Johnson & Johnson JNJ announced that the FDA has accepted its regulatory filing seeking the FDA’s approval for nipocalimab, its investigational neonatal Fc receptor (FcRn) blocker, in generalized myasthenia gravis (gMG) indication.

The filing has been granted priority review by the FDA, bringing down the review period by four months. We expect a final decision in the third quarter of 2025.

The FDA filing is supported by data from the phase III Vivacity-MG3 study, which evaluated nipocalimab in adults with gMG, including those with anti-AChR, anti-MuSK and anti-LRP4 positive antibodies. Data from the study showed that patients who received nipocalimab plus standard of care (SOC) achieved sustained disease control over 24 weeks compared with those who received placebo plus SOC. A similar regulatory filing for the drug is under review by the EMA, also supported by data from this study.

Per J&J, the above results make Vivacity-MG3 the first and only study to achieve sustained disease control in gMG patients with anti-AChR, anti-MuSK and anti-LRP4 positive antibodies. Management has claimed that the study is the longest dataset available for a FcRn blocker in this indication.

gMG is an autoantibody-driven neuromuscular disease marked by fluctuating muscle weakness. Nipocalimab has been designed to block FcRn and reduce levels of autoantibodies while preserving immune function without causing broad immunosuppression.

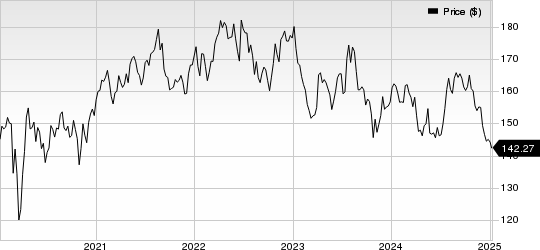

JNJ Stock Performance

In the past year, J&J’s shares have lost 12% compared with the industry’s nearly 3% decline.

Image Source: Zacks Investment Research

Competition in the gMG Space

If approved, nipocalimab will enter a competitive market for gMG treatments. The J&J drug would face stiff competition from Argenx’s ARGX Vyvgart/Vyvgart Hytrulo and Belgium-based UCB’s Rystiggo, both of which are also FcRn blockers and approved in the gMG indication.

While the ARGX drug is approved only in patients with anti-AChR positive antibodies, the UCB drug is approved for those with anti-AChR or anti-MuSK positive antibodies. Argenx’s drug is also approved for a second indication — chronic inflammatory demyelinating polyneuropathy (CIDP).

JNJ’s Nipocalimab Development

J&J is evaluating nipocalimab across multiple immunology and neuroscience indications in separate mid to late-stage clinical studies.

Management is evaluating the drug in late-stage studies for CIDP, hemolytic disease of the fetus and newborn (HDFN) and warm autoimmune hemolytic anemia (wAIHA). This J&J drug is also being evaluated in separate mid-stage studies for idiopathic inflammatory myopathy, Sjogren's disease, systemic lupus erythematosus and rheumatoid arthritis indications.

JNJ’s Zacks Rank

J&J currently carries a Zacks Rank #2 (Buy).

Johnson & Johnson Price

Johnson & Johnson price | Johnson & Johnson Quote

Other Key Picks Among Biotech Stocks

Some other top-ranked stocks from the sector are Castle Biosciences CSTL and CytomX Therapeutics CTMX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bottom-line estimates for Castle Biosciences have improved from a loss of 8 cents per share to earnings of 34 cents for 2024 in the past 60 days. During the same timeframe, loss per share estimates for 2025 have narrowed from $1.88 to $1.84. In the past year, shares of Castle Biosciences have surged about 53%.

CSTL’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 172.72%.

In the past 60 days, estimates for CytomX Therapeutics’ 2024 loss per share have narrowed from 18 cents to 5 cents. Estimates for 2025 loss per share have narrowed from 55 cents to 35 cents during the same timeframe. CTMX’s shares have lost 41% in the past year.

CytomX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 115.70%.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Johnson & Johnson (JNJ) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

argenex SE (ARGX) : Free Stock Analysis Report

Castle Biosciences, Inc. (CSTL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20a%20Buy%20as%20Wall%20Street%20Analysts%20Look%20Optimistic%3F%20%7C%20Nasdaq&_biz_n=6&rnd=80981&cdn_o=a&_biz_z=1743442456648)

%20%7C%20Nasdaq&_biz_n=7&rnd=354677&cdn_o=a&_biz_z=1743442456761)