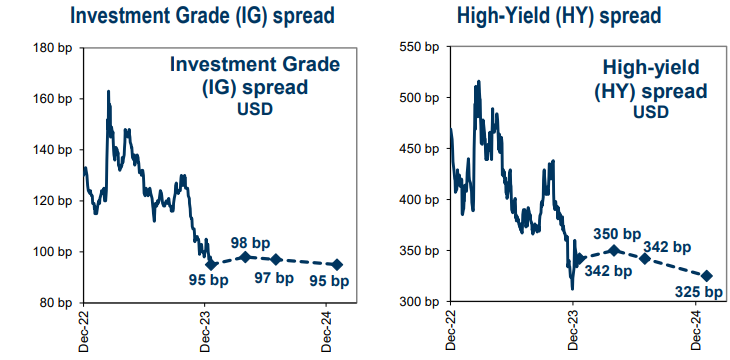

-US investment grade spreads fell to their tightest level in over 2 years

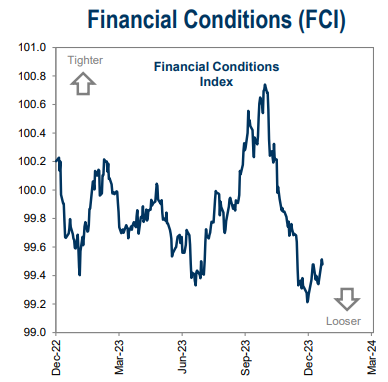

-Bloomberg’s index of US financial conditions eased to its most accommodative level in the last two years

-ECB President Lagarde struck a more dovish tone than expected, which led investors to dial up the chance of a rate cut as soon as April (rate cut odds = 93%)

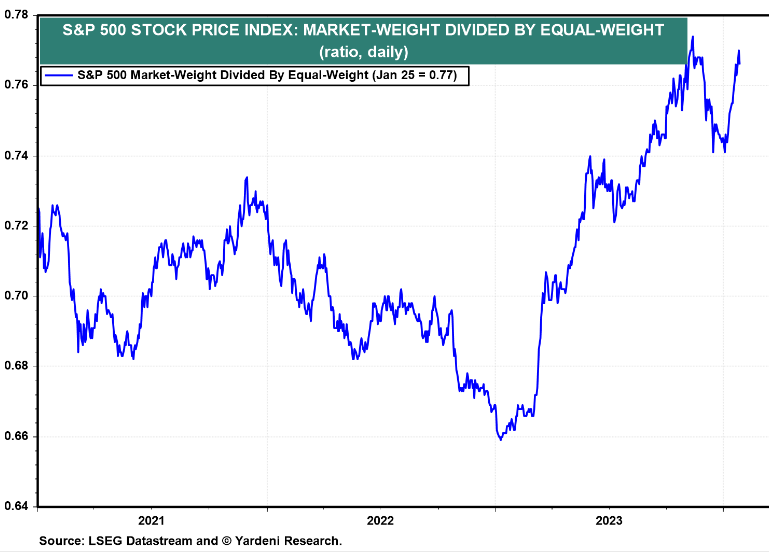

back to mega caps leading markets higher

* source: Yardeni Research

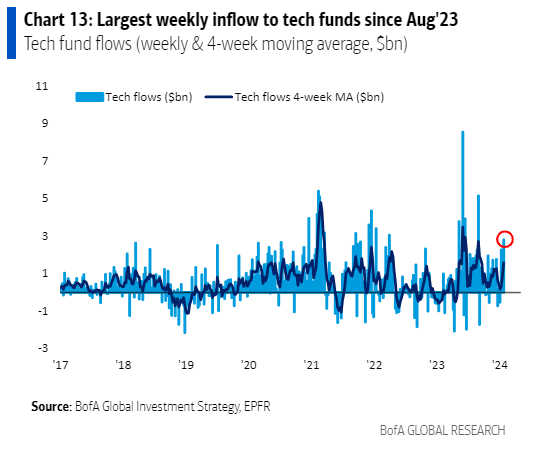

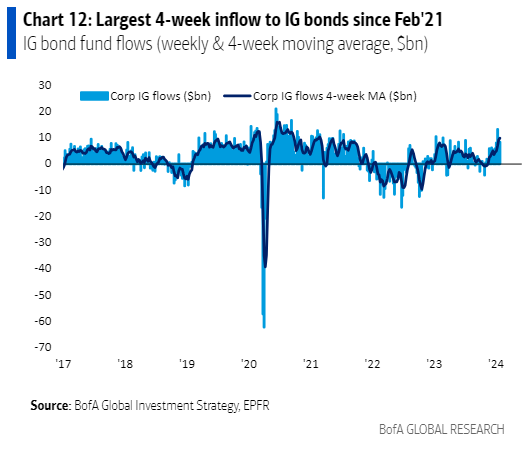

* source: BofA's Michael Hartnett, The Flow Show

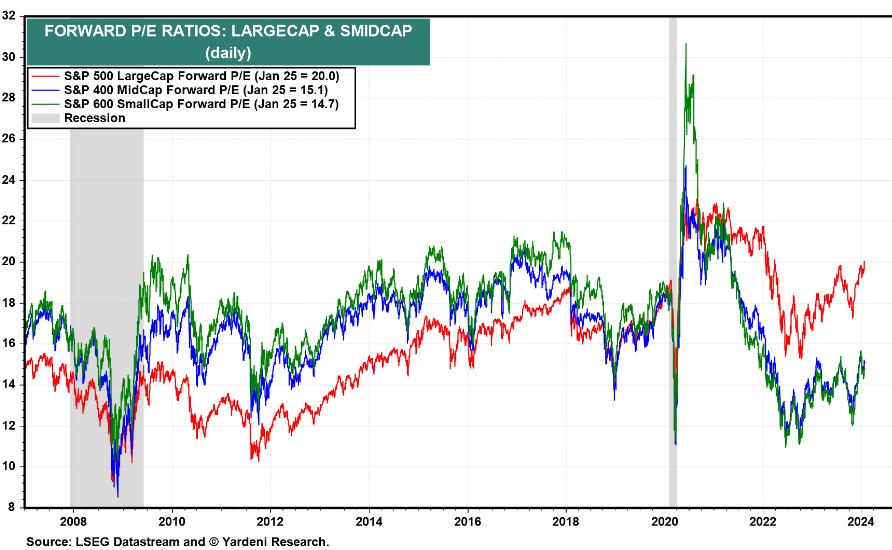

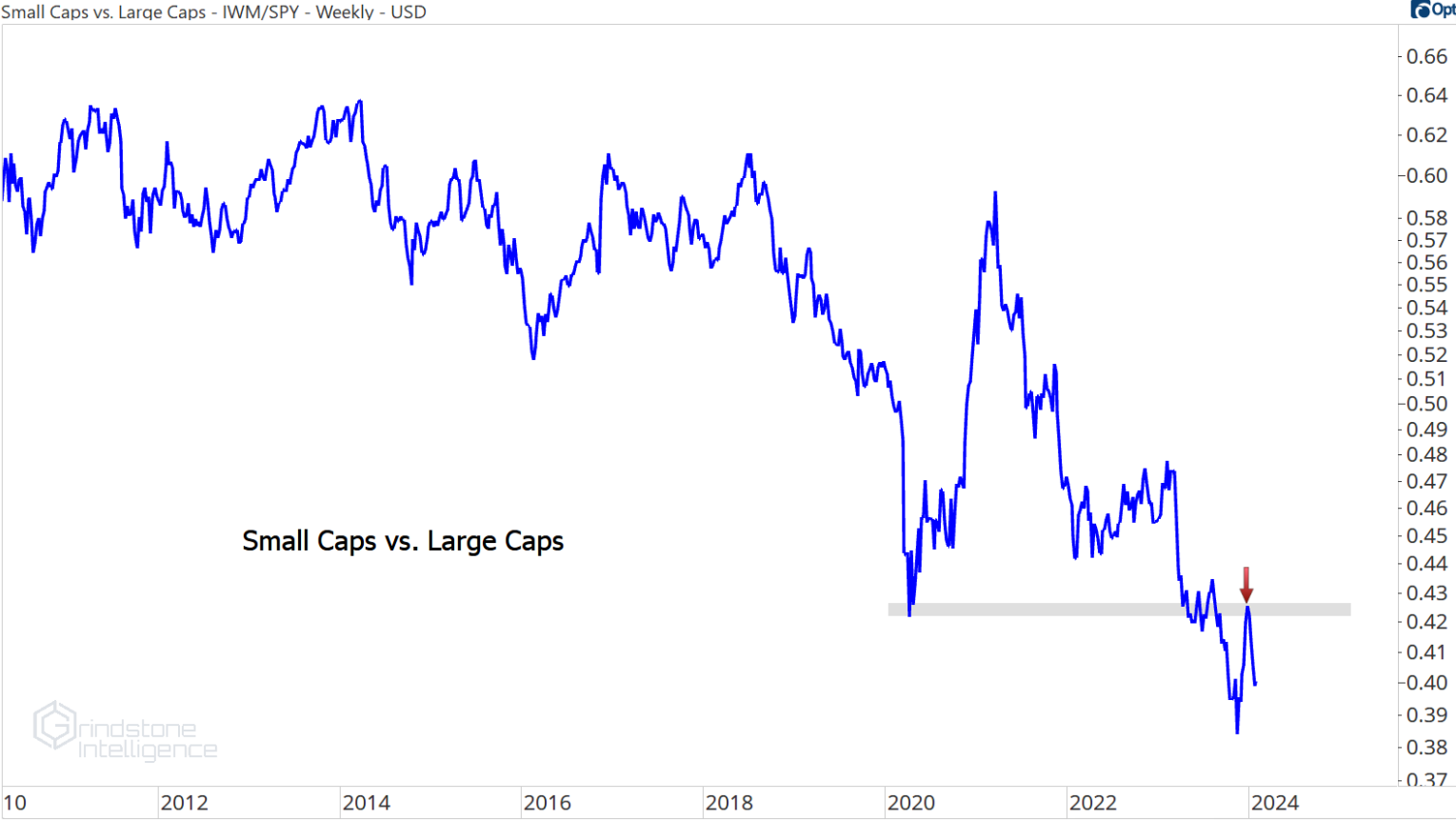

valuation disparity between large caps and SMIDs widening...

* source: Yardeni Research

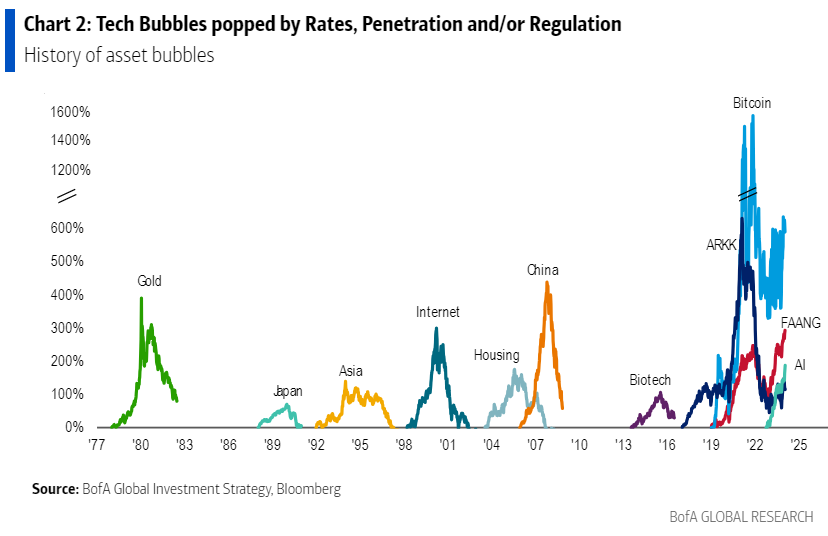

"US stocks surging to new highs driven by monopolistic tech as AI "baby bubble" grows"

* source: BofA's Michael Hartnett, The Flow Show

spreads tightening...

* source: Goldman Sachs Global Investment Research

* source: BofA's Michael Hartnett, The Flow Show

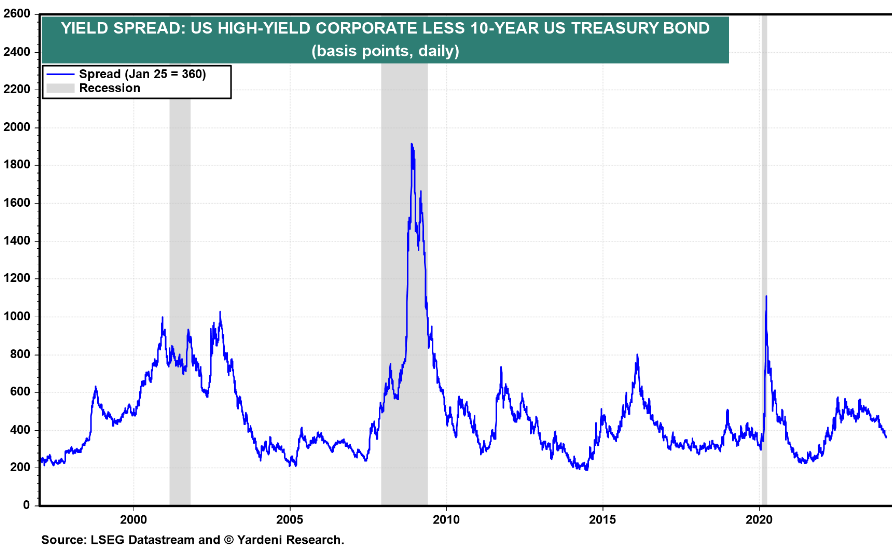

High Yield spreads also tightening

* source: Yardeni Research

Financial Conditions are relatively loose

* source: Goldman Sachs Global Investment Research

1) KEY TAKEAWAYS

1) Equities MIXED / TYields HIGHER / Gold + Oil + Dollar LOWER

Still some work left: Fed’s favorite inflation gauge +0.2% in Dec, +2.9% from a year ago -CNBC

DJ +0.1% S&P500 -0.2% Nasdaq -0.7% R2K +0.4% Cdn TSX +0.0%

Stoxx Europe 600 +1.1% APAC stocks LOWER, 10YR TYield = 4.153%

Dollar LOWER, Gold $2,019, WTI -0%, $77; Brent +0%, $82, Bitcoin $41,422

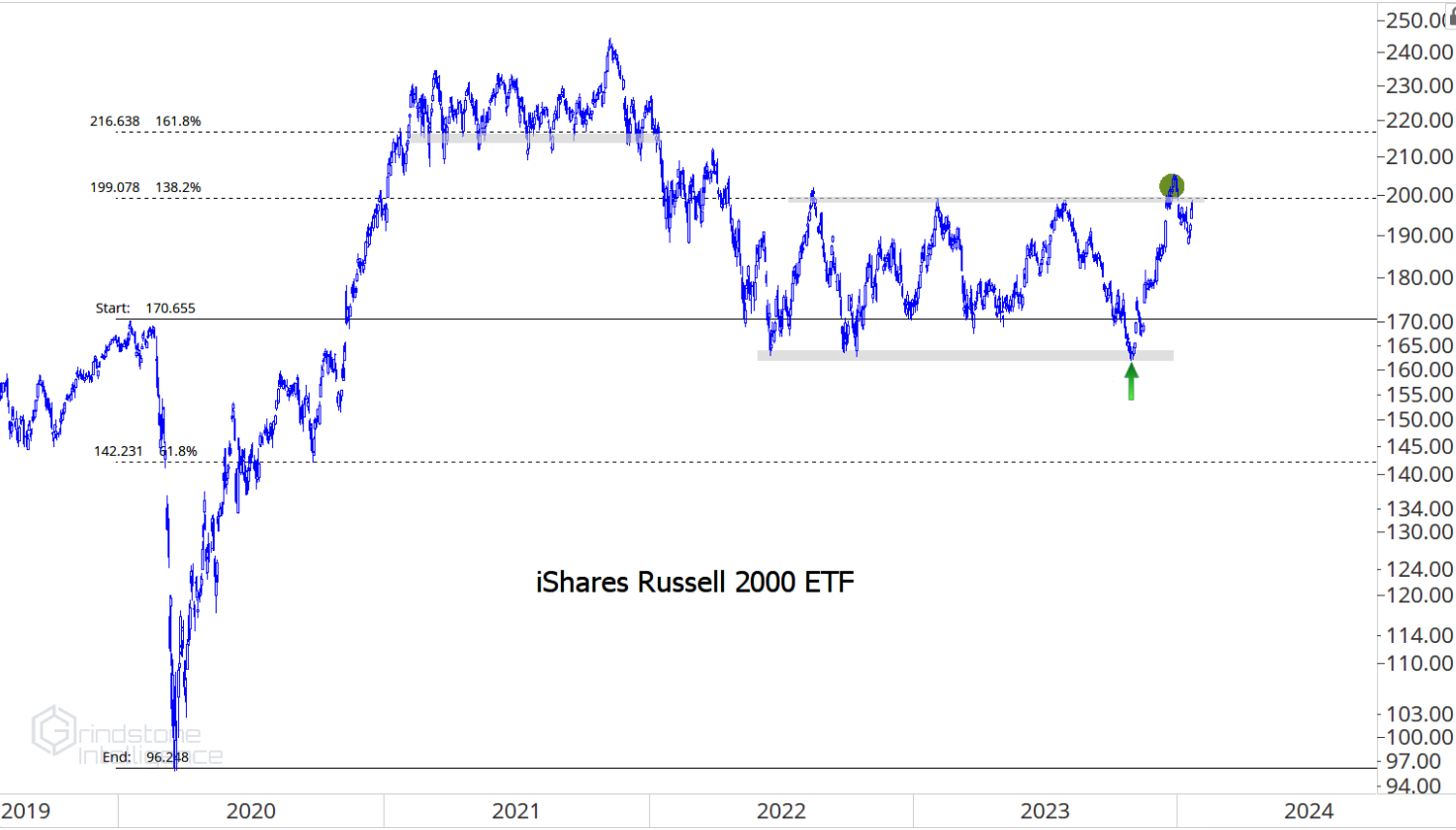

2) "Sluggish Small Caps"

* source: Grindstone Intelligence

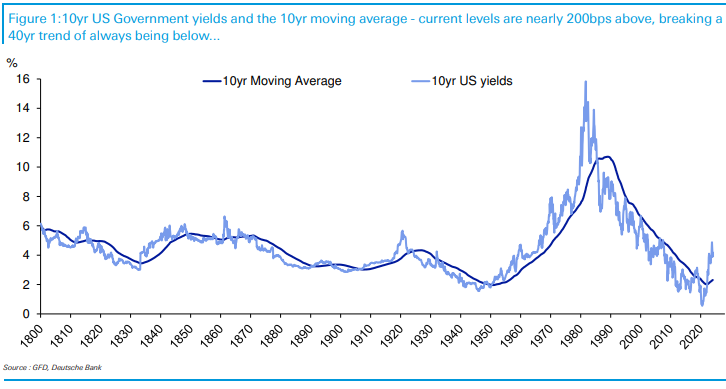

3) The Great Unwind : "10yr US yields usually hug their 10yr moving average quite closely over time. However, at the moment they’re nearly 200bps above it." -Deutsche Bank, Jim Reid

* source: Deutsche Bank, Jim Reid

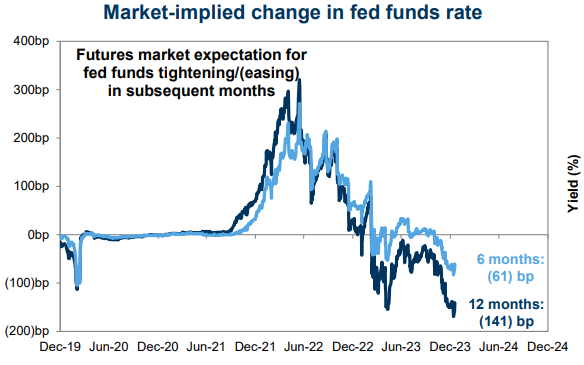

4) 2024 theme - how much will the Fed cut rates?

* source: Goldman Sachs Global Investment Research

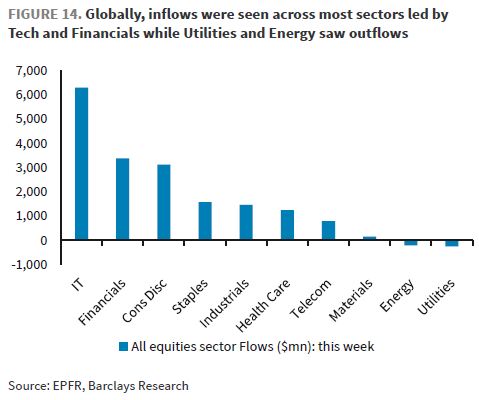

5) Flows last week:

* source: Barclays' Emmanuel Cau

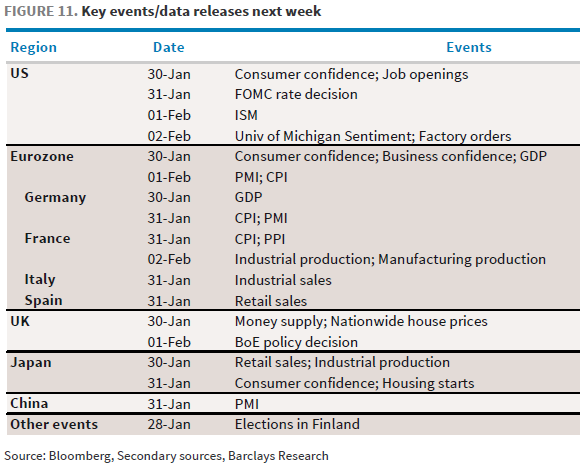

6) NEXT WEEK:

US: Fed's policy decision Wednesday | Friday, US jobs report for January.

Europe: BoE meeting | CPI and GDP reports across the Eurozone.

Earnings: Apple, Amazon, Microsoft and Meta.

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

OFF TODAY

3) MARKETS, MACRO, CORPORATE NEWS

- US economy defies recession fears with 3.3% growth in fourth quarter-FT

- China signals more targeted stimulus to come-BBG

- Inflation in Japan's capital slows, missing central bank's 2% target-RTRS

- Chinese provinces target modest 2024 growth after missing prev goals-RTRS

- UK consumer confidence hits two-year high as inflation cools-BBG

- Joe Biden halts permits for LNG projects under climate campaign pressure-FT

- Central banks navigate tricky path from rate hikes to cuts-RTRS

- Lagarde’s talk of summer ECB cut sees traders bet on April-BBG

- ECB’s Kazaks says worst mistake would be cutting too early-BBG

- ECB didn’t turn dovish this week, Vujcic says-BBG

- China equity funds draw largest weekly inflows since 2015 -BofA-RTRS

- Mergers lose their shine as Biden racks up antitrust wins-YAH

- McConnell casts doubt border deal, saying Trump opposition may sink it-NYT

- Trump opens up lead over Biden in rematch many Americans don't want-RTRS

- Scoop: Biden tells Bibi he's not init for a year of war in Gaza-AXIOS

- Hostage deal deadlocked over Israel’s refusal to agree permanent ceasefire-FT

- Putin sends us signal on Ukraine talks, seeing war advantage-BBG

- China presses Iran to rein in Houthi attacks in Red Sea, sources say-RTRS

- Jake Sullivan and China’s top diplomat to hold back-channel talks-FT

- Disney’s India unit valuation halves in Ambani merger talks-BBG

- Bain-backed Zelis weighs sale, IPO at $15 billion-plus valuation-BBG

- Salesforce laying off 700 workers in latest tech industry downsizing-RTRS

- Tellurian hires Lazard to explore sale of US natural gas developer-BBG

- Evergrande faces rare hearing, may lead to liquidator selection-BBG

- Intel plunges after forecast casts doubt on comeback bid-BBG

- Boeing production woes 'will get resolved' says major customer Avolon=RTRS

- Tesla erases $80 bln in valuation after Musk's sales warning-RTRS

- Elon Musk’s AI start-up seeks to raise $6bn from investors challenge OpenAI-FT

- LVMH shares jump as reassuring Q4 lifts luxury peers-RTRS

- Microsoft lays off 1,900 Activision Blizzard and Xbox employees-VERGE

- Apple overhauls App Store, iPhone features in EU to appease regulators-BBG

- Levi Strauss plans to cut 10% global corporate workforce in restructuring-CNBC

- Norfolk Southern cutting 7% of management and staff positions-TRAINS

Oil/Energy Headlines: 1) Freight through Suez Canal down 45% since Houthi attacks – UNCTAD-RTRS 2) Saudi Aramco keeps sending oil through Houthi-menaced Red Sea-BBG 3) Govt slashes support to oil firms, postpones filling strategic oil reserves-BW 4) China calls for a halt to Houthi attacks on Red Sea shipping-BBG 5) Venezuela, Guyana pledge to keep peace amid territorial dispute-BBG 6) Red Sea chaos pushes fuel tanker costs above $100,000 a Day-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.