Fed Chair Powell Still Insists Inflation is Transitory, And the Markets Agree. Why?

The Chair of the Federal Reserve Bank is a prestigious, powerful position, but it does have one major downside: The Fed Chair is required regularly to testify before both houses of Congress. That usually means that he or she has to sit quietly while a bunch of people, many of whom seem not to understand the role of the Fed nor its influence on the economy, criticize their every move and utterance, or ramble on about unrelated subjects in an attempt to score political points. That requirement came yesterday for Jay Powell before the House and will continue today before the Senate. Powell has shown himself to be adept at deflecting the nonsense without allowing it to fluster him. As a result, as hyped as these events are, he rarely says anything of import at them.

Yesterday was another example of that, but the Chair’s continued insistence that the inflation we are seeing in the U.S. and elsewhere around the globe is “transitory” stood out as notable. That isn’t news, of course, but repeating it the day after the CPI data for June was reported as showing the highest rise in prices for thirteen years demonstrated a conviction that, depending on your point of view, is either admirably consistent or foolishly stubborn. Whichever it turns out to be, one thing is clear. Powell et al are not alone in this belief. The markets, where money makes apolitical statements and changing one’s mind regularly is a necessity rather than a weakness, agree.

One of the main characteristics of inflation is higher commodity prices, which we have certainly seen in this run up. However, if we look at the futures market for industrial staples such as crude oil and copper, we see that both are in a state known as "backwardation," where prices for contracts further into the future are lower than for those with shorter time to expiration. That implies a belief that prices will fall before too long, which would make the current commodity inflation transitory indeed.

Then there are the interest rate markets. The Fed controls short-term rates directly, and thus longer-term rates indirectly, but those longer-term rates are set by the market on a day-to-day basis. If traders believed that inflation was really taking hold and would force a rate hike before the Fed’s predictions of more than a year from now, the 10-Year Treasury yield would not have fallen from around 1.75% in March to its current 1.3%. Again, the money is saying, shouting even, that neither the 5.4% annualized CPI growth, not the 4.5% jump in the Fed’s preferred “core inflation” metric reported this week, will be sustained for long enough to force a reaction in rates.

Lastly, there is the stock market. There, if inflation were to take hold and prompt an early rate hike, it would create a double blow. It would hurt companies by stalling growth and increasing their cost of borrowing, while also eliminating the “free money” that banks currently have access to and that is providing such strong support for stocks.

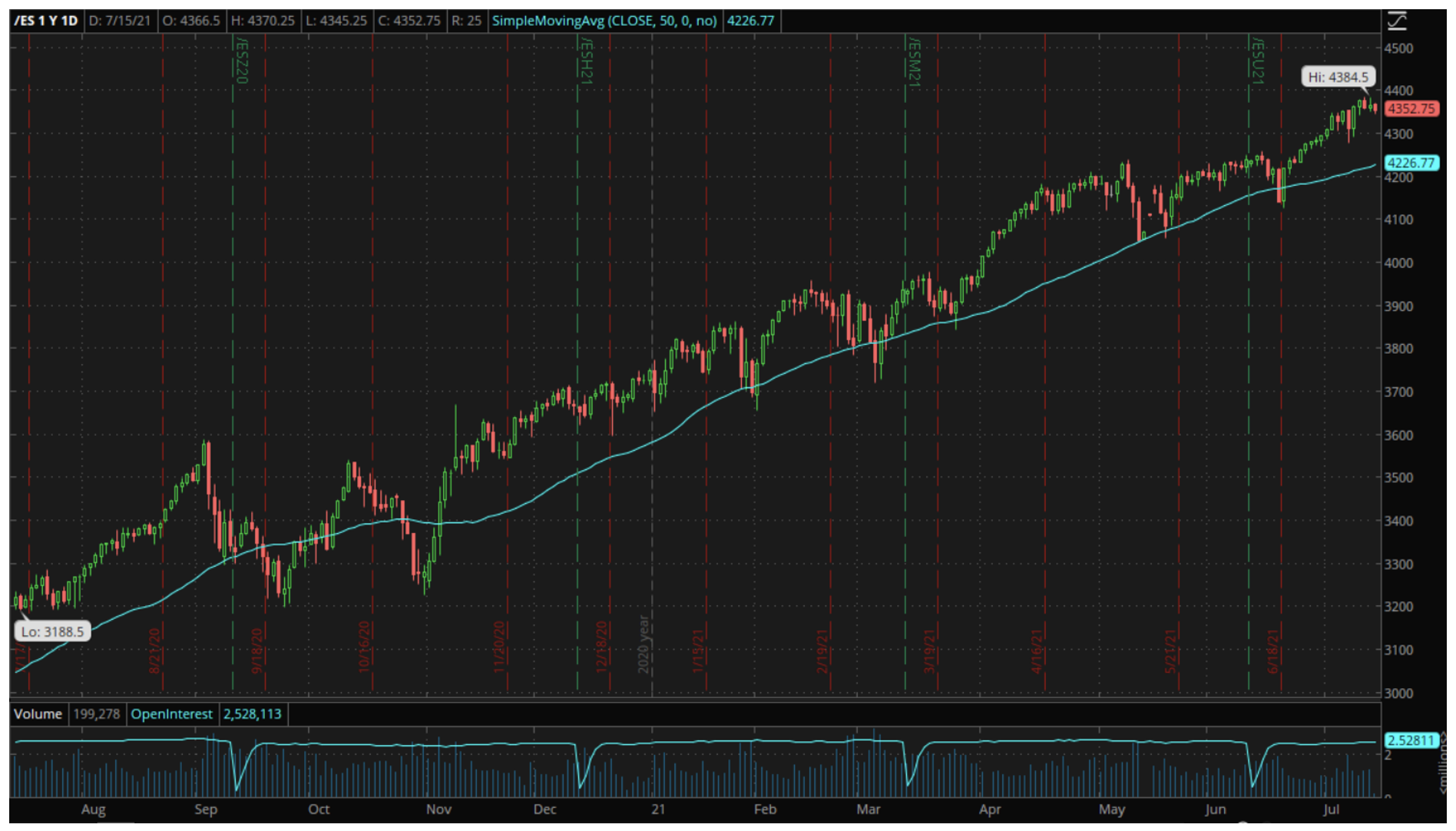

Clearly, with the S&P 500 50-Day moving average (the blue line on the above chart) showing no sign of even slowing its upward trend, never mind reversing, that isn’t concerning equity traders right now. There is an occasional wobble when data emerges suggesting inflationary pressure, just as there was yesterday, but we still keep hitting new highs.

None of this is to say that the market can’t be wrong. In fact, both logic and hard research suggest that markets are far more reactive than predictive, so are not good at forecasting problems. I am old enough to remember inflation of days gone by, and still see it as a beast that is hard to tame once unleashed, so the very concept of transitory inflation sounds suspect to me.

However, from a trading perspective, two of the most important rules I was taught early as a trading room rookie were "never fight the Fed" and "don’t stand in front of a runaway freight train." Right now, the Fed is driving that freight train and until they switch tracks, there is clearly no desire among traders in any market to stand in front of it. Given that, it makes sense to stay overweight equities and not to panic, but to keep an eye on commodities and bonds as well as stocks for any indication that things are changing.

Do you want more of Martin? If you are familiar with Martin’s work, you will know that he brings a unique perspective to markets and actionable ideas based on that perspective. In addition to writing here, Martin also writes a free newsletter with in-depth analysis and trade ideas focused on just one, long-time underperforming sector that is bouncing fast. To find out more and sign up for the free newsletter, just click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.