Cinthia Murphy, Managing Editor, ETF.com

It’s easy to overlook the impressive growth some of the smallest ETFs have seen this year, because in dollar terms, the asset numbers don’t come close to the traction the biggest funds have.

For example, year to date, the $139 billion Vanguard S&P 500 ETF (VOO) and the $108 billion Invesco QQQ Trust (QQQ) have picked up the most net new money, raking in $15.8 billion and $12.8 billion, respectively. These are massive net creations.

But percentage growth tells a different story. ETF.com Analyst Sumit Roy dug into the numbers and found that some much smaller funds have seen their asset base grow more than 8,000% this year. For perspective, VOO and QQQ have grown about 12-14%.

“Admittedly, it’s much easier for a small fund to register a big percentage increase in its assets,” Roy reported. “A fund with only $1 million in assets under management (AUM) simply has to grow to $2 million for its assets to double. Is that noteworthy? Not really.”

But asset growth is asset growth no matter how you slice it. And some of these smaller funds can fly under the radar for a long time before anyone notices their growing following.

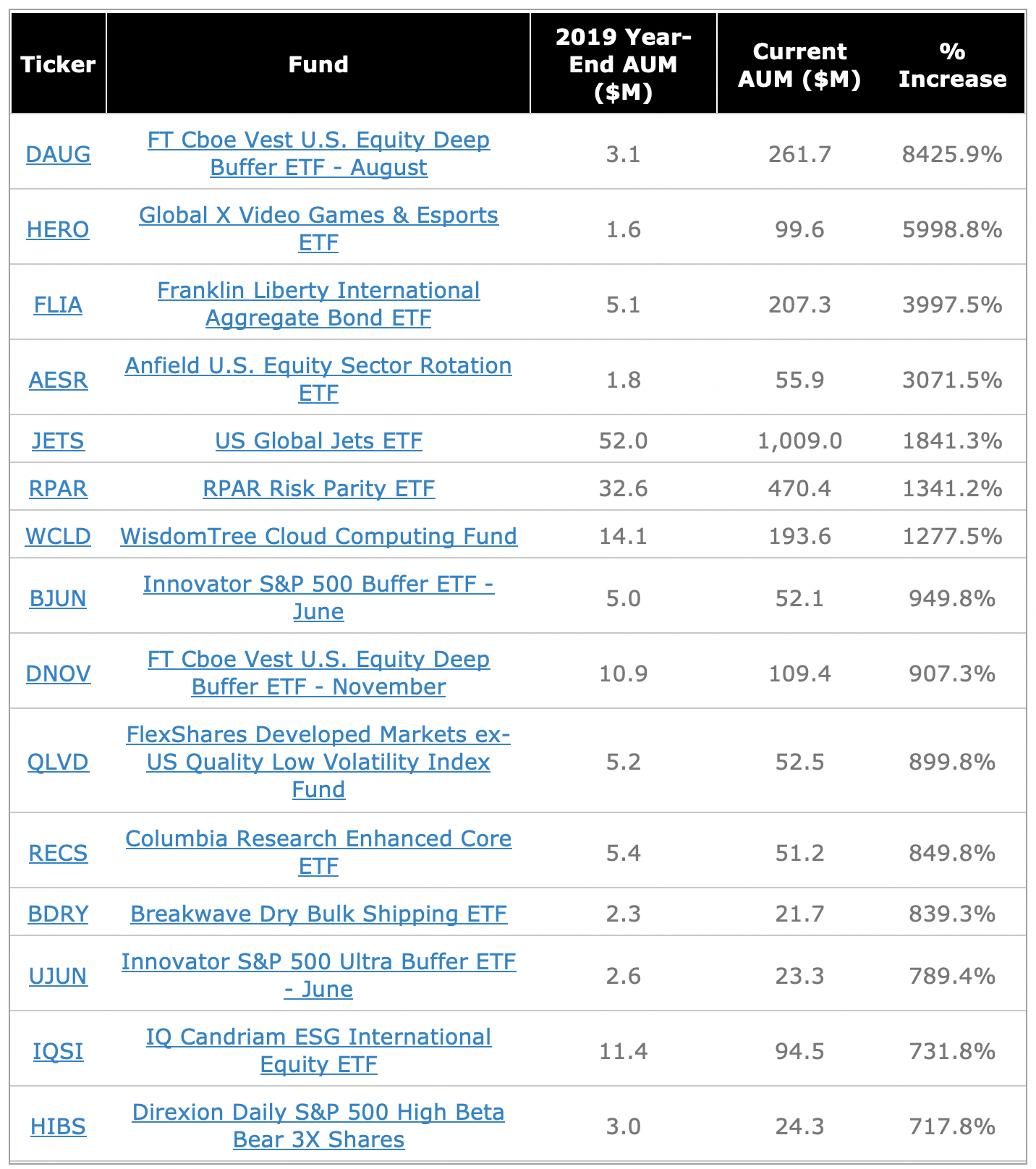

Here’s a look at the fastest-growing ETFs this year, regardless of their starting AUM:

Fastest Growing ETFs of 2020 (Starting AUM >$0)

Data measures the year-to-date period through June 2. Source: Bloomberg

A quick glance at these fast-growing funds show some of the hottest themes in investing this year are also reaching some of the smallest ETFs.

Demand for downside protection as volatility picked up in the face of a pandemic and economic shutdown; stay-at-home winners such as video gaming companies and the cloud computing industry; bargain hunting among the hardest hit, in this case in the form of picking a bottom in the airline industry—all of these broadly discussed themes are seen here in this list.

When we look at net creations and ETF asset flows, it’s easy to be dazzled by the biggest numbers and the biggest players. But there’s a lot of interesting action happening among some of the smallest funds, which, should this pace continue, could soon find themselves among bigger ETFs.

More on ETF.com:

Thematic ETFs The New Sectors?

Fixed Income ETFs Dominate Weekly Inflows List

Pandemic Lifts Video Game ETFs

ETF Working Lunch: Building An Advisory Biz

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.